UUP is our proxy for the dollar as you recall. It’s right at make or break here hanging about it’s 61.8% retrace. Now, on my other graphing software, the 61.8% — Golden Ratio — retrace line is at $24.07. No matter, we want this sucker below $24 to feel good about the dollar not threatening this rally again.

Good thing we are in PM’s and heavy metals as they are negotiating this squall just fine today. On the gold side, [[ANV]] continues to show real nice relative strength, to the point where its making me wonder if there’s not something going on. [[PAAS]] and [[PTM]] are doing well as well, and you may want to have a sally at [[NG]] as it’s getting bootstomped for no particular reason while [[NXG]] is up. Perhaps it’s the “X” chromasone?

I like [[TIE]] and [[TC]] is just insane. I may sell the calls after this posting, in fact. In the meantime, the golds and silvers are hanging tough, and [[TBT]] is right at my intermediate sell level (high of about 59.50 today). I may sell the calls on that one as well, depending on what the dollar does to the close.

On other crazy stuff, [[ENTR]] is finally breaking out, while the [[HEB]] takes it in the shorts. Watch that one, along with [[IMGN]] as I think they’ll both “be baaahhk” like Arnold. Another Fly buy is [[OVTI]] which I’ve had for a while now, and is finally perking.

Queries welcome.

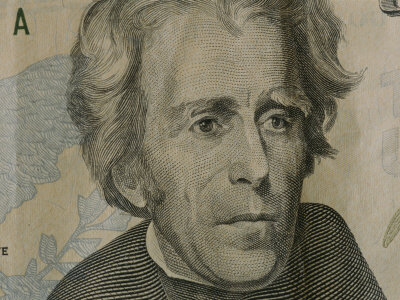

Here’s a great theme for today. Whether we’re talking the dollar or the market, you gotta love this humble boy from Northern Florida. Fantastic rendition, too, the way he gets the blase LA crowd to sing the whole first verse (Hat tip to Boomer):

Update: Funkier version from Hamburg, sorry about the “non-embed” you can see that one on Youtube.

[youtube:http://www.youtube.com/watch?v=RiztRc910Ps 450 300]__________________________________

Update: Sorry, no calls to sell on TC! Therefore I am selling one third of my position here at $11.21. I am risking that I won’t get the better price to reload.

Update: Bot 1k more [[GDX]] @ $40.88 for shizzles and gizzles. Hanging on the 61.8% fib.

Update: Re: [[UUP]]– she ended up at $24.00 on the dot. Isn’t that just like a woman?

_____________________________________

Comments »