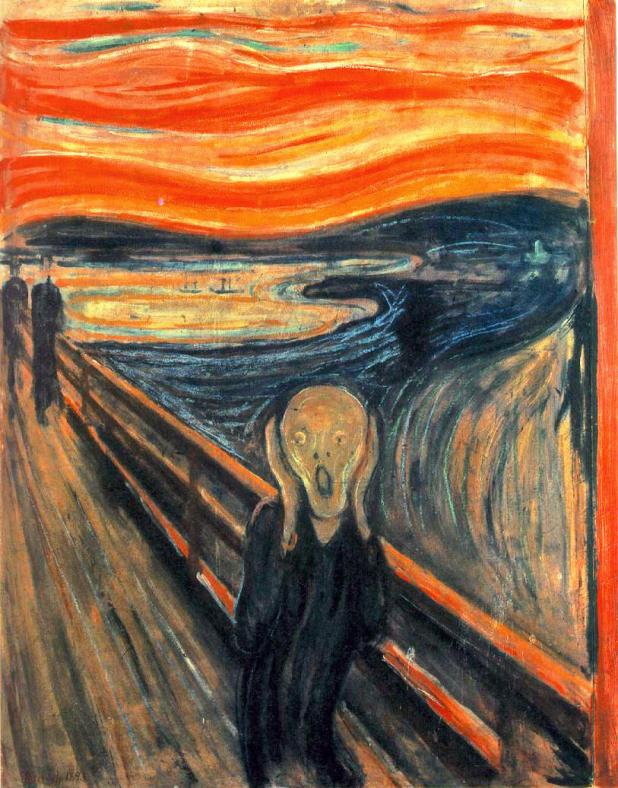

There’s that bloody pullback we were talking about last weekend! Um — No need to overdo it, there, brother! We don’t want to scare any new Jacksonians away now, do we?

Well I can’t say this wasn’t expected, although the bludgeoning of [[TSO]] is a mite much in my opinion, and may warrant some additional consideration, should it continue much past the $14.80 level, where I would consider it more than a bit damaged. Obviously VLO and WNR are the culprits here, both pointing to an overcapacity in the business and possible need to raise capital (on WNR‘s part) allegedly. As you know I was short the June 17.50’s, but even that money doesn’t make up for today’s bludgeoning. I may just reshort the 15’s, here and exit if that is my fate. TSO is something of an oddball (like MON and ANDE) in that it’s not directly commodity related, but rather peripherally.

In short, I’ll let you know what I decide, but for now, TSO is on the “back alley execution” list. Even though I bot most of my TSO below $10, I recognize that it’s only “Jacksonian” from the official start date of May 1st, so I will account for the loss (bot @ $16.01) from that date if I take it.

The good news is I think we may have a new Jacksonian entrant. I began a “starter” position in [[PTM]] today, at $15.14. As I type, it’s about a dime below that, so I may add before the day is out. If do add PMT to the JCHP, then I will likely kick out TSO, at a loss.

In other Jacksonian news, [[TC]] is getting its socks rocked, in one of it’s now familiar one day pull backs. Perhaps I’ll remember to sell the calls when I should next time. As it is, it’s filled that $9.59 gap from last Friday, and I shall probably add a small amount more today.

[[EGO]] has tested the rim of that long term cup that was in formation from July of last year. I expect it should hold up here, and I will likely add a small amount from recent biotech winnings to my pile here as well. [[SLW]] I would wait on, now, to see if it can’t fill that gap down around $10-. Gap fills have been excellent buy opportunities as of late. [[SSRI]] ($23.38) and [[PAAS]] ($22+ ) are both at good accumulating points, here. Also if you feel adventerous, non-JCHP double Silver ETF [[AGQ]] has pulled back nicely here, too, but you may want to wait to see if it fills that gap at $52.30.All the JCHP golds are accumulatable at these levels, right now, and I’d grab RGLD first, as always, and GDX is always a good “backbone” hold.

Caveat: As always, I offer my opinions only, and not the usual advice for which you consult your local gypsy palm reader. If you decide to follow me into the Jacksonian fold, it is because you are a person of independent means who spits in the face of market carnage. Just remember that here, even in this sainted borough of the iBC Website, you can most assuredly get shot. Trade accordingly.

_______________________________

Update: I bot 2k more EGO at $9.38.

Update: I bot 1k more PAAS at $22.05

Update: I bot 4k more NG at $4.85

Update: I sold 4k TSO (25%) at $15.02

Non Jacksonian Update: I bot 10k CTIC (25%) at $15.02

______________________

Comments »