‘Twas a rough day in the trenches for most of the Jacksonian Core, but then we turned lemons into lemonade by using the retrenchment here to pick up some final positions in the silver miners, including AGQ (Double Silver ETF), PAAS, and SSRI. Those buys were featured in my previous post, if you want entry points.

I did not add to my “favourite” (sic) silver miner – SLW, but only because I already have what I consider to be a “full position” in SLW, at least for now. I may augment that position from time to time with options purchases (or sales in hedging situations), but I will likely not add any more equity in that name.

I also eschewed adding more EXK (-5.89%) today, due mostly to it’s volatility and low float (less than 150 k shares traded a day). This is a stock you want to accumulate when it’s asleep — its just too damn hard to pick up when it’s moving hard one way or another. I reserve the right to add to EXK in more calm seas.

I also added some non-Jacksonian Core gold positions, some old, and some new, whose entries are also found in the previous post. You’ll recall I purchased a beginning position in NGD just before yesterday’s close. That stock actually held up well, so I decided to also add its “brothers” NG and NXG. All of these have been showing favourable (sic) patterns in the last few weeks, and their purchase is part of a diversification strategy in the smaller miners. It’s best to take this shotgun approach with these smaller guys, as you usually cannot pick up their exposure via the GDX ETF, which only purchases the larger cap issues but you want to have a position in these flyers for when they start to run. Some of them will double and triple, but in these cycle peaks, you never know which.

In that regard, I also added to my position in ANV at the end of the day. Like with SLW and EGO, I now have a full position in this name, and expect to see it run to at least the 61.8% fib retrace at $6.72 before breaking out to new 52-week highs.

I also took this opportunity to hedge out my largest (and non-Jacksonian) position in UPS, and to begin a “foot in” purchase in SRS as well.

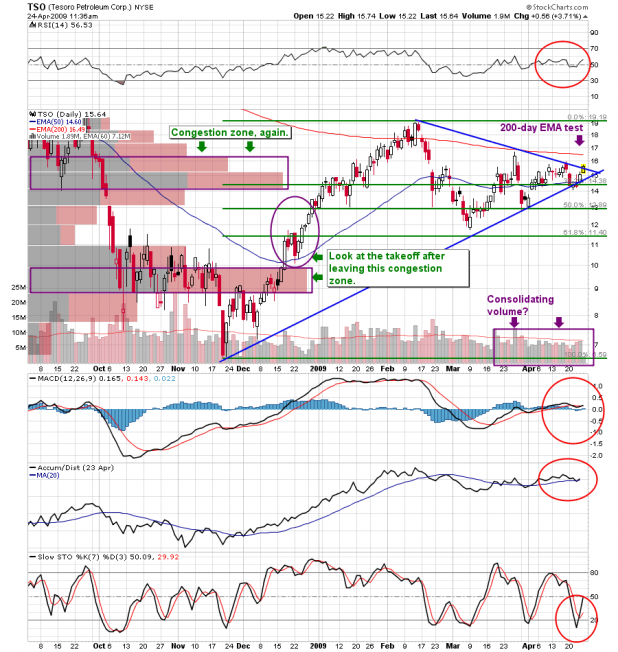

Non-PM Jacksonians did well and not so well today, MON was up a little less than 1% while its sister Ag play ANDE was off 4.67%. If ANDE cannot hold above the $19.40 uptrend line here, it’s likely to fill that gap over a dollar below it. As well, Jacksonian Core Coal play NRP (-4.89%) has been performing miserably here, even as coal operators have been consolidating. This could be due to a (temporary) interest rate response, but I won’t recommend adding to this one until it’s back over the 38.6% retrace at $22.70. Last, refiner TSO was largely flat– off less than half a percent.

Without further ado, here’s the 14-Member Jacksonian Core’s performance (arranged alphabetically for your reading pleasure) for today:

ANDE — $19.79 (-4.67%)

GDX — $37.94 (-2.61%)

GLD — $91.09 (+0.42)

IAG — $9.87 (-2.66%)

PAAS — $19.26 (-3.02%)

RGLD — $40.60 (-2.98%)

SLV — $13.81 (-1.49%)

SLW — $8.85 (-5.04%)

SSRI — $19.93 (-5.18%)

TBT — $49.29 (-2.08%)

TC — $7.68 (-4.00%)

TSO — $16.09 (-0.43%)

_____________________________

A bloody good evening to you all!

(Warning! Extremely stupid video to follow, usher the children from the room)

[youtube:http://www.youtube.com/watch?v=teM_imSYGVs 450 300]

Comments »