___________________________________________

Sorry Florida fans, we’ve got your “Urban Meyer Magic” right here in the Lou, and he’s not going anywhere.

(At least not this year)

No, seriously, though… do you think it’s a coincidence that The University of Florida, with the best recruiting classes over the last ten plus years, bar none, sucked balls this year without Defensive Coordinator Charlie Strong?

And do you believe it a coincidence that Florida head coach Urban Meyer has decided to resign again this year, and flee back to the bosom of his family and “good health?” C’mon.

I happen to think it’s no coincidence, especially as Charlie Strong has managed to not only make the Cards bowl eligible in his first year as head coach (after 27 years as an assistant at various racist SEC-Conference schools), but also to win their first bowl since winning the 2007 Orange Bowl four years ago (with former, now Arkansas coach Bobby Petrino), 31-28 over Southern Mississippi.

Okay, so it was the Beef O’ Brannigans Beer & Cheesenutz and Light Draft Bowl, but you have to start somewhere right? And that “Florida Magic” — which really stemmed from Charlie’s ability to recruit fine young men from Florida –has already begun to bear fruit. Note this week’s news — as Louisville has landed it’s first five star recruit, Teddy Bridgewater of Northern Miami, since hometown boy RB Michael Bush (now with the Raiders), signed seven years ago. Here’s the skinny:

Miami Northwestern quarterback Teddy Bridgewater, a five-star recruit who is widely considered to be one of the best dual threat quarterback prospects in the county, announced his commitment to coach Charlie Strong and the Louisville Cardinals earlier today. Bridgewater, a one-time Miami commit who reopened his options after Shannon’s termination, made it clear that the chance to get on the field early was the biggest factor in his decision.

That’s right, they stole this guy from “The U” — Miami University — his own hometown school. Now that’s strong… that’s Charlie Strong. Looking forward to watching my Cards continue to kick ass until the SEC steals Charlie back, swallowing crow on their 27 year mistake. I fear will ultimately be our porridge, and am resigned to it.

_________________________

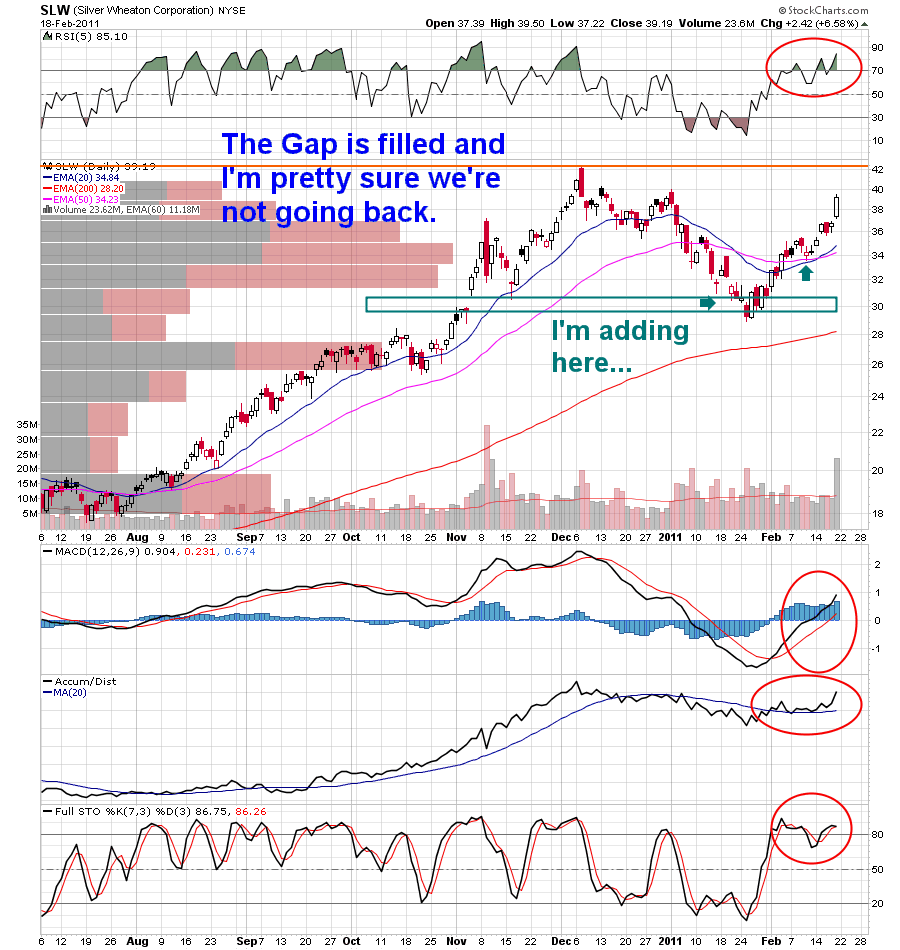

Speaking of “resigned to our porridge,” I am ultimately resigned to a pullback here, and have begun hedging my large PM positions with sold “in the money” calls on my largest pieces.

I sold 80 $34 strike February calls for SLW today, for example. I also have written call orders in for EXK, ANV, IAG and several others that have yet to fill. I also sold 10k shares of GSS today at $4.79, which was 45% of my position.

I plan to keep on with these moves as we go to year end. I am writing calls because I’ve already taken egregious gains this year, and would like to defer any additional taxable gains into next year. Also, I would like to maintain my “core position” in many PM positions despite my inclinations toward lower prices in the near term. Silver, however is looking like it will pull back in dreadful fashion. Be apprised.

One other thing, I must take the opportunity to brag on my “rare earth metals” position in AVARF, which I will likely trim by 30 to 50% tomorrow. After holding for about a month, that sucker took off today with a newly announced AMEX listing. Sometimes it’s as simple as that.

Best to you all, my gente.

______________________

Comments »