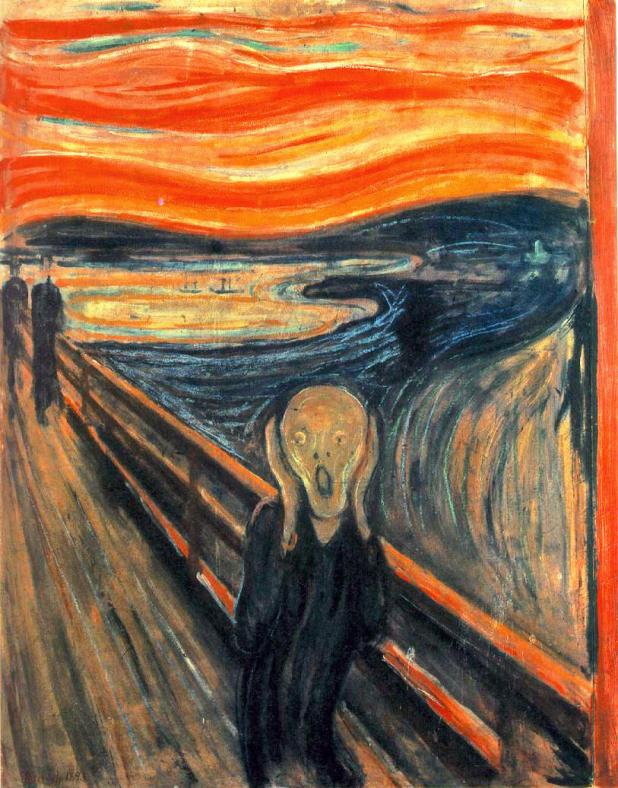

Comments »Why now this crying, this cringing, this fear?

What ‘ports of market disaster come near?

Come, there’s no trembling, no reason to hide.

For this day, Brave ‘Drew Jackson, the Dude, will abide.

____________________

Have you good silver and gold in supply?

Use you green paper instead for your chai?

Best keep this warning in back of your mind,

Fed Notes like those will soon buff your behind!

_______________

Silver Wheaton, Pan American and S-S-R-I

With bright silver trumpets the thieves they descry!

And their fellows in golden and anthracite hue,

(Gold, Royal Gold, NRP name this crew)

Like friends made in foxholes– they will always stay true.

___________________________

And in our travels, let’s not forget “farmer’s friend:”

Stout “Mr. Anderson” forges an uprising trend.

And those thinking now of their grandkiddies needs,

Must never disdain Sir Monsanto’s brave seeds.

_________________

“Molybdenum’s” fun just to say, if you ask me,

But “TC” is the name of the stock that will task me.

Especially when earl and gas spreads ‘come dear,

And Tesoro’s my ‘folios’ sole quit-claiming cheer.

_________________________

What’s left to us then, in the Jacksonian Core?

But to brandish the bane of that Great Federal Whore?

Yes Ben Bernake, I speak now to thee…

And like a cross to a vampire, hold high TBT!

___________________________

ANDE — $22.75 (+0.57%)

GDX — $40.47 (+5.31%)

GLD — $92.25 (+1.42)

IAG – $10.16 (+2.83%)

MON — $91.83 (+2.49)NRP — $23.37 (+3.41%)PAAS — $20.99 (+6.33%)

RGLD – $42.77 (+5.19%)

SLV — $14.10 (+0.86%)

SLW — $9.46 (+3.61%)

SSRI — $22.00 (+5.47%)

TBT — $49.95 (-2.14%)

TC — $9.14 (+1.56%)

TSO — $17.29 (+0.41%)

Daily Average: +2.69 %

_____________________