______________

C’mon, you know I couldn’t resist a low hanging curve like this one. But enough about the not-so-mourned paedophile (sic), as it looks like the real Jacksons are breaking out again. Even with the modified [[TZA]] hedge position, I still came away with a righteous 2.73% up day yesterday for the JCHP.

And that’s not including the sundry “side-bets” I made courtesy of the Chart Addict Casino and Burlesque Review. I try not to play long there, as it can be “addicting.”

Yesterday, while the site was down, I played around a little with the Jacksonian Portfolio Presentation again, and while I don’t think I will reveal the actual stock holdings every day, I thought the additional information below might be helpful for you to understand how I am trading within the portfolio to harvest gains and manage risk. So today, I’ve done away with the “comments” portion in order to show you the actual holdings as of yesterday.

As a point of clarification, the only change I made yesterday was to sell one half the TZA hedge position at $23.67, taking a little over a dollar loss on 201 shares (I still hold the remaining half). That left me with a bit over $13,440 in cash in the position. For the purposes of the weighting, I have cash sitting at an annual return of 2.5%.

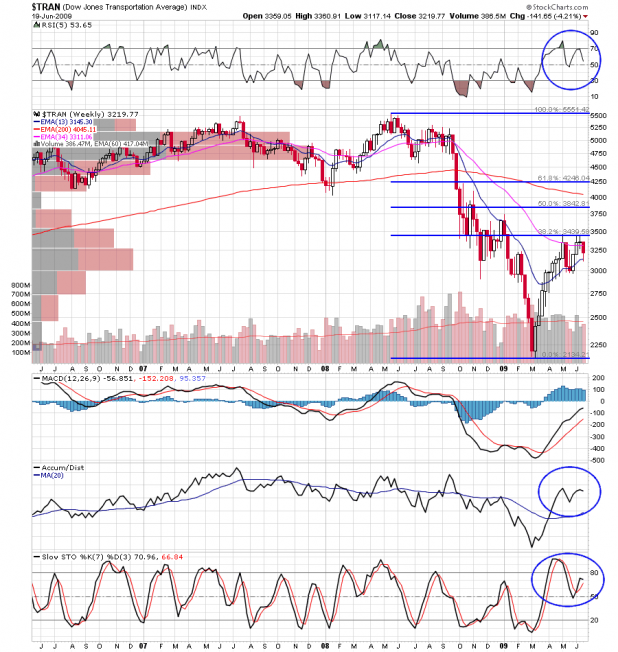

As you will see it was an amazing day yesterday, as silver cleared $14.00 and gold held steady as well, pushing the $940 area (we are flirting with that price again today, despite the rest of the market being down). I think the miners will likely take a rest today and we may even be in for more consolidation. The trick is not to get impatient here, and to manage your positions for the next major cycle turn.

For today, continue to keep an eye on the junior miners, including Jacksonian Eldorado Gold Corporation (USA) [[EGO]] , and non-Jacksonians NovaGold Resources Inc. (USA) [[NG]] , New Gold Inc. (USA) [[NGD]] , Northgate Minerals Corporation (USA) [[NXG]] , Allied Nevada Gold Corp. [[ANV]] , Aurizon Mines Ltd.(USA) [[AZK]] and maybe most important, Rubicon Minerals Corp. (USA) [[RBY]] . This should be a consolidation day for all of those, so shop with “moth hands.”

As for silvers, they are all strong relative to the market today as the underlying metal is making a nice return over $14 here. Keep an eye on micro-junior [[EXK]] for action, and also [[CDE]] which seems to be a day ahead of its brethren, and may have a consolidation day today as well.

As for the non-PM’s… I continue to like Teck Cominco Limited (USA) [[TCK]] here, and good old Jacksonian Thompson Creek Metals Company, Inc. [[TC]] might run into trouble again at its 38.2% fib retrace at $10.88. More in updates to come…

Jacksonian Core Holdings with Cash & Stock Weightings

| Name/ | Position’s | Number of | Percentage | Weighted | ||||

| Ticker | 24-Jun | 25-Jun | % Change | Port Value | Shares | of Port | return | |

| ANDE | $ 28.84 | $ 29.95 | 3.85% | $ 18,085.75 | 603.86 | 10.34% | 0.40% | |

| EGO | 8.51 | 9.39 | 10.34% | 8,798.43 | 937.00 | 5.03% | 0.52% | |

| GDX | 38.49 | 39.99 | 3.90% | 12,103.51 | 302.66 | 6.92% | 0.27% | |

| GLD | 91.45 | 92.31 | 0.94% | 10,616.44 | 115.01 | 6.07% | 0.06% | |

| IAG | 9.99 | 10.58 | 5.91% | 13,045.62 | 1,233.05 | 7.46% | 0.44% | |

| MON | 76.16 | 75.66 | -0.66% | 4,437.53 | 58.65 | 2.54% | -0.02% | |

| NRP | 20.92 | 20.83 | -0.43% | 8,646.74 | 415.11 | 4.94% | -0.02% | |

| PAAS | 18.47 | 19.34 | 4.71% | 11,615.62 | 600.60 | 6.64% | 0.31% | |

| RGLD | 43.74 | 46.00 | 5.17% | 12,710.69 | 276.32 | 7.27% | 0.38% | |

| SLV | 13.68 | 13.81 | 0.95% | 11,218.52 | 812.35 | 6.41% | 0.06% | |

| SLW | 8.34 | 8.81 | 5.64% | 8,557.48 | 971.34 | 4.89% | 0.28% | |

| SSRI | 18.65 | 19.65 | 5.36% | 11,431.07 | 581.73 | 6.53% | 0.35% | |

| TBT | 53.03 | 51.03 | -3.77% | 10,165.34 | 199.20 | 5.81% | -0.22% | |

| TC | 9.63 | 10.31 | 7.06% | 4,836.52 | 469.11 | 2.76% | 0.20% | |

| TCK | 16.12 | 15.99 | -0.81% | 10,631.65 | 664.89 | 6.08% | -0.05% | |

| TZA | 24.86 | 22.74 | -8.53% | 4,581.18 | 201.46 | 2.62% | -0.22% | |

| AVG (daily) | 2.48% | $ 161,482.09 | Equity value | 92.32% | ||||

| AVG (monthly) | -5.89% | $ 13,440.07 | Cash | 7.68% | 0.00% | |||

| AVG (inception) | 16.22% | $ 174,922.16 | Tot Port Value | 100.00% | 2.73% |