Do you know what an ETF is? Ha! We probably just trade them just to trade them. The easiest way to describe it is it’s like a stock-mutual fund.

If you’ve been trading ETFs, and iETFs (inverse), then you know that they are influenced by market forces. Well, you probably didn’t realize just how strong this force was. In other words, many of these highly liquid ETFs (especially the 2x), like SRS SKF FXP EEV, can quickly trade at a huge, and I mean huge huge huge premium or discount. For that reason I’ve been saying the 2x ETFs were becoming a good contrarian indicator, much like the put/call ratio (currently we are trading at a discount).

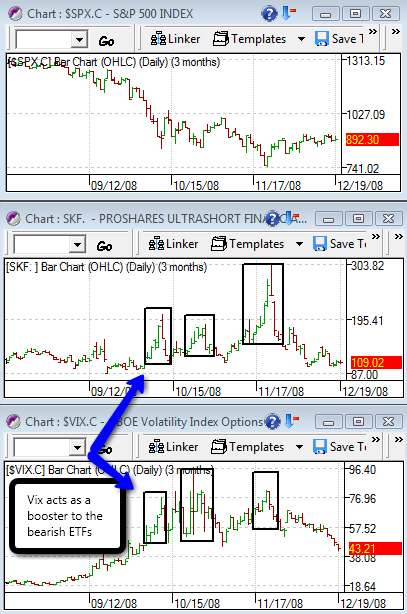

So how can we find an entry point in an ETF like the aforementioned, when it seems like they’re so cheap? Well, because a lot of the index 2x and 3x ETFs are very forward looking and emulate the properties of contrarian indicators, I find these ETFs trade best when there is a lot of volatility in the market. So, check the volatility!

Ask yourself: How does the market’s volume and direction affect an ETF like SRS, SKF, FXP, EEV?

…Understand that these ETFs are deteriorating, or like gravity, just have a tendency to go down. So, if there’s not enough volume in the market, then you will see an invETF like FXP or SKF just melt down. If the general market is trending up, the deterioration in price will be accelerated.

Ask yourself: How does volatility affect these invETFs like FXP or SKF?

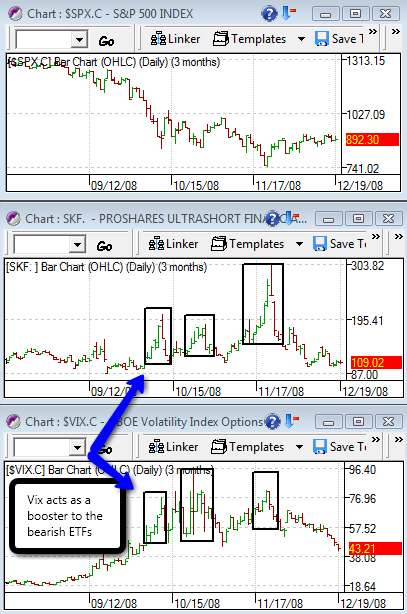

…They affect them drastically! The higher the volatility, the less deterioration/gravity effect on them. Usually when volatility is high, these instruments become easier to trade over longer periods. Therefore, it is important, at least for me, for the VIX to be in firecracker mode. Notice from these 3 charts, that the Vix actually acts as a booster for the invETFs. This theory sounds reasonable because the invETFs are acting a lot like contrarian tool- we tend to overshoot the market when it comes to fear. More importantly, notice when the Vix reverses, these invETFs drop, as if the floor were just removed from under it. For this reason, I prefer to short SKF rather than get long UYG in the event of a relief rally.

Pretty amazing stuff there going on. Another thing you may want to consider is to short the invETFs on the first sign of a Vix reversal/fear reversal if you’re holding shorts. I mentioned earlier when SKF was above 300, and the Vix was above 80 that you should buy some December puts. Those would have been incredible hedges!

In hindsight, I noticed a lot of people were buying up stuff like FXP, EEV, and SKF since late November, thinking they were getting a bargain on them, but were actually buying knives. Remember, since late November, the market’s personality drastically changed as the Vix lost a lot of strength, which translated to less interest in the bearish ETFs. And, because they are strongly dictated by market forces (demand/supply), they just kept on falling.

So try to stay away from going long these inverse ETFs, 2x, 3x, 5x, 10000x, when the market is “quiet.” If you want to maximize your gains on them, use the VIX to amplify the price. Remember, they are driven by market forces. Occasionally you will get some life in the Vix intraday, and when that happens I like to short or get long these “badly priced” deteriorating ETFs.

One last note- I have a feeling the entire ETF market is turning into a bubble, and that they are destroying our market. Remember, these instruments are deteriorating… One day they will all just be another mutual fund. We have yet to see the damage that these ETFs will do to the market and to itself.

-gio-

Comments »