“That Was a Bad Idea”

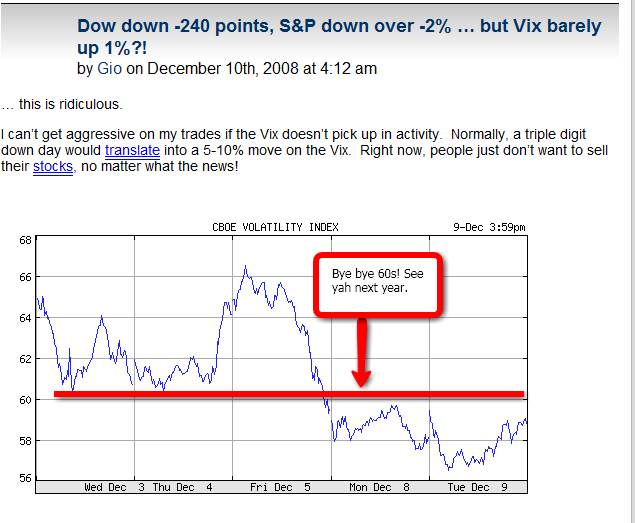

Although I am medium term bullish, long term bearish, a move like this week makes me short term bearish. A lot of false bullish signals showing up. Be careful not to mistake bullish moves in bad places as, well, bullish moves. I did enter a few shorts, as I noticed the Vix barely dropped on this move, as well as seeing some inverse ETFs showing relative strength (SRS, SKF… not FXP, EEV, I am bearish on FXP which should be de-listed for being so idiotic). My strategy here is to short on the rips and buy on the dips on any index that moves +4% over a multi-day period. It’s too early in the year for me to pick a side. I still think retail traders are moving this low volume tape, and the institutional investors are waiting to sell at higher prices.

Nevertheless, some things I noted today:

– Ugly stocks moving up

– Volume down on major indexes

– AAPL testing 91 resistance

– Nice move in solars today, but solars is not a leading sector. FSLR, JASO, SOL, SPWRA

3 of the 4 commodity horsemen were strong on price, but weak on volume.

– Nice jump in oil. Again, stocks up in the energy sector are up, but about 1/2 the trading volume. CLR looks good for a swing long. APWR is a trader stock.

– Gold was weakest. I am short EGO.

– Steel and other worthless scraps of metal were also up. X, MEA (up almost 30%! Mama MEA!)

– Ag/Fertz stocks up. MOS, POT, TNH, MON

… keep positions tight! It’s still a little to early to short aggressively, but I do think it’s a little late to enter new longs. But, whatever is working for you, stick to it with a few exit strategies.

Go check out Pearlman’s new blog. He’s a trader focused on trader psychology, so his field and skill intersect a little with my sentiment trading background. For those interested in a technical approach to the indexes, I think C-Addict’s latest post about the Indicators is a must read.

K, back to work!!!

-gio-

Comments »