Do you know what an ETF is? Ha! We probably just trade them just to trade them. The easiest way to describe it is it’s like a stock-mutual fund.

If you’ve been trading ETFs, and iETFs (inverse), then you know that they are influenced by market forces. Well, you probably didn’t realize just how strong this force was. In other words, many of these highly liquid ETFs (especially the 2x), like SRS SKF FXP EEV, can quickly trade at a huge, and I mean huge huge huge premium or discount. For that reason I’ve been saying the 2x ETFs were becoming a good contrarian indicator, much like the put/call ratio (currently we are trading at a discount).

So how can we find an entry point in an ETF like the aforementioned, when it seems like they’re so cheap? Well, because a lot of the index 2x and 3x ETFs are very forward looking and emulate the properties of contrarian indicators, I find these ETFs trade best when there is a lot of volatility in the market. So, check the volatility!

Ask yourself: How does the market’s volume and direction affect an ETF like SRS, SKF, FXP, EEV?

…Understand that these ETFs are deteriorating, or like gravity, just have a tendency to go down. So, if there’s not enough volume in the market, then you will see an invETF like FXP or SKF just melt down. If the general market is trending up, the deterioration in price will be accelerated.

Ask yourself: How does volatility affect these invETFs like FXP or SKF?

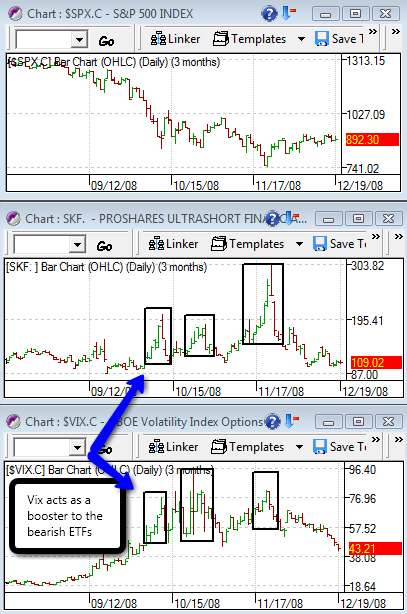

…They affect them drastically! The higher the volatility, the less deterioration/gravity effect on them. Usually when volatility is high, these instruments become easier to trade over longer periods. Therefore, it is important, at least for me, for the VIX to be in firecracker mode. Notice from these 3 charts, that the Vix actually acts as a booster for the invETFs. This theory sounds reasonable because the invETFs are acting a lot like contrarian tool- we tend to overshoot the market when it comes to fear. More importantly, notice when the Vix reverses, these invETFs drop, as if the floor were just removed from under it. For this reason, I prefer to short SKF rather than get long UYG in the event of a relief rally.

Pretty amazing stuff there going on. Another thing you may want to consider is to short the invETFs on the first sign of a Vix reversal/fear reversal if you’re holding shorts. I mentioned earlier when SKF was above 300, and the Vix was above 80 that you should buy some December puts. Those would have been incredible hedges!

In hindsight, I noticed a lot of people were buying up stuff like FXP, EEV, and SKF since late November, thinking they were getting a bargain on them, but were actually buying knives. Remember, since late November, the market’s personality drastically changed as the Vix lost a lot of strength, which translated to less interest in the bearish ETFs. And, because they are strongly dictated by market forces (demand/supply), they just kept on falling.

So try to stay away from going long these inverse ETFs, 2x, 3x, 5x, 10000x, when the market is “quiet.” If you want to maximize your gains on them, use the VIX to amplify the price. Remember, they are driven by market forces. Occasionally you will get some life in the Vix intraday, and when that happens I like to short or get long these “badly priced” deteriorating ETFs.

One last note- I have a feeling the entire ETF market is turning into a bubble, and that they are destroying our market. Remember, these instruments are deteriorating… One day they will all just be another mutual fund. We have yet to see the damage that these ETFs will do to the market and to itself.

-gio-

If you enjoy the content at iBankCoin, please follow us on Twitter

very educational, as always. Thanks Gio

Nice explanation. Makes alot of sense when spelled out to a newbie as am I.

do the wave!

nice post

Interesting blog on the math behind ETFs:

http://potrix.com/ryan/b.do?blog=/08/10/30/b_175123.txt

Please borrow Fly’s time machine and warn me of this two months ago.

Please.

Gio,

Thanks for the imformative post. Then what say you about TBT? Alot of people are eyeing this in 2009 as a slam dunk when interest rates rise.

TIA

thanx tim for the link.

Jingle… i’ll check out TBT. I’m not sure how fast rates will be raised though. We probably chill down here for a while.

Thanks a lot Gio, superb analysis. Can you go deeper on the market destruction part?

destruction of $-currency pending… money base quadrupled

http://www.nowandfutures.com/images/fed_all.png

That last paragraph sums up the feeling that I’ve had for some time. People scoffed when I said that problems were coming with those instruments.

scum… that was you? I remember there was someone shouting and cursing and venting at the ETFs. i was just going to ask who that was. Anyway, I think you’ve been correct on that for awhile now. These ETFs will be sooooooo 2008.

Gio

The other say I sold short 3000 shares of ARTC when you mentioned it on twitter.

The stock tanked today and made a HUGE amount of money. I would like to donate some of this cash to a charity in your name (no bs). Please list one that you support and I will post a copy of the check and put it up for you and everyone else to see.

Thanks man, great call.

Ass Napkin

P.S I will not donate anything to the Lakers. Although they could use it to get some talent on the team.

LOL.. great one Ass Mike! I’m super glad you made money off that call!!!!! It’s funny you mentioned that because my next post is briefly about ARTC. It’s on a “timed-post” so it will come out in about 2 hours.

How about tipping some of that to Danny? Heh.

If you really want to donate to a charity, I would like you to give some to the National Breast Cancer Society, by either two ways:

1) shop here <a href = “http://shop.thebreastcancersite.com/store/category.do?siteId=224&categoryId=339&origin=BCS_GOOGLE_ADGROUP-GenericBreastCancer&gclid=CM-9ue7SzZcCFRlRagodkEOCDA” Pink Ribbon and pass those items out to some women.

or

2) directly donate to American Cancer Society here: https://www.cancer.org/docroot/DON/DON_1_Donate_Online_Now.asp

… I’m totally for supporting the Pink Ribbon because my oldest sister fought breast cancer.

Thanks for helping!

P.S. Celtics are a bubble. I increased my shorts in Boston today.

Anton —

Just borrowed Fly’s time machine and went back two months to warn you about the ETF’s.

You said, and I quote: “Fuck off, I’m stickin’ with.”

_______

Whoa Mike, i just noticed you banked $30,000.

Buy me a drink fool!!

scum… that was you?

Well, I never did touch ’em, but I remember telling Fly some time ago my opinion about FXP. I can’t believe that professional traders lean so heavily on such a flaky, volatile, and yet popular mutual scheme. If risk doesn’t eat you alive management and leverage fees eventually will, on top of that you have counterparty risk and gubmint meddling. They have a radioactive decay rate measured in days, sometimes hours. I would think a straight long / short self managed system would provide better results over time.

time machines only go forward Jake.

We’ve had this convo SO many times re the double ETFS.

They are not and never were a proxy to day-to-day moves.

Gains over several days or weeks COMPOUND in the direction of the trend which mean losses compound too.

fins from 30 ——–10

= skf from 100 —— 230

fins gain 20% ——- 12

skf ————150.

fins gain 20% ——- 14.4

skf ———- 90

notice how skf LOST money even though the fins started at 30 and ended at 14.4

even if I made a mistake in my extremely hasty math, the example remains. It’s not hard to grasp and I am flummoxed that it causes such problems

Gio, Did you see the move in XOM? Heh heh.

Props to A.N. Mike for expressing his gratitude to the deserving and for his do-good plan.

Congratulations on the banked coin, too.

Danny is right… coming from a trader, we get a good feeling for these market anomalies. when it doesn’t feel right, it’s probably time to adjust the way you trade them.

Gio

Consider it done. I will make a donation of $4,000 in your name (right now) to the second link you posted. I looked over both sites and prefer the second where you can just give cash directly and not have to purchase any items. My guess is that the cash would help them more.

Thanks again for the call– it would have never made it on my radar screen if I wasnt reading your posts. It is my pleasure to be able to do this right now. I wish your sister well and let her know that this donation was able to be made b/c her brother has skills.

Thanks again Gio. This was a HUGE win for me.

Im making the donation rigt now.

If time machines only go forward….

how does fly get back to the present?

Mad props to the Altruistic Ass Napkin.

Jake,

Sure you didn’t go back too far and talk to this guy?

http://filip.stir.org/images/comics_animation/slide0016_image009.jpg

Couldn’t have been me. I don’t use such language.

DMG’s reasoning is airtight, btw.

———–

Mike,

Well done.

Ass Napkin…

I sent you an email.

Mucho mahalo!

big props mike!

DMG – notice how fly ONLY uses his machine to go FORWARD to get a future price — going back in time is impossible and means nothing. Of course if he goes forward he comes back to implement what he saw. He’s not traveling back in time, he’s returning to his original state.

Perhaps, you’re familiar with my TM? It’s a different model but still quite capable and She only goes forward as well. They all do.

Regarding the mystifying moves of the ETFs (especially the diETFs that we know and sometimes love):

Compounding certainly explains why a multi-day change in the diETFs diverges from the d.i. of the multi-day change in the underlying index.

However, I don’t believe that compounding (or any other explanation I’ve seen) fully explains the magnitude of the divergence.

We understand the goal of the diETFs (-200% of the daily change of the underlying index), but what do we know about the mechanism used to achieve that goal? How does the transactional cost vary in differing market environments? Does the mechanism work as well on days of high % change as it does on days of low % change? Etc.

Some months ago, Woodshedder and I had some discussions about diETFs versus the index, and he provided a spreadsheet with daily price data for a diETF/index pair. Not surprisingly, the daily performance was not exactly -200% of the index. I was curious as to whether there was any systematic difference between the actual daily relationship and the -200% target. At the time, the issue under discussion was about the effect of compounding, so I didn’t pursue the matter.

If I did take another look, one thing I’d like to graph is the actual daily relationship versus the daily % change in the index, to see if the d.i. mechanism has a directional bias and to see if the output of the mechanism is distorted by large daily % changes in the index.

You are wrong about the time machines, guys.

The Fly lives in the future. He uses the machine to visit us.

Gio,

Got the email.

Sure thing.

These etfs tend to play catchup the following day or next if they start to lag behind on a single day. They will overpay the next time. I’ve done tests over long periods (using my own trading signals) that it still paid to continue to use the ETF, but you had to stay with the ETF the whole way through the trade.

If lets say you were supposed to be long for 5 days according to your trading plan and you decided on day 3 to get out because the etf wasn’t keeping up. Typically over a span of time the total % move equals (or better) the declared 200% move of the single beta pair, if you get the direction of the etf right <- and that is the rub.

The exploding ultra etf example:

So lets say the XLF goes down 2%, theoretically the SKF should go up 4%, but under the premise that these ETF’s are going to explode someday, then what do you think SKF does on a day like this example? Is it possible the SKF goes down 70% while the XLF is down 2%?

I agree though the best way around any of the problems related to these etfs in achieving near exact % gain everyday is playing the inverse etf both sides. Long the inverse for short and short the inverse for long.

Some are not shortable @ Ameritrade fwiw. FXP being one.

Dan-0

Forward = Backward / present + .25% – all things that are creamy…

know waht i’m sayin’?

Dammit Jim! I’m a doctor!