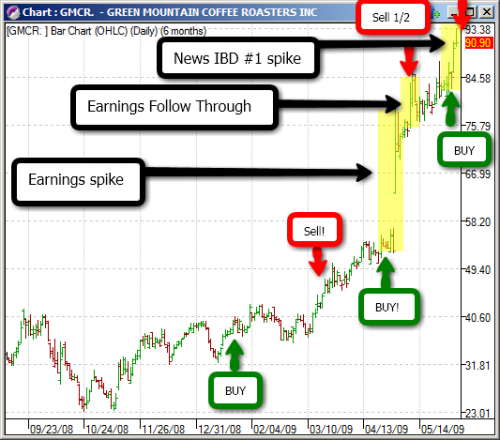

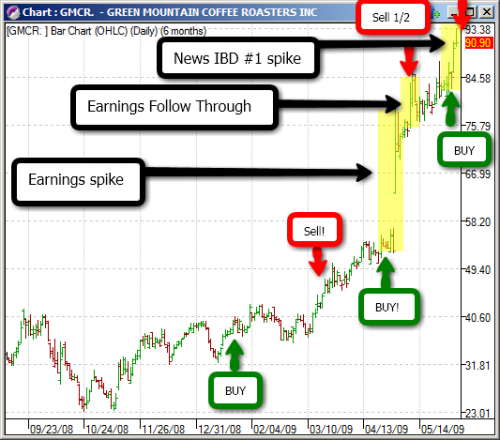

I sold half of GMCR today as planned at 92.xx, bringing my average-cost gain for this trade to about 190%. Bought this in the 30s, 50s, and 70s. I hope the remaining half gets me into the 200 zone! I figured we would get a follow-through over into the 90s, and we did, but heading into the weekend I wanted to make sure I took advantage of this and decided to sell on the news.

If you’ve been following me, then you know that I know GMCR in and out and have been following it both as a stock, but more importantly as a company. I don’t track that many stocks, but when I lock in on one of them that has all the right properties within a longer term swing trader’s comfort area, then it’s a textbook trade from there. I placed the significant buy and sell points on GMCR on the chart, try to remember the reasons why I bought and sold in these areas. They are unique in that I didn’t pay any attention to moving averages throughout these trades, but kept with simple cause-and-effect relationships and the generally behavioral pattern of the stock thereafter. These work best for small cap companies

- Find company with growing earnings… the ones that jump out of your screen, like double digits or even triple digits. GMCR surfaced in screen late 2008, and hit my priority list in late January.

- Track mutual fund and institutional ownership trend.

- I decided to buy pre-earnings because GMCR had a nice run, but on low volume up until that date. It was under the radar, and with a good chance that it would beat estimates, I figured the skeptical buyers would come in. Post report, volume surged!

- Usually with surprise earnings you will get a post-earnings run-up. If you’re a swing trader, then you want to sell into these run-ups, then re-buy closer to stock price close to the earnings day spike (I usually aim for low-of-day on the spike).

- So, GMCR was giving us 1) stellar earnings, 2) increased institutional ownership in a very short period of time, and 3) breakout after breakout on technicals … these are the key criterias for stocks on the IBD 100. But GMCR’s was special, and so it jumped all the way to #1 recently. Again, by the time it gets there, if you are a swing trader then you want to sell some on the news. I say “some” because the after effect is 50/50 from here: we either rally up again, or we see profit-taking. When it is 50/50, we move to the current status of the market, which is 1) really choppy, 2) overbought, and 3) the VIX is signalling increased volatility. All three indicators there give me reason to take partial profits instead of adding to position.

So anyway, that was a brief case-study in action on position-sizing for swing trading. As you can see, you can pick entry and exit points by minimizing technical analysis and it really works. Looking back, this trade in GMCR is starting to look more like an “investment” rather than a “trade.” Hmmmmm, feels like 2007 all over again. Time for some coffee!!

Aloha,

Gio

Comments »