This is a stock pickers market. I got three stocks worth trading tomorrow based on Wednesday’s tape. They can either be day traded or swing traded:

1) Life Partners (LPHI)

- Rationale: Wednesday, LPHI was the biggest loser on the IBD 100. LPHI was a leading stock since late March before losing steam early November. Late November the stock caught fire and rallied a little higher than its previous high. That caught shorts off guard. Wednesday stock was down 11% on higher volume.

- Swing traders: short this with a stop above 38 which was previous support. Notice on the 5-day, LPHI rallied Tuesday, but that entire rally has wiped out. If that gap is filled, then there is a swing trade opportunity on the long side. However, I think reward is better on the short.

- Day-Traders: play the gap. There may be a rally attempt back to 38, so I would enter daytrade shorts if LPHI struggles with 37.xx.

2) RTI Intl Metal

s

- Rationale: Kind of similar to LPHI, except the long term chart for LPHI was nice, while RTI is ugly. Look at the 5-day chart, you’ll see RTI was up about 10% yesterday for an earnings spike, but nearly all of that is gone + we are back below the roof of that channel.

- Swing traders: use the 1-month consolidation as your stop point. I like this as a longer term short.

- Day traders: play this either way. You have 13.90 as a selloff point, and 14.20 as a breakout point.

3) Edwards Lifesciences (EW)

- Rationale: EW had a runaway rally after reporting good results and outlook on Wednesday. Stocks high is 66.

- Swing traders: look for a slight reversal under 60 before getting long. Buy 1/2 now and 1/2 just below the 52-high. Set stop for initial position to 58.

- Day traders: use the flag at the close. Buy above 60.20 for continued move. Probably doesn’t move much though.

Other notes: NYSE notched another distrbution day yesterday. That makes it 2 distribution days since IBD issued a follow-through day. Tomorrow will be filled with earnings, so I’m going into tomorrow expecting choppy waters.

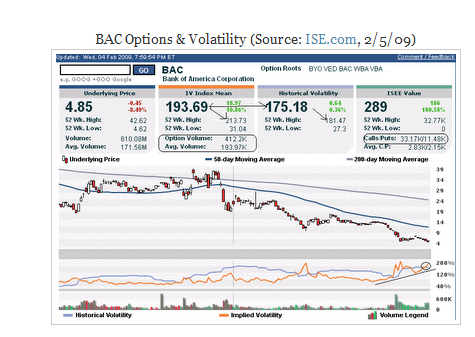

Today I jacked a BAC chart from DistressedVolatility . He uses options activity and volatility indicators for direction on individual stocks. I’m a fan of the put/call ratio so I think its a good way to track a highly volatile stock… like BAC.

http://2.bp.blogspot.com/_xlGBqqM0muE/SYqZzzP6y7I/AAAAAAAABAg/5N4lAox5YAc/s1600-h/bac3.PNG

If you enjoy the content at iBankCoin, please follow us on Twitter

What? No aloha?

so do we get your Thunder Thursday today?

Aloha!

watching 8050