If the July Retail Sales was another strong one, then yes the Federal Reserve Confab at Jackson Hole could have been the Fed’s Waterloo. But it was not.

The fact is the July Retail Sales was anemic at best. The Federal Reserve cannot move with a data point like today’s retail number and who knows it may get revised in a month because IMO the data makes zero sense as the last several personal spending numbers do not validate this drop.

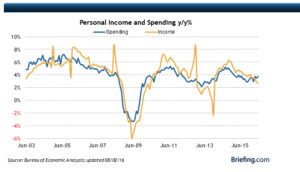

In fact, the chart below shows that personal spending just moved above personal income. A pretty interesting chart.

Around 11:00 witness the Federal Reserve of New York cutting Q3 GDP to 2.4% from 2.6% and then closer to 12:00 the Atlanta cutting to 3.5% from 3.7%. Seems like they are in panic mode as well. But guess what, they can take some air out of the market so they will do it.

The best analysis of economic data I read day in and day out is Brian Wesbury of First Trust. I met Brian make in 1986 and have been a fan since I first met him. His commentary also is free and can be found on the First Trust website.

I am on the edge of my chair to what he says about today’s action. Once I know then I will post those thoughts here. Until then, have a great weekend.

If you enjoy the content at iBankCoin, please follow us on Twitter

I love the J-hole