We know that rotation is the lifeline of a bull market, which forces us to consider Tuesday’s strength in energy stocks even as the Nasdaq, small caps, and transports generally lagged. On the weekly chart of the sector ETF, the XLE (first one, below), we can see a multi-year symmetrical triangle breakout to begin 2013. The key, of course, to a major breakout first and foremost is whether it has staying power, or instead reverses lower in a nasty bull trap.

With this in mind, there are a slew of individual energy stocks I am watching for strength throughout the rest of this week. While I would not chase an extended energy stock like ConocoPhillips (COP) up here right now, I would certainly consider a long swing trade in Continental Resources on further strength, among others. On the second chart below, consider the multi-year look of CLR as it threatens to break above major resistance and rally back to all-time highs.

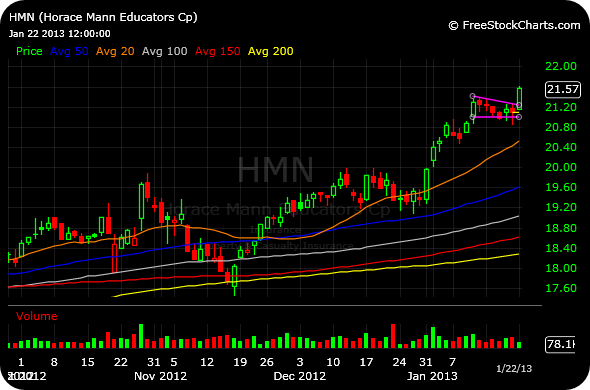

The setup with the overall market right now is such that bears are arguing for a broad correction, while bulls wants to see the rotation thesis persist as the indices grind higher or sideways. I believe watching the bevy of, currently, non-extended energy stocks is an excellent indicator of which side wins out. And the third and fourth charts, below, of the daily timeframes for other energy/driller/services stocks should likewise flourish in a continued bull rotation. They might need more time to base or form bull flags, but generally speaking recent gains should largely be held intact. Furthermore, in order for me to actually take the trades I need to see further actual strength.

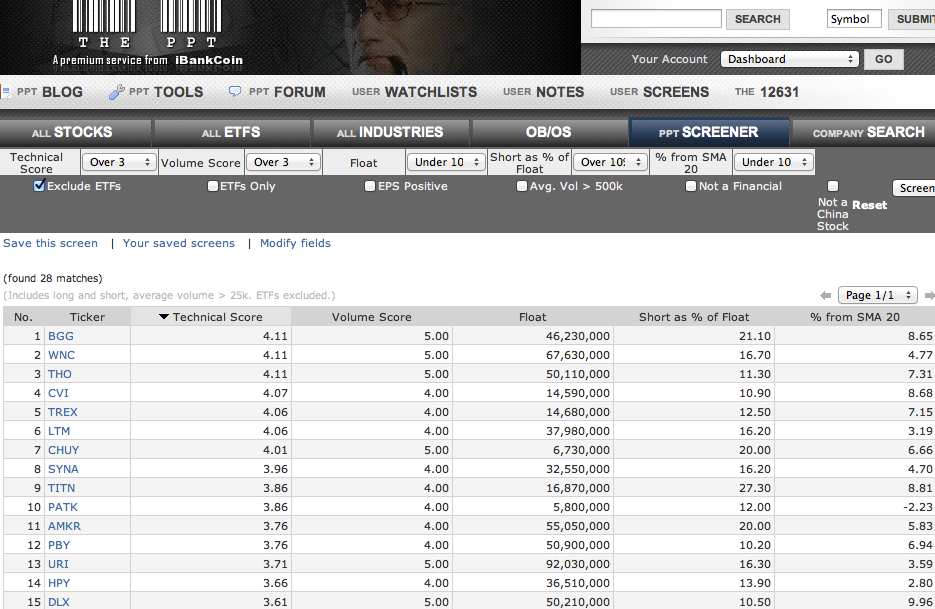

Member of The PPT and 12631 can click here for my “12631 Top Energy Performers” saved screen for other ideas in the space, sorted by Daily Hybrid percentage change.

____________________________

____________________________

____________________________

____________________________

Comments »