Comments »

Yearly Archives: 2014

A Good Day for Losers

2013 laggards like BBRY MCP shined today, while many marquee names from last year like LNKD NFLX SBUX underwhelmed. Solars and china stocks remains the bright spots for bulls, however.

Be sure to stick around after the bell for my video market recap.

________________________________________________

Comments »A Crude Development After the New Year’s Party

Molycorp is consolidating well today on the intraday chart, first below, as one of the brightest spots in the tape for bulls today.

On the other side of the coin, crude oil is turning in a terrible session, with the ETF, second below, sporting a weekly chart bearish rising wedge breakdown. I have favored natural gas over crude for a while now, and that remains the case.

Drop me your top tickers for the final hour.

_______________________________________________________

_______________________________________________________

Comments »

A Silver New Year’s Toast from Marc David

Loyal iBC reader an subscriber @marc_david notes the strength in silver miner AG of late.

The good news for Marc is that despite the carnage in the metals and miners complex in 2013 (though we did pinpoint some tactical long trades inside 12631 along the way), the weekly chart shows a potential double-bottom. It is not yet confirmed, but there are notable bullish RSI divergences versus the prior lows.

Today’s gap higher is a promising start, and it may very well catch many out of position if the strength continues in the sector.

____________________________________________________________

Comments »Two Charts I am Staring Down This Afternoon

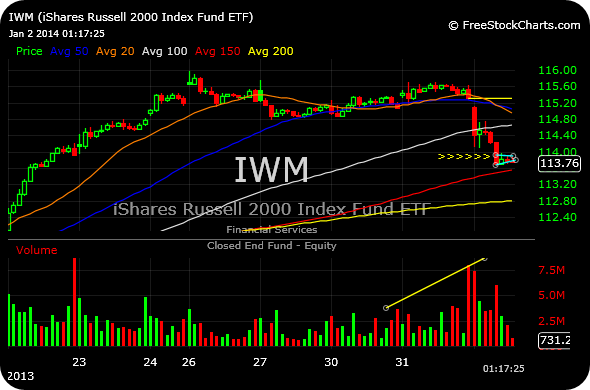

The small caps in the Russell 2000 ETF, seen first below on the 30-minute timeframe, are notably weak today on heavy sell volume and bear-flagging with the potential to drop lower.

This type of action is the main reason I am reticent to go full throttle initiating new swing longs, even though the action in the solars (CSIQ FSLR SPWR YGE, to name a few) is quite encouraging, as is the action in China names like SINA VIPS YOKU.

That said, if the bulls can pull off the type of afternoon rallies we saw so many times in 2013, I would be quick to pounce on some longs.

Also note the tight intraday consolidation on the silver ETF, second chart below.

______________________________________________________

______________________________________________________

Comments »

Bright, Photogenic Spots Amidst the Red

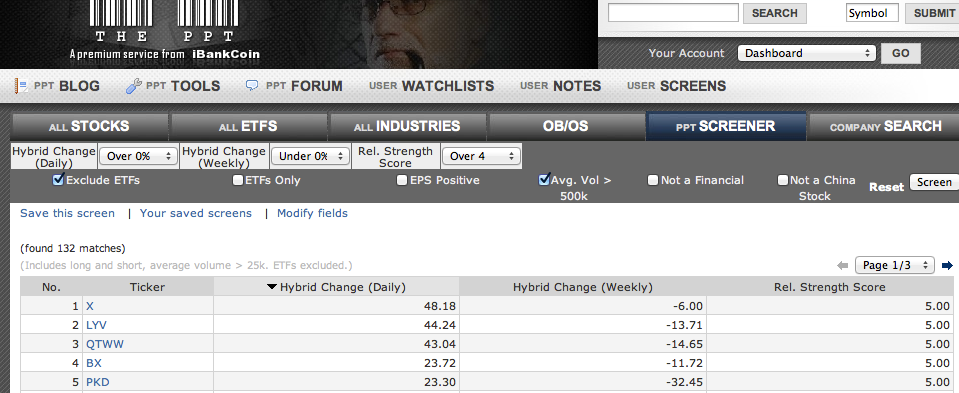

Courtesy of The PPT algorithm, here are the most current top five readings from my “12631 RELATIVE STRENGTH” custom-made screen, identifying which stocks are exuding some of the best performances to the market at-large at any given moment.

I look for stocks whose Daily PPT Hybrid Score surges, while the Weekly Hybrid has been negative over the past week. This can often yield stocks which are emerging from consolidations.

Members can click here to view and save the screen.

Sorted for at least 500,000 shares of daily average volume to ensure liquidity.

Please click on image to enlarge.

________________________________________________________

Comments »