A long-term money-saving concept to remember in the market is that divergences do not always resolve in favor of your bias.

Case in point: The highly defensive consumer staples had been notably outperforming the consumer discretionary stocks. We were observing this divergence the past few weeks to see if the broad market would follow suit with the general “risk off” theme of the divergence. Instead, however, discretionary stocks started to turn things around.

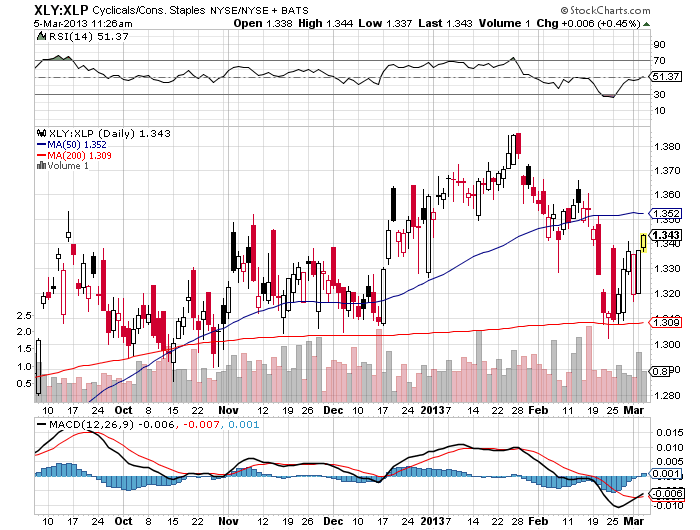

The following chart pits the XLY (discretionary/cyclical stocks) versus the XLP (defensive staples). Note the V-shaped move by the discretionary stocks off the correction lows last month. Suddenly, they are at all-time highs (on their own chart) and notably outerperforming the staples today.

Being nimble and keeping an open mind with divergences may very well be cliché, but it sure is necessary.

______________________________________________

If you enjoy the content at iBankCoin, please follow us on Twitter