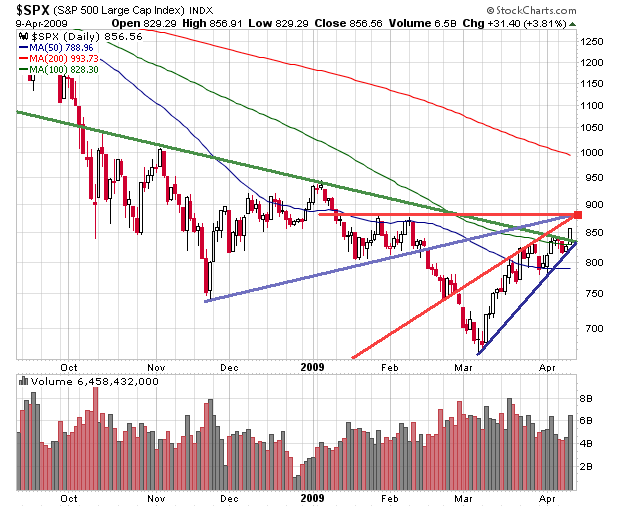

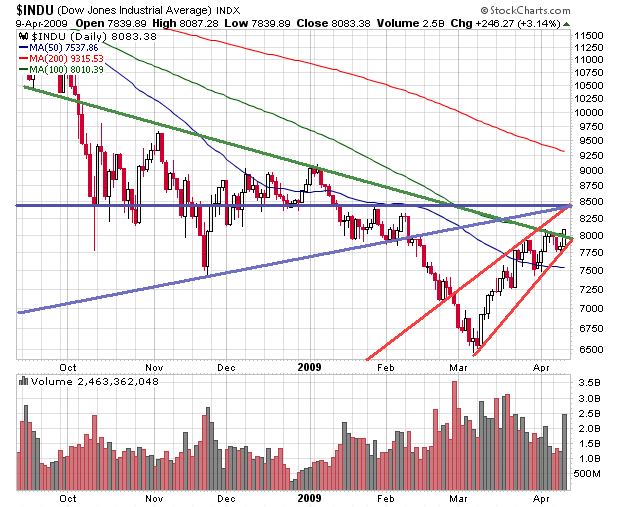

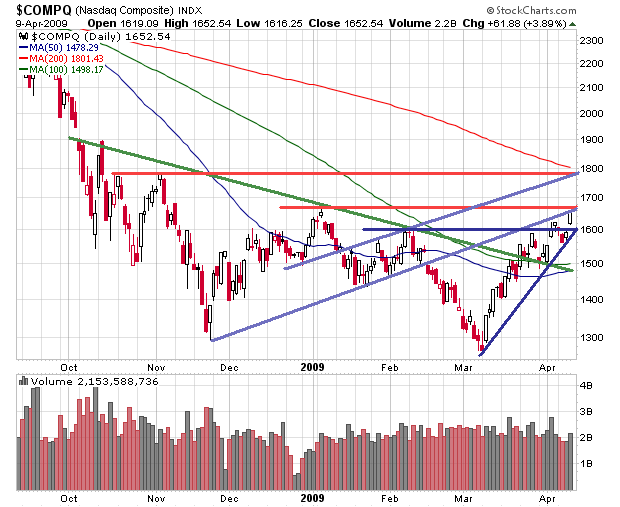

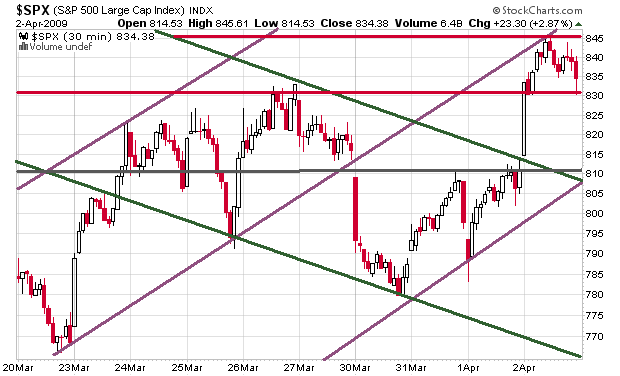

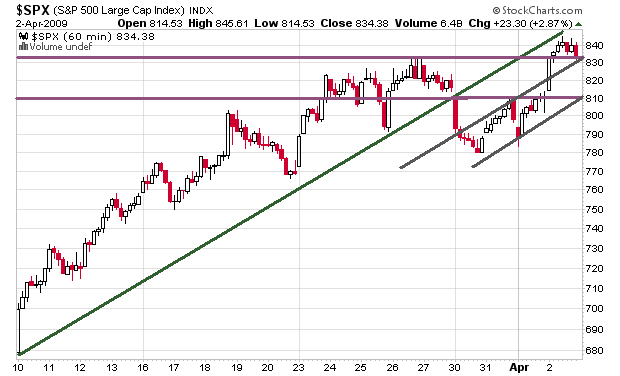

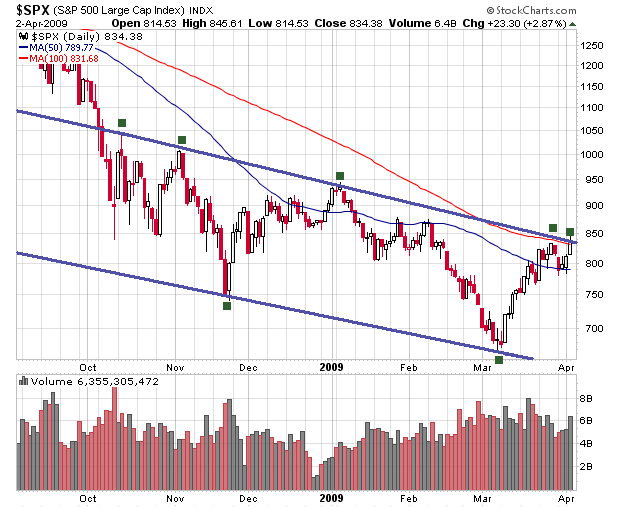

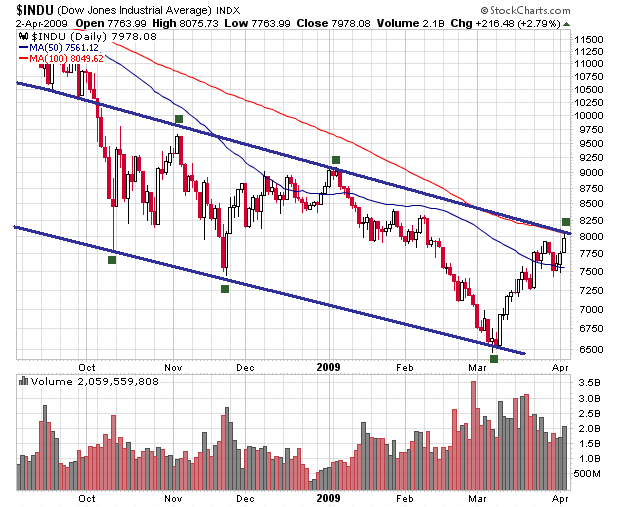

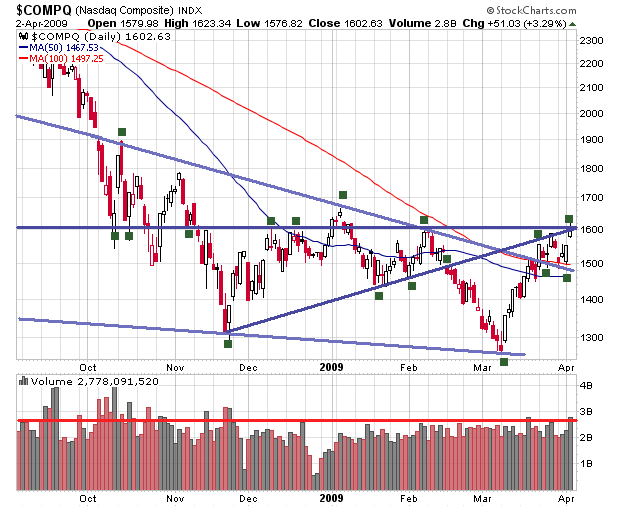

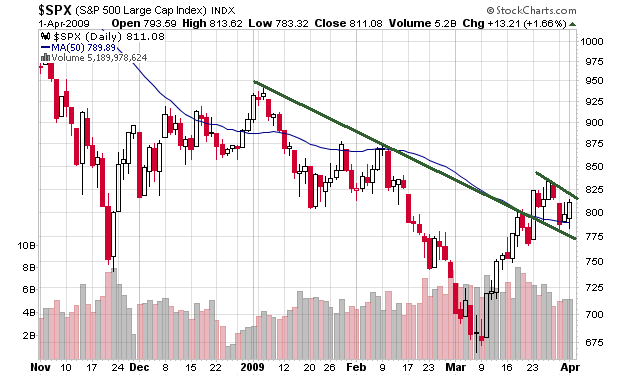

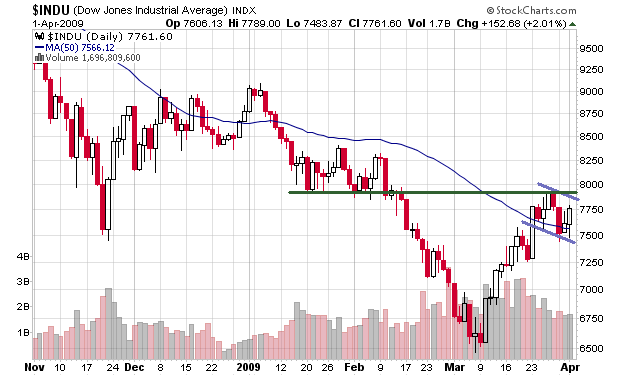

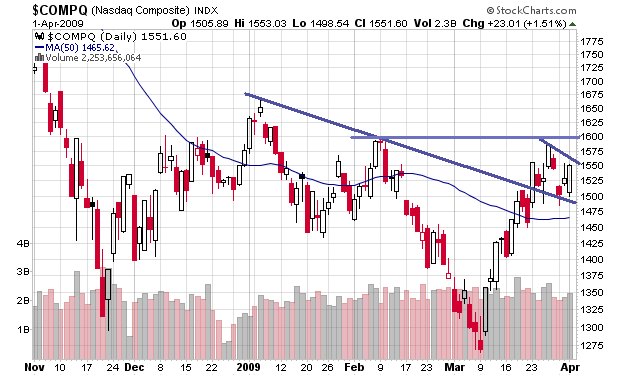

875 is the top range of the mid-Jan to mid-Feb SPX consolidation area. So far, all indices have hit resistance areas but continue to push forward. Bad news is considered good news and good news is considered great news and the market rallies every chance that it gets. At this stage, the Nasdaq actually has a really good chance of reaching the 200-day MA, something that was quite unheard of a few months ago. The problem is that not all indices are following each other perfectly, so you are seeing divergences between the SPX, DJIA, and COMP.

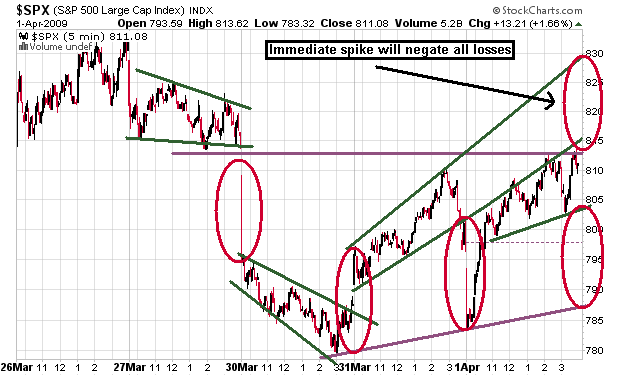

It will take some seriously terrible news to bring this market down, and I think it would take a massive pre-market gap down, sustained with follow through, in order for a downtrend to emerge. The last breakaway gap down at the end of March actually failed, which was a signal to go long. Those gaps have a 1% failure rate, so it’s important to pay attention to them.

I didn’t want to hear any bullshit from anyone, so I just posted on my other blog and told just a few people of my long swing experiment. The experiment was to open large long positions before last Friday’s close, hours before I left for my trip. The purpose was to prove that TA still works and that it is not “dead” when it comes to swing trading. I’m up +8.7% as a result. Prior to leaving, I was down -2% for April. The decisions made last Friday had to meet several criteria:

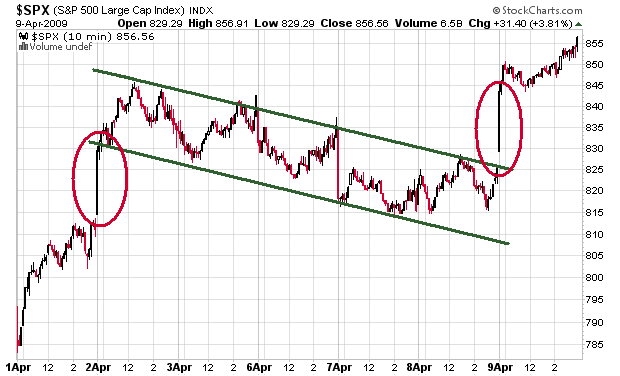

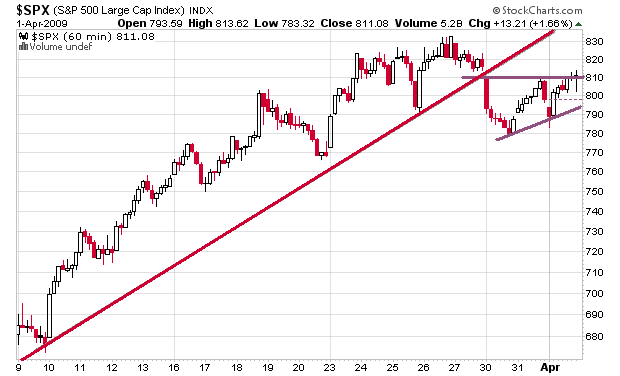

1) The breakaway gap down fails and fills to the upside within 5 days, breaking the 1% probability. Check.

2) There needs to be a equal or greater-sized upside spike than the gap down spike. Check.

3) The market needs to be consolidating or flagging for a potential breakout. Check.

4) Individual names must be setting up in high probability consolidation patterns. Check.

This is the rare Rising 7 Method.

I know that the Ragin and I are in several names together, but I also added MI, HBAN, and SIRI to the overall mix, which includes TSL, JASO, FEED, and LDK, which was actually bought on 4/7. I still hold everything cause I got back well after the mkt closed. 875 will be an initial sell point. Some stocks, such as FEED, and SIRI did not breakout while I was away, which was frustrating. I’ll give them just a bit more time to cook in the microwave before deciding their fate. Another promising wave 1 symmetrical triangle? FIG. I’m not in it, but I will likely add it into the bunch.

Just a personal experiment for my own benefit since I never left so many positions open while at the complete mercy of the market. I did not want people following me on this, since I know there are people that just blindly follow other people without any good reason. It was just a test and yes, TA still works so don’t worry.

Comments »