Since my last update credit spreads (above) are wider and while the S&P is only 2.2% from its ATHs the Dow has closed at a new low since the 7/27 rally low and the Russell 2000 closed below its 200 day for the first time in 2015. Underneath the popular averages the breadth is awful and many stocks are in bear markets. The bulls are very excited about the Transports bucking the trend lately but given the downside non confirmation by the Dow Industrials it is actually bearish. Additionally the SOX index made a new closing low today. Basically the market is slowly telling us that the Global Economy, despite the rainbow and unicorn nonsense coming from the Fed and the complicit/stupid MSM, is rolling over hard. In addition, the commodity complex has been decimated and is trading near 2009 lows. A fun fact is that in the summer of 1929 Jesse Livermore noticed that the commodities complex of his day was literally doing what we are seeing now. He liquidated all his longs and built up shorts before the great deflation made its way to equities in the Fall of 1929.

Deflations cause debt liquidations which cause credit tightness which cause margin calls in non-equity instruments which eventually cause the selling of equities. Given the amount of margin in the equity complex any minor sell-off could cause things to accelerate very quickly in equities. The wild card of course is the Fed. Will they attempt to reflate with QE4, will it matter or do they just let it go? All interesting questions. I believe they have been preventing any major sell-off but my thesis has been and will remain that mother nature will win and when she does it could be very painful and quick. They key is credit and credit continues to widen and thats what I am watching and keeps me very short this market. Also I have noticed that compared to the last 7 years individual short ideas are a lot easier to find and stay short. I find that short squeezes don’t occur as often. That is a huge tone change from years past and decidedly bearish.

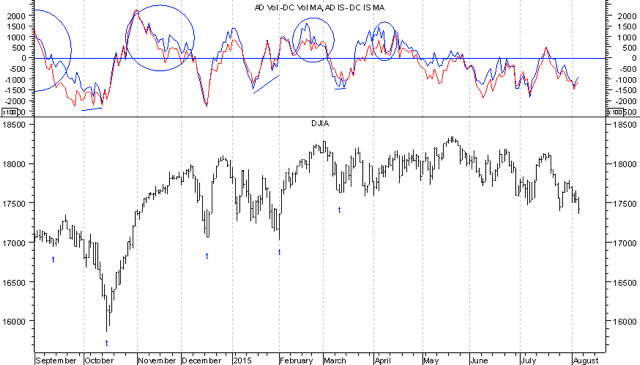

Below are some of the indexes I mentioned and I also included the Advancing Volume vs Declining Volume and Advancing Issues vs Declining Issues Chart. Notice that in the most recent rally out of 7/27 low (which already is rolling) that the movement in price was not confirmed by advancing issues or volume. It appears to me that this market wants to drift or accelerate lower. Everyone on the buy side expects a Fall correction of varying degrees of magnitude. If that is the case, then perhaps we correct now as the market likes to cause immense pain to the most amount of people at any given time. It may be time for the MOUs of the Hedge Fund community to get a head start on their competition and get their asses back from the Hamptons because it looks like Mr. market is about to do it for them.

If you enjoy the content at iBankCoin, please follow us on Twitter

Whats your favorite short at the moment?

I think it’s quite telling that the “bad news is good news” rally off ADP couldn’t even last until lunch time. We rally on news and sell off on nothing. Even Martin Armstrong, who has called for stocks to the moon in next 2 years, is looking for a pullback here.

Hmmmmm….

Bernie,

After the pop my new favorite short is NUS. China story and they just lied on conference call last night. Big SEC news is coming.

What did NUS lie about? I’m always looking for a crooked Chinese ADR to short.

PPT coming in right on time for the stick save…

for resource investors – free portfolio ranking

http://kingworldnews.com/rick-rule-8-9-15/

I’m using an alias because I hate to admit I can’t quite grasp the significance of your credit spread chart. Being new to investing beyond index funds, are there any books/reading material you would recommend for learning about markets?

On whom did this vast depreciation mainly fall at last?

“Before the end of the year 1795 the paper money was almost exclusively in the hands of the working classes…Financiers and men of large means were shrewd enough to put as much of their property as possible into objects of permanent value.”

Von Sybel, quoted in Fiat Money Inflation in France – Andrew Dickson Sept 1912

Key phrase: ‘objects of permanent value’

Capital controls, coming to a financial institution near you.

If the stories are true, in Greece you can only withdraw $67 per day from your account. So if you have $1 million in “your” account, it will take you 59 years to withdraw all “your” money.

My credit union just implemented a new IT system. One thing I did today was to change $9 in loose change into dollar bills. To hand me my money back they required my drivers license and I signed the electronic receipt.

China just ushered in the currency wars, boosting the USD and taking a machete to /CL and stocks. But other than that, everything is awesome.

QCR,

When you are part of the team!

Lava Man,

So many books. I started my career reading liars poker. My knowledge has been accumulated over eons.

bear raid,

they lied about # of sales leaders in china and the sec investigation. other than that this is an awesome story.

currently reading Herbert Hoovers memoirs of the Great depression Interesting reading, especially in light of the global economy and the devaluing of currencies (going off the old standard) and the role of politics….history rhymes

ZH sums up perfectly my thought on the carry trade blowup:

“As mentioned earlier this devaluation is likely not a one-time event but rather the beginning of an ongoing and persistent depreciation of the CNY versus the USD. The embedded USD short position within the carry trades will begin to result in losses and margin calls as the USD appreciates versus the CNY, thus forcing investors to liquidate some of their positions. These trades, which took years to amass, could unwind abruptly and exert an influence of historic magnitude on markets and economies.”

Short USD/long CNY carry trade estimated to be worth as much as $3 trillion. For reference, the 1997 currency wars involved $300-500 billion in carry. Global carry trade in all currencies estimated to be $9 trillion.

So USD/CNY carry is 1/3 of global carry. Once traders start closing out carry positions out of fear it will start a cascade of carry trade margin calls/closures, resulting in a very high USD, lower stocks, and commodities crushed like a gnat. You’ve been warned if you buy this dip.

QCI thanks for the heads up

Re PMs

http://usawatchdog.com/china-just-turned-the-currency-war-nuclear-andy-hoffman/

BlueStar,

You going to do a post on your thoughts and beliefs as to why the devaluation?

Jason,

Its simple. The rising dollar I wrote about on many occasions is the cause. The CNY is pegged to the dollar. They were getting killed on their exports. had to happen. Don’t know why this is a shock.

Blue,

Love your writing. Long time follower. Even if no whole post. Drop a nugget.

The Slammer,

Ok nugget comming.

Don’t dismiss the selloff in high-yield bonds, and keep a close eye on widening investment-grade credit spreads. Chief Income Analyst, Alan is continually and fervently analyzing the financial markets.