Finally we get around to the oil and gas folks. Gotta say, not what I was expecting.

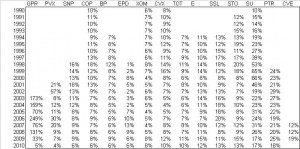

First off, here is the entire data set in case you feel like getting snappy all by yourself.

As before, the missing data is likely an issue with my data provider and not a real indication of missing sales or capex (which would be a little sticky in real life…). There are 68 tickers here after deleting all the ones with no data at all. An industrious individual is encouraged to dig through the 10Ks to fill in the blanks and collect all available information. A caffeinated hedgie would be up until 3am filling in the blanks for fear of missing that one golden nugget someone else might find tomorrow. I am neither.

A word about capital intensity before we dig into the list. After looking at all the other groups over the past few weeks, we have seen some that cycle in a range (utilities) and some that show decline but still invest heavily (telecom). In reality, when looking through these groups the thing we are looking for is abnormally low capital intensity whereupon we can make our assessment as to whether there is a coming investment cycle.

Now that we are smarter about the search, let’s look for a recently low level and from there look for declining investment. We will say “low” is anything less than 20%, but my feeling is less than 10% is low. Here we go, cleaned up and easy to read.

Look at this list. We whittle it down to a reasonable 15 tickers from 68 and get a whole lotta nothin’ for it. This is terrible. Let’s hope our good man Po Pimp can set us straight here and tease a pattern out of it.

If there is anything we might quickly get out of this, we have COP, BP, XOM, CVX and TOT with an average capital intensity of 8% over this time period which is not that far off from 2010. If sales are expected to go up for these big boys, then constant capital intensity means capex is going up. But that is too easy and not indicative of something folks don’t already know.

We don’t even find help by looking at how capital intensity trended for this group around the 08/09 timeframe. You would think a trough occurred then, but in fact capital intensity troughed in 2004 for these five companies. Again, maybe we are looking in the wrong spot or in the wrong way?

Y’know, I am beginning to think this whole “declining capital intensity leading to an investment cycle” thing is a bust. It sounds cool and like it might be a sexy way to identify a coming trend, but so far the only group we have examined that looks like it might fit our thesis is refiners. At this point we have gone through quite a few examples and busted a few ideas. I would therefore caution readers to be skeptical the next time you hear some sell-sider babble anything about capital intensity as some sort of leading indicator.

Stay tuned – there will be one last thought on how to play investment cycles when considering capital intensity.

10 Responses to “The O&G Folks”

go2jupiter

You were looking to use declining capital expenditure as a contrarian indicator?

ie. When company spending is low, then it needs to turn up soon

And you discovered its not the case? Is that right?

Just trying to understand.

Analyst Bomber

Yes, sort of. The original idea is that there are certain goods that we seem to be running out of as indicated by rising prices, including those that don’t trade futures. Separately, certain portions of the media will tell you abnormally low capex is present in a post-08/09 world. In an effort to tie the two together, the idea was to look for places where scarcity might exist, where abnormally low capex was present, and where there were investable (sp?) companies that would benefit as a result of this coming expansion.

Po Pimp

Yep, when you sent me the data on Friday I had a similar reaction upon first glance. You are right, this stuff tells us jack shit about timing of expected increases in capital intensity. But there is absolutely no doubt that oil and gas is about as cyclical an industry as any out there. So what screws this all up?

Quite simply we picked the wrong metric. I know, thank you Captain Obvious. Something tells me this metric is even less reliable for the big dog companies. Why, you may ask? Let’s consider what we’re looking at here. CAPEX / Sales. There are several problems with this.

When the two main products you sell (oil and gas) are highly volatile commodities you are going to get huge swings in revenues. If the price of oil goes from $140 to $35 and back to $80 all in the course of one year good luck trying to get a nice steady revenue figure.

This industry is probably the most capital intensive one in the world. Not only does it require a lot of capital, this capital is spent over many years just for one project. I think most people have heard that from discovery to first production can take 10 years. That entire time money is being invested like crazy to bring the project on-line. Yet at the same time the cokeheads at the NYMEX are fucking with your sales prices both to the upside and downside.

Now why do I think this is even worse for the big companies? Because they normally have very strong balance sheets they have less need for hedging. This means their sales are even more exposed to the wild swings in oil and gas prices. But because they are cash flow machines they can survive these gesticulations without much worry of going tits up.

The other thing to consider for the big companies is they are not going to waste their time on small potatoes. Nope, they are the big game hunters meaning they want to find a new field that will produce oil / gas for years and years. My current client expects their wells to produce anywhere from 20 to 40 years.

Let’s put ourselves in the seat of a CEO at a major oil and gas company. Our goal is to make shitloads of money by selling oil and gas. In order to do this we need to find the oil and gas, get it out of the ground, and bring it to market.

We spend several million dollars obtaining state-of-the-art 4D seismic data, processing the data, and interpreting the results. After poring over the results our Rock Doctors tell us it looks like we found a great prospect. Now we gotta drop some more cash buying up the leases and this is not something that happens overnight. Eventually we get all our leases and we’ve dropped multi-millions and spent probably at least a year already.

Now we start to ramp up the spending even more. We go out on the market and procure a drilling rig to drill our first exploration well(s). Sometimes you get lucky and can pick up a rig that just came off contract or we are in the part of the cycle where there are stacked rigs ready to go to work. Then again we could be in the part of the cycle where you have to wait a considerable amount of time to get your hands on a rig. Hell, the market may be so tight you have to wait for a rig to be built especially if you are in a difficult environment like deepwater. There are only so many rigs out there that can do the job. Not all are created equal.

Even if we found a rig ready to rock the day after we buy our leases we can’t start right away. We need to make sure we got all the services lined up and contracts in place. Bean counters and lawyer work. Guess how fast this happens? Not very fast.

Right, now we’ve drilled our initial exploration wells (for some more millions) and the test results are even better than we expected. We definitely want to develop this monster field. Guess what, now the REAL money gets spent. If it’s a huge project in a difficult area we’re probably moving from millions to billions in the next phase.

If it’s offshore we need to build and install a suitable platform. A billion dollars here is not out of the question for some real space age shit. We also need to put in pipelines to get the shit from the platform to our gathering facility. Oh wait, gathering facility such as an LNG plant complete with export terminal? Yep, another couple of billion there and a LOT of time. We’re talking years.

But despite the challenges we manage to get everything installed, hooked-up, commissioned, blah blah blah. We have even started drilling our first production wells. Eventually we get the first oil and gas out of the ground and sold on the market.

We’ve spent billions and its taken 10 years (just to conform with the rule of thumb). Yet all this time our revenues have been up and down because we’ve surely gone through an entire business cycle since the start of this journey. But it’s all good because we’re producing so we can kick back and relax, right?

Wrong. From the moment that first barrel of oil got produced our reserves begin to deplete. Reserves are our lifeblood. We run out of those we’re fucking dead in the water. In other words we gotta do this shit all over again and continue to do it else we go out of business.

So to sum it all up, we’re going to be spending a lot of capital in these cycles. Some parts of the cycle are a lot more intensive than others. The costs to procure, explore, and develop reserves cannot be straight-lined over time. And because this all takes so long we have no idea where we are going to be in the overall economic cycle when the big money gets spent. We can delay some stuff if market conditions aren’t suitable but only for so long.

Eventually we got to bite the bullet and spend the cash else we lose our leases. Or if you are in the situation that my client found itself back in 2008, you’ve already sunk so much money into the project you are well beyond the point of no return. Just in time for the worst financial crisis since the Great Depression.

By the time the bottom fell out of everything I believe they had already committed $20 bln and eight years on their project. And how much revenue had they received from this particular project at the time? A big fat fucking $0. They got first production in December 2009. Lucky them.

There probably isn’t an easy way to predict when capital intensity is going to pick up. But in general when the oil companies believe there is a high probability for sustained higher oil and gas prices they will spend that money. About the only thing I can think of that forces their hand a little bit is Reserve Life (reserves / production). If that drops too low they get on the ball and look for new projects to develop.

Analyst Bomber

Thanks for the above – good stuff.

My next post is now a little shorter.

Yogi & Boo Boo

Great analysis Po. Thanks. I think that’s a first where a comment was substantially longer than the original post. Thanks AB for getting this started.

The_Real_Hmmm

Thanks for that insight Po.

go2jupiter

I thought its common knowledge that oil & gas CEO’s are some of the dumbest on the planet

didn’t they go all in at $140 oil?

In other words, cyclical capital expenditures are reactionary to demand and this would already be priced into the stock

Same goes for telecom

Companies are not going to build new towers until their current towers are over saturated

I will go back to drawing lines on a chart now

Analyst Bomber

It wasn’t the oil CEOs, it was Bush, and he was all in through the 120s before Pelosi and Co said “Basta!”

http://www.washingtonpost.com/wp-dyn/content/article/2008/05/16/AR2008051603579.html

You have no idea how hard it is for me to say “Pelosi was right.” I console myself with the idea the puppeteer made her do it. And has anyone asked about why we are selling the SPR at $100 when we bought into the $120s? Anyway…

Whatever, I do know the suppliers were also a little concerned about the sustainability of oil prices. I just don’t have those exact quotes ready. Maybe someone else can help out on this one.

And I understand what you are saying about telecom and towers. But be careful to separate “what you hear” from “what you know.” We are all trapped in this News World that is not necessarily incented to tell the truth over drama. Going through this series of observations helps us understand what is real and what is not.

If you are more comfy with your above observations, God Bless, go in health and keep drawing lines. I can’t do that.

muktukchuck

@Po – your view is well spoken and enlightening (despite my long held view that the O&G industry is just about as badly managed as my own industry).

Taking the situation as you present it, could this the significant attraction to plays like the Bakken? Despite high drilling/production costs in these tight plays, infrastructure is in place making those economics better and time interval to production shorter?

As a heads up, spoke with some field guys over the weekend involved with the Alberta Bakken. MUR and ROSE seem to be well placed in terms of their land portfolio. Exp well results shortly (I’ve heard some good rumours). I bought a junior Co that has 300,000 acres in the play.

Po Pimp

I bought a junior Co that has 300,000 acres in the play.

Interesting. I hope it wasn’t Primary Petroleum though.