Go buy some semis, boys!

I think I am a terrible trader even after all this time. Luckily, it mostly works out for me as fundamentals do eventually assert some influence on equities after an indeterminate amount of time. But sometimes I don’t have the patience or interest in waiting for my view of the world to cycle around.

Then there’s The Wife and her astute technical analysis, skipping happily along and saying “What’s your issue, Lotto Boy? Why do you fight so hard?” All the while booking seemingly easy gains in a good tape and laughing at me from the sidelines when I’m fighting a difficult tape. The Lao Tsu of trading, she seems to be, and I cannot argue with the results.

I have found peace in the world by following the herd with technicals while also peeing my pants in excitement when fundamentals and technicals line up nicely. This makes my life less drama prone and allows me to focus on more important things like “Just how hot is Racer X vs Racer 5?” “Why do they call it a drought?” and my personal favorite “Just who are these people who have invaded my California?” These are much easier to digest on a daily basis than “Why is TSLA going higher when units are OBVIOUSLY stagnating?” (That was a Feb 2014 argument I had with myself. I did not win, which is a problem when you are arguing with yourself.)

Which brings us back to semis. The fine folks at ISI recently gave us this:

“The SOX is just now emerging from a 14-year base. The decisive breakout from a well-defined 100 point trading range bounded roughly by $550 on the low end and $650 on the high end projects measured upside to $750. This is where moves begin, not where they end.” Moreover, “with January the best month historically for Nasdaq performance, we don’t see why this breakout wouldn’t work into the new year.”

Here is ISI’s chart of the idea:

The below charts are The Wife’s take on the SOX breakout:

Meanwhile, INTC keeps poking 37 and AMAT claws toward 25. You mean we go higher?!? How on God’s green earth is that possible? My initial response is to scoff, guffaw, and generally whine about the obvious inanity of the comment “This is where moves begin, not where they end.”

Unfortunately for me, such grumbling usually leaves me in the king chair watching the little lines draw themselves further up and to the right. Luckily, The Wife sets me straight, stuffs a sock in my mouth and pushes the buy button anyway. (I chewed through the red rubber ball like a dog, so we are on to tougher and more pliable toys – like I said, the Lao Tsu of…oh, nevermind…)

Let’s give ISI the credit and assume the SOX not only goes higher but does so with gusto in January. How will this happen?

The SOX is the aggregation of multiple other stocks, a derivative as it were. We are drawing lines on a chart of a derivative and saying this means the components go higher as a result, as opposed to drawing lines on a chart of certain stocks and saying the SOX goes higher. The tail wags the dog? My bloods bubble a little just considering the idea.

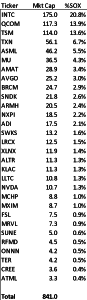

There is indeed only one way the SOX goes higher: its component stocks must go higher. Let’s look at those components. The chart at the bottom breaks down the SOX into its components with market cap quotes after the Dec 12 close when the SOX was at 671.

- The Top 3 are INTC, QCOM and TSM. I get it and this makes sense to me. These guys are 48% of the SOX. My personal feeling is that INTC and TSM go flat and QCOM goes lower into January. It is hard for me to believe the SOX goes higher without at least stability from these three, and I think these “three” go lower as QCOM goes lower.

- The Top 5 includes TXN and ASML who add 13% of the SOX. How ASML made it up here is beyond me, but the lunatics who bid the thing up in the first place likely don’t give up until end-2015 at the earliest; the SOX could get a boost from ASML.

- MU, AMAT, AVGO, BRCM and SNDK are the next five and add another 16% of the SOX. The Top 10 comprise 77% of the SOX. I am most definitely bearish on MU and SNDK which means they go higher just to piss me off. These can be offset by AVGO and BRCM. AMAT likely goes sideways.

It is impossible for the SOX to go higher without these Top 10 stocks also going higher. That’s a problem for me. But, if the SOX goes higher, my guess is that ASML, MU, AVGO, BRCM and SNDK make the push.

Well that was fun. Did you know CREE is still in the SOX at #29? And why is FSL or NXPI in the SOX? Nevermind, I am sure I can look that up later. If FSL and NXPI can be added, surely we can remove MCHP simply because of its idiotic CEO. I need to go have a talk with the guys in Philly.

So there we have it: the chart of a derivative says it is not just going higher but 15% higher (per ISI), and my personal view is that the components of SOX go lower through January.

I know how this ends. I’ll be hopping around the house with a scowl on my face simply because I am short some stocks. Meanwhile, the SOX will go higher simply because the chart says so as QCOM, ASML, MU, AVGO, BRCM and SNDK add ~$100bln to the SOX. The Wife will yell at me to “Settle down and quit scaring the dog!” I will go sulk in the corner king chair to watch the stocks and her portfolio go higher.

So do yourselves a favor and go buy some semis. Don’t fight it. And let The Wife show you how to do it stress free.