Alrighty then. Nothing like a quick trip across country to get some stuff done.

Like pondering “What is the point of that space between I-5 and I-95?” I guess something needs to keep the edges from falling off, but aside from good skiing what is the point? I guess it is kind of like our brains using only 10% of their capacity even though the other 90% still exists?

Hmmm…all I know is that there isn’t a decent beer brewed in New York but you can throw a stick west of I-5 and hit a hobby brewer doing a better than any $12 six pack at Gristedes. And on that, WTF is up with the beer prices in New York?

Here is another way to view the “space in between” issue. Near this lovely town of San Diego, how many folks west of I-5 can sing the correct national anthem? How many folks east of I-5? See how this point can be proven again and again?

Instead of being bored silly staring out a window for six hours, I spent my time chasing another project that many of you might deem as ridiculous as my view of “the space in between.” Moving on to my capital intensity project.

This time we look at refiners and telecom. I wanted to look at these as prices here are definitely going up, and for telecom stocks there are distinct suppliers of equipment that can be singled out as investment targets.

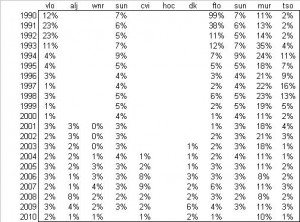

First refiners, but only because they have been getting lots of love on this site recently. Honestly, I don’t think there is any way in hell these guys invest in such a way to add meaningful capacity. The market and public has screwed these companies for so long it is very easy for them to step back and say “What have you done for me lately?” while quietly not adding capacity. Luckily, capacity is cheap if they do decide to invest – just don’t expect them add enough to lower prices anytime soon. Also lucky for them is NIMBY, which is alive and well in the good ol’ U S of A. All the refiners need to do is allow some explosion to happen every once in a while and Voila! the barrier to entry is permitting and legislation, not the low cost of capex. But I digress. Here you go. These guys are going to bank some serious coin if they keep up this capex trend.

In actuality, there is really no trend to see here other than these guys barely invest. (The blanks are merely missing datapoints. I am sure these companies had sales and capex, it just isn’t flowing through to my spreadsheet.)

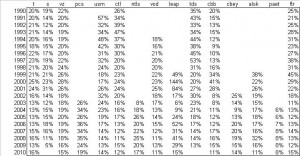

Next is telecom. This is a little trickier because there are only a handful of viable wireless carriers out there, and comparing them against the landline folks is not meaningful given gov’t mandates to maintain existing wirelines in rural areas while most of the customer adds and plan increases are in wireless. The poor wireline folks – heaven help them as they fight the good fight.

I think it is more meaningful to consider the wireless folks by themselves. There are clear suppliers of equipment to the wireless providers, and many who do serve other markets still have high concentrations in wireless infrastructure. Unfortunately, this is not a new theme as everybody and their uncle is on to the idea. Despite this concentration, my feeling is we are about to have a huge investor shakeout in the coming months where folks become disenchanted with the idea and conclude “meh, this trade is done.” More on that some other time.

Once again, not good signals in here. There is no consistency across names. Looking only at T, VZ and S we see a decline but it is really nothing meaningful – these guys still spend a lot. At the very least this confirms why everyone is so jiggy about chasing towers and chips aimed at wireless infrastructure.

Next up: the big bad O&G folks. Our man at large – the Good Mr. Po Pimp – has supplied a good number of tickers to make sure I don’t miss anything. I am sure I will anyway. I am easily distracted by a good beer.

3 Responses to “Refiners and Telecom”

flyaway18

Upstate New York has a couple of breweries fairly well known, I think, in Saranac Lake and FX Matts (Utica) and then there are several microbreweries here as well in the Finger Lakes region, including Ithaca. I primarily drink one dark brew – Guinness.

The Fly

nice work

kedzilla

I can tell you first hand the majority of refineries run by Suncor, Encana, Husky, and Cenovus operate at 50-65% capacity. Even lower if the price is unfavorable.