I am enjoying the ride on these low-priced names (aka penny stocks) of late. Anytime you come off a bottom and rally, it seems that low-priced, beaten down names are where to look for profit opportunities.

Take American Capital Ltd (ACAS) for example. Just the name itself should iginite a spark of patriotism and induce an appetite for apple pie. I mean, sheesh, how much more pro-business can you get?

ACAS was a stock I bought at $1.04 on 3/18. It’s up 117%, closing at $2.19 today. Why waste money on Lotto tickets? Same thing with Zales (ZLC), which was also purchased for $1.07 on 3/18. That’s up 89%, closing at $2.04 today. Just know that both of these were previously at highs of $36.97 and $31.90, respectively, within the past 12 months. So, even though the poor saps who bought at the highs have lost over -90%+ , I’ve now basically inversely equalled their magnitude of loss with a positive return of 90%+ , and the stocks are still way down off their highs. How ironic. (Ah, the magic of math.) This is why it makes sense to look at throwing some lottery ticket money at these stocks when they are beaten down this far—-as long as they can stay in business.

But, don’t be gambler and bet on a just few of these. Better to buy a basket of them. In my case, I’ve now bought over 30 of them, and added CBL ($2.42) and CCO ($2.85) today.

On Monday, in the midst of a blizzard, I wrote:

“….ACAS +56.73%; IX +54.68%; AFL +40.75%; SFY +38.29%; PVA +36.98%l CENX +34.43%; GDP +30.19%; TXT +30.00%; WTI +29.08%; SGY +28.40%.

Bottom 3: SAY -0.00%; AMGN -2.00%; JTX -6.66%

I will sell these tomorrow along with MGM, PETD and WGOV, since all of these lagged the S&P’s return of 7.17% today. JTX,, as you might have surmised, will be sent to a special hell, due to it’s egregiously wicked return today.”

Well guess what? I didn’t sell yesterday, or today. Call it a hunch, or the fact that I wasn’t all that worried since I own over 30 of these suckers. I’m going to hold on, using a 20% trailing stop, because these things are more volatile than your average stock.

It’s almost like they’re option premiums, only without the time decay.

In any event, here are the current positions I’m holding, since 3/18:

ACAS +117.30%

ZLC +89.71%

CENX +36.42%

LDK +34.16%

ROCK +21.80%

JTX +6.70%

AINV +6.64%

FOE +5.55%

MGM -0.34%

SAY -1.22%

Here are the two I bought 3/17:

ASIA +6.31%

NFLX +2.46%

And, those I bought 3/16 of last week:

IX +55.18%

GDP +36.42%

WTI +30.79%

PVA +30.22%

AFL +29.91%

X +27.74%

TXT +26.03%

PETD +22.29%

SFY +20.56%

CRZO +19.80%

DRI +19.65%

RIG +17.82%

OSG +14.60%

DOW +12.37%

BBY +11.42%

WGOV +8.88%

QCOM +6.38%

AMGN -3.77%

Finally, today I added :

CBL , $2.42 +9.92%

CCO, $2.85 +3.51%

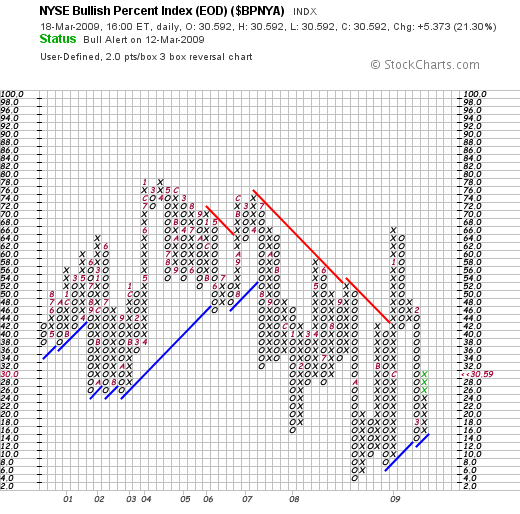

My take on this market: we will see this rally extend, until it doesn’t. So, stay with it, especially if you’re already up big. Granted, it appears overbought in the short term, but with March 31 next week, I think the fundies and hedgies will want to do some elaborate window dressing.