After Hours with Option Addict is a great platform to discuss trades and analysis in great detail. It allows me to interact with members and walk them through trades and ideas, all while answering questions at the same time.

Blogging is a shit-fuck platform. This is why I dedicate the same effort to blogging like most of you dedicate to your portfolio. Luckily tonight, I am in the mood to share some charts to further expand on my bond mention last night.

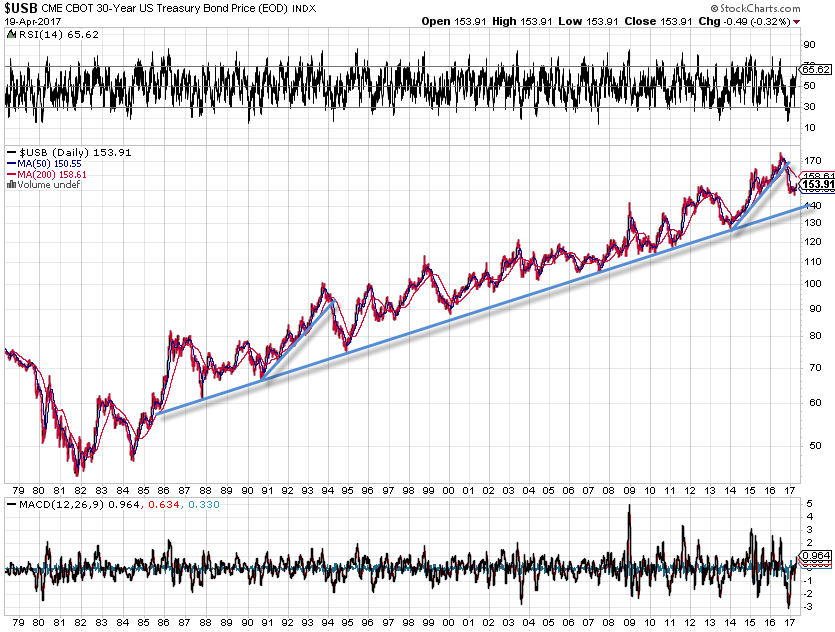

All of last year, we talked about the high probability of a top in the bond market. Here’s a look at some LT charts on the 30 year.

Fall of last year I spent a lot of time talking up a top being set in the bond market. Late last year when asked if people should be buying the dip, I said I’d rather wait til Q1-Q2 of this year for a trap to be set. Let me explain…

First, Looking at this chart, bull or bear?

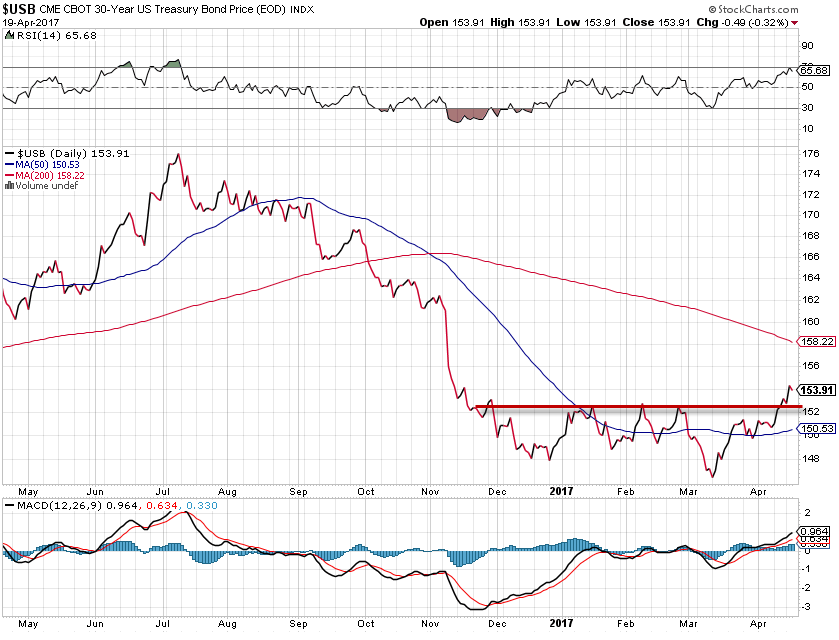

If I switched this up…any difference in opinion now?

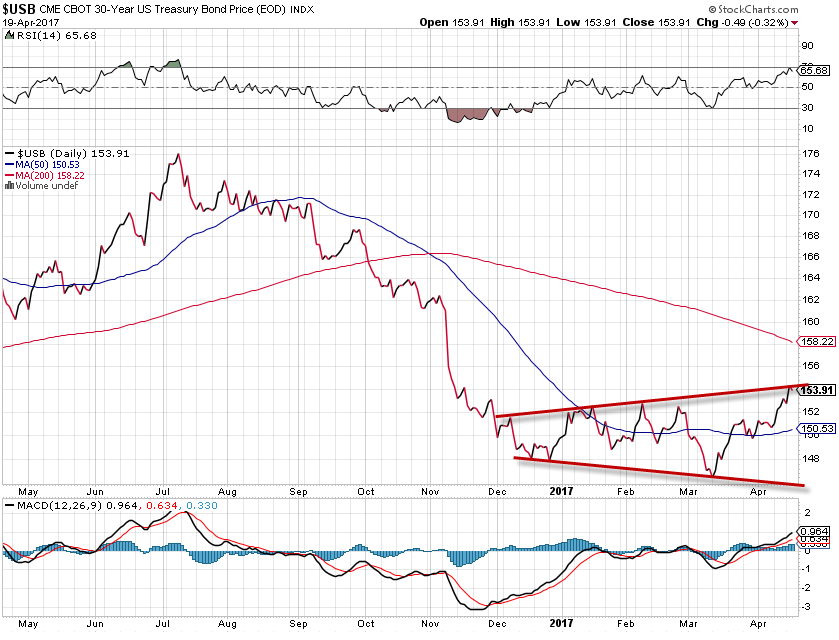

If I switched this up…any difference in opinion now?

What if on further inspection, bonds were overbought here? What if they were also running into a huge roadblock of overhead supply?

What if on further inspection, bonds were overbought here? What if they were also running into a huge roadblock of overhead supply?

The overbought signals here have proven fairly useful. This signal is unique as we run up into the balance of 2015 prices. I am aware the profile thins out here, but prices are at an exhaustion area, right as bond bulls are excited about what seems to be a bullish breakout. This was a trade I mapped out as bond prices plummeted without chute last year.

The gap up in $TLT yesterday caught a gap down and hold today. That’s not a bad start to this idea.

Thoughts?

If you enjoy the content at iBankCoin, please follow us on Twitter

Where would you know that you’re wrong in this case? I mean, because of the pocket above, I might say over 127?

Option premium is the best for measuring where you are wrong. I wouldn’t let TLT go that high against puts…I wouldn’t want this too far above my 124-125 area that was used to plan this trade.

Thanks for sharing more of your thoughts on this. I really appreciated the deeper dive. I think you’ve outlined a compelling case and will look forward to seeing how it plays out!

Interesting OA, thanks. Does it strike your fancy any that the % move on your 90’s trendline is parabolic compared to the now global shift?

Not sure what you’re saying, but the sound of it makes me horny.

Lol, mission accomplished.

I agree with your analysis but it would be a stronger case if the profile showed growing overhead supply. I expect a decline to be relatively shallow, down to 122 or so. That’s probably enough for an option win but not enough to get me off my use of TLT as a hedge to my core TQQQ position.

What I really respect is your exquisite timing to buy yesterday instead of waiting for today. Here’s to a profitable trade (clinking champagne glass).

That is a year of supply that didn’t hold as support. Doesn’t sound like you appreciate the significance of that.

One reason I would not want to be short bonds is the same reason I would not have wanted to go long X when Gartman said it was a great long. I am 99 percent sure that yesterday and today Doug Kass has been making sure everyone knows that he is short bonds. That said – of course googling “Doug Kass twitter” would bring up his twitter feed to verify what he is saying.

I don’t think I could be on the same side of a trade as Kass and sleep at night.

Haha. Talking about bonds to try to divert attention from one of your biggest screw ups ever, SNAP. This is the week, man.

I made money on that trade. But then I manage my trades. Evidently you followed along blindly.

Does it ever make sense to buy TBT or is that just a bad product and doesn’t do what you would expect when bonds and TLT go down?

Yeah, buying TBT is fine.

come on down TLT your next on the psr

market same game plan as yesterday pop early then go down all day

lol, you sure?

no i’m never sure with this market

So funny you’d just blurt that out right here. Don’t think I’ve ever seen you comment on the market like that.

i’m a good contranian indicator

This article seems relevant in some ways. Seems like a different way of describing a lot of what you have been saying if I’m understanding it correctly.

https://www.armstrongeconomics.com/world-news/sovereign-debt-crisis/the-end-of-quantitative-easing-perhaps-now-it-will-be-inflationary/

The similarities:Lack of public participation, end of bond trade, (asset inflation but economic deflation=rotation into stock market?).

Government cost rising with rising interest rates but increased spending and increased velocity of money. Finally the end of QE and actions by fed, treasury and local governments pushes all the capital (13.5Trillion) QE created into regular economy and shift from bonds to stocks.

?

That’s exactly what the smart guys have been telling me since last year. Lot of money supply sitting around to build shit with.

I can’t understand this growing notion that we are reaching some point of exhaustion and running out of options. Raising rates so they can lower them in the future? That’s peanuts. The Fed could pin the entire curve to -10% if they wanted to and primary dealer banks would be obligated to buy whatever the treasury wants to sell. Would it last? Maybe, maybe not. QE has always struck me as some pretty mickey mouse stuff. Pinning the entire curve is the next logical step. So many bullets left in the chamber.

just had a guy from edward jones at my door said he had some stock tips to give to me in person or over the phone maybe i should give him some of OA stock picks for a fee,btw OA so glad for everything you do on this web site for traders