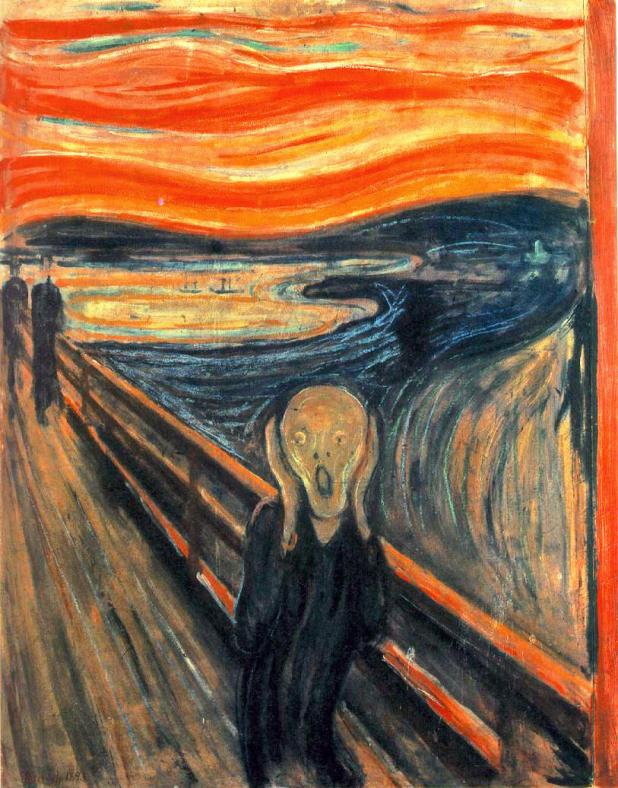

There are many reasons that we must prepare our portfolios for more stormy weather, Jacksonians, and the increasingly dangerous interplay of our Federal government in the formerly “private” sector, whether it be for alleged “stimulus” or “rescue,” is one of the most foreboding.

Case in point — there has been a lot of back and forth on the iBC blogs recently regarding the Chrysler re-organization plan, and the Federal Government’s role — reaching all the way to the White House — in “negotiating” the terms of the deal. For sure the Republicans opened the door to this heretofore unprecedented interference with the perfidy of Lex Luthor (remember him?) and his banking pals, but the Obama Administration has really gotten into the swing of things, pirouetting from control of the financial institutions (ie, “the TARP losers”) to attempting to rig the already down on it’s heels U.S. auto industry.

In the latest news we hear that Obama’s people are attempting to “cram down” senior Chrysler bond holders in a less than typical fashion — by inserting unsecured creditors– specifically the UAW labor union — in front of senior bond holders. There’s a very heartfelt — and angry — attack on this land grab found in this article, written by “Evil Hedge Fund Manager (TM)” Clifford Asness of ($20 bn) AQR Capital Management, who is not a party to these proceedings, but has a pretty good idea of where such machinations will end, and so has stepped forward in print. Here’s a cogent excerpt from the piece (highlights mine):

Bankruptcy court is about figuring out how to most fairly divvy up the remaining assets based on who is owed what and whose contracts come first. The process already has built-in partial protections for employees and pensions, and can set lenders’ contracts aside in order to help the company survive, all of which are the rules of the game lenders know before they lend. But, without this recovery process nobody would lend to risky borrowers. Essentially, lenders accept less than shareholders (means bonds return less than stocks) in good times only because they get more than shareholders in bad times.

The above is how it works in America, or how it’s supposed to work. The President and his team sought to avoid having Chrysler go through this process, proposing their own plan for re-organizing the company and partially paying off Chrysler’s creditors. Some bond holders thought this plan unfair. Specifically, they thought it unfairly favored the United Auto Workers, and unfairly paid bondholders less than they would get in bankruptcy court. So, they said no to the plan and decided, as is their right, to take their chances in the bankruptcy process. But, as his quotes above show, the President thought they were being unpatriotic or worse.

Let’s be clear, it is the job and obligation of all investment managers, including hedge fund managers, to get their clients the most return they can. They are allowed to be charitable with their own money, and many are spectacularly so, but if they give away their clients’ money to share in the “sacrifice”, they are stealing. Clients of hedge funds include, among others, pension funds of all kinds of workers, unionized and not. The managers have a fiduciary obligation to look after their clients’ money as best they can, not to support the President, nor to oppose him, nor otherwise advance their personal political views. That’s how the system works. If you hired an investment professional and he could preserve more of your money in a financial disaster, but instead he decided to spend it on the UAW so you could “share in the sacrifice”, you would not be happy.

Asness goes on to mention how damaging such action can be to the fabric our capitalist system, and not just specifically to the non-TARP lenders who are holding out against the Obama Plan. If the “government” starts taking sides in otherwise quotidian corporate restructurings, what trust will the private sector — not just hedge funds, but any large investor pools — have in any government or union associated businesses going forward?

And how will that affect the pricing of their securities?

From the standpoint of M&A valuation, unions are already anathema to private capital and tie a huge millstone around the neck of even the best companies who are saddled with organized labor. This kind of side-picking will only drive those businesses’ long term equity values — and subsequent ability to grow — down even more.

For a test — just ask yourself: would you buy a car built by a company largely owned by the Federal government and the UAW? Even if you were sympathetic to the Obama Administration’s aims?

In the 1930’s this sort of corporate-government collusion led to fascism in a number of the “enlightened” European countries. I’m not saying we are going down that path, only that we are looking at another major strike to the economy if we allow the government to continue to treat the sources of private capital as second class citizens, their legal standing be damned.

Because the first tenet of capitalism is “Capital is Mobile” my friends, and it will fly to other pockets of investment where the risk-return parameters are more in balance if it feels threatened on these shores. The President may discover this principle too late, much to his chagrin, and our own.

In the meantime, Jacksonians, as small investors, all we can do is listen to Fly’s Goat’s singing admonition, and “be prepared*:”

[youtube:http://www.youtube.com/watch?v=-nJOY0P84v4 450 300]

_______________

*(TBT, GLD, SLV, SLW, PAAS, EGO, RGLD, NRP, etc., etc., etc. )

Comments »