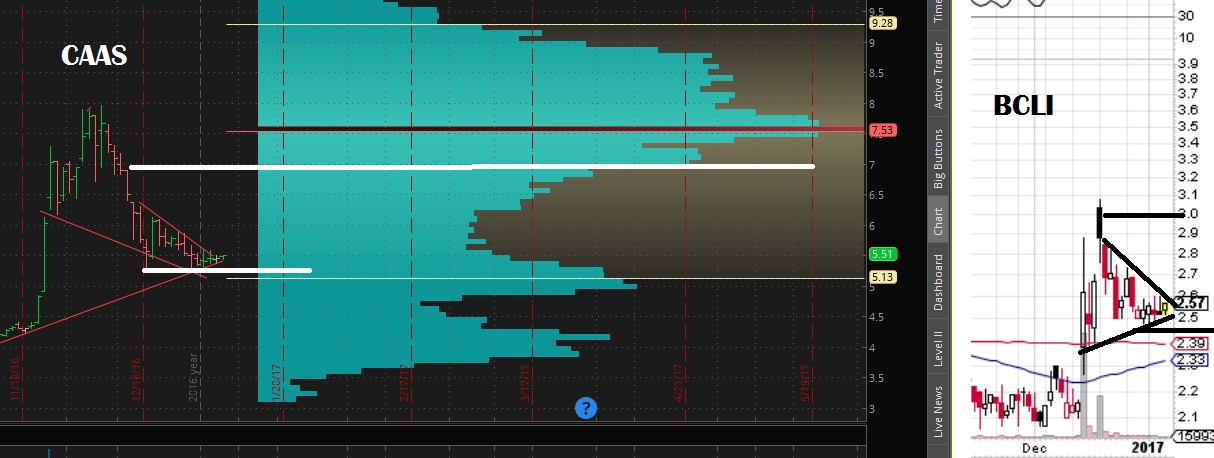

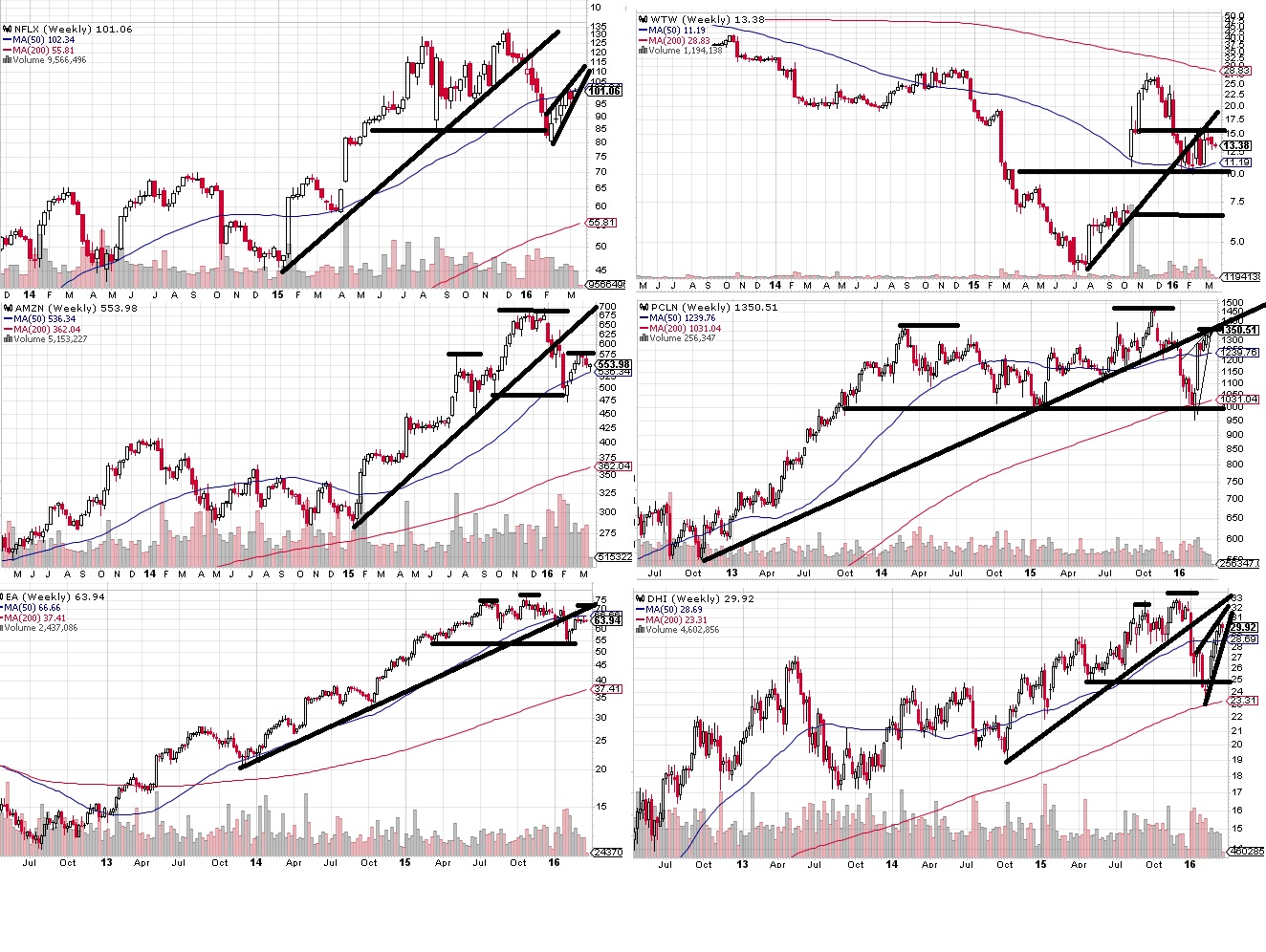

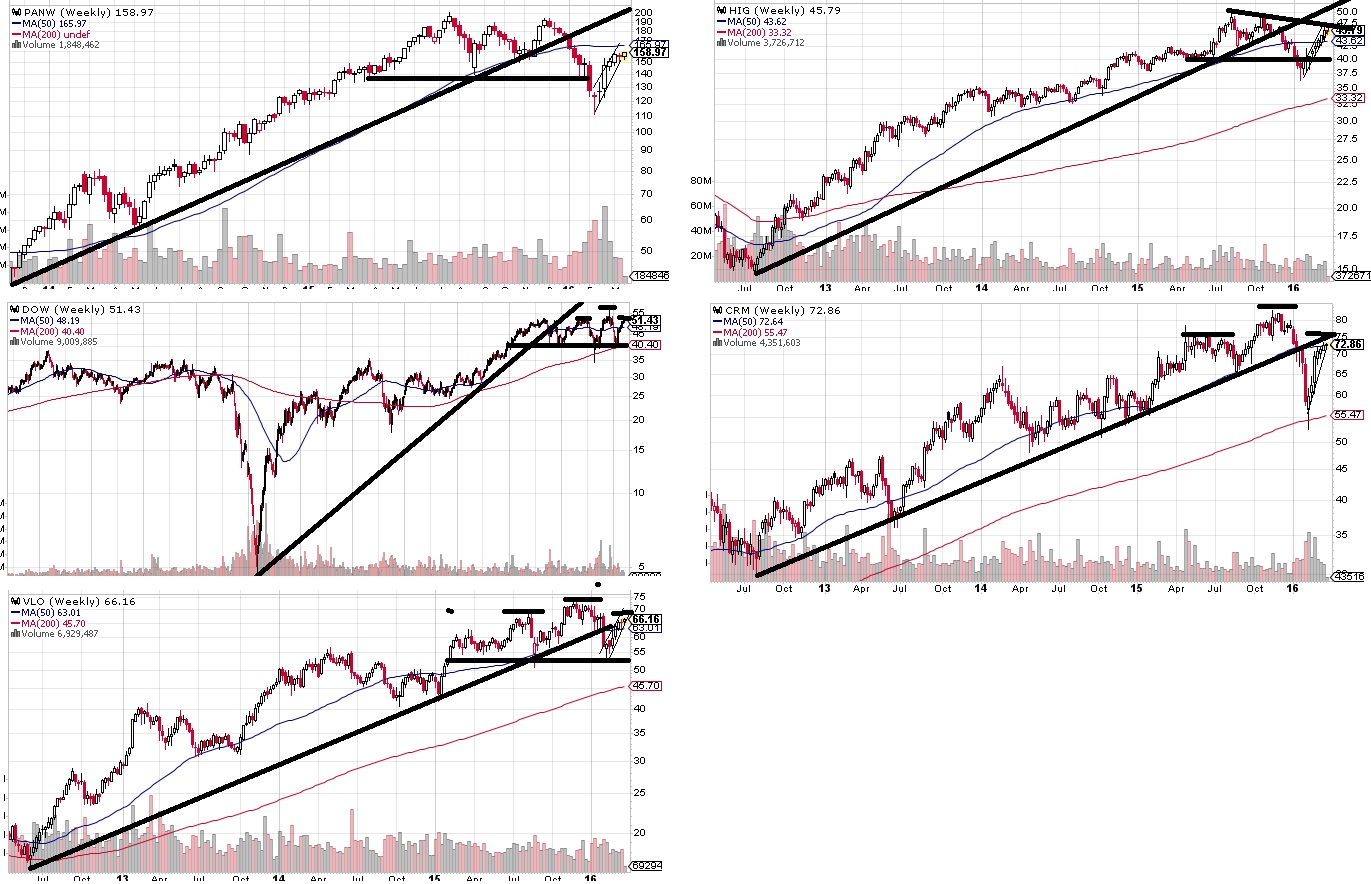

Posting both weekly charts and daily charts to try to show you what I’m looking at.

Method: Manual scan of all stocks that have available weekly options. Using a list that I update 2-3 times a year.

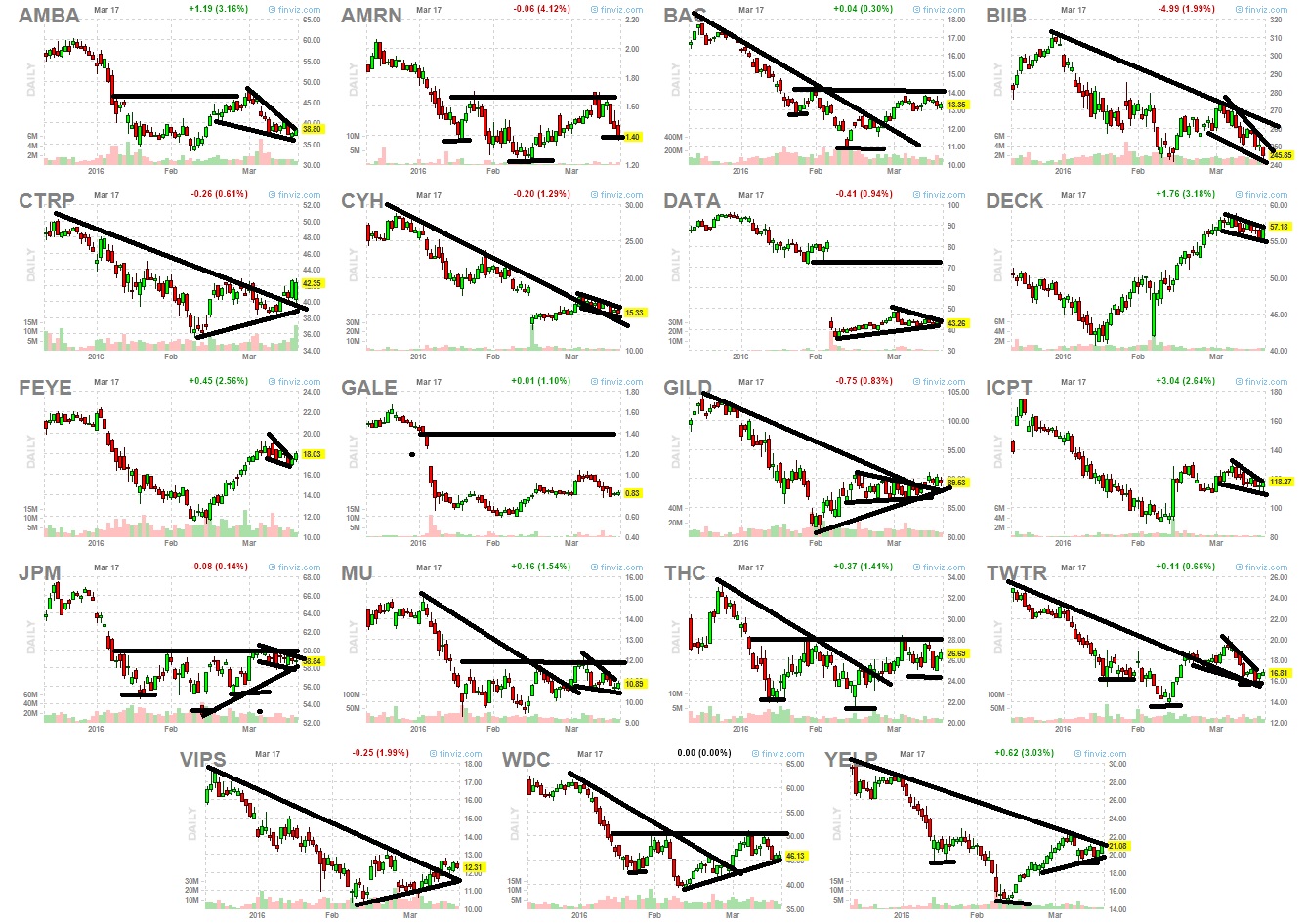

Bullish setups:Usually looking for 1-2-3 reversals. Typically the first low following equal high.. Typically focusing on finding “aversion” sentiment, or in EW terms looking to buy before wave 3.

Bearish setups: Typically focused more on selling retest or resistance and/or with volume profile below and/or with some kind of bear flag or rising wedge.

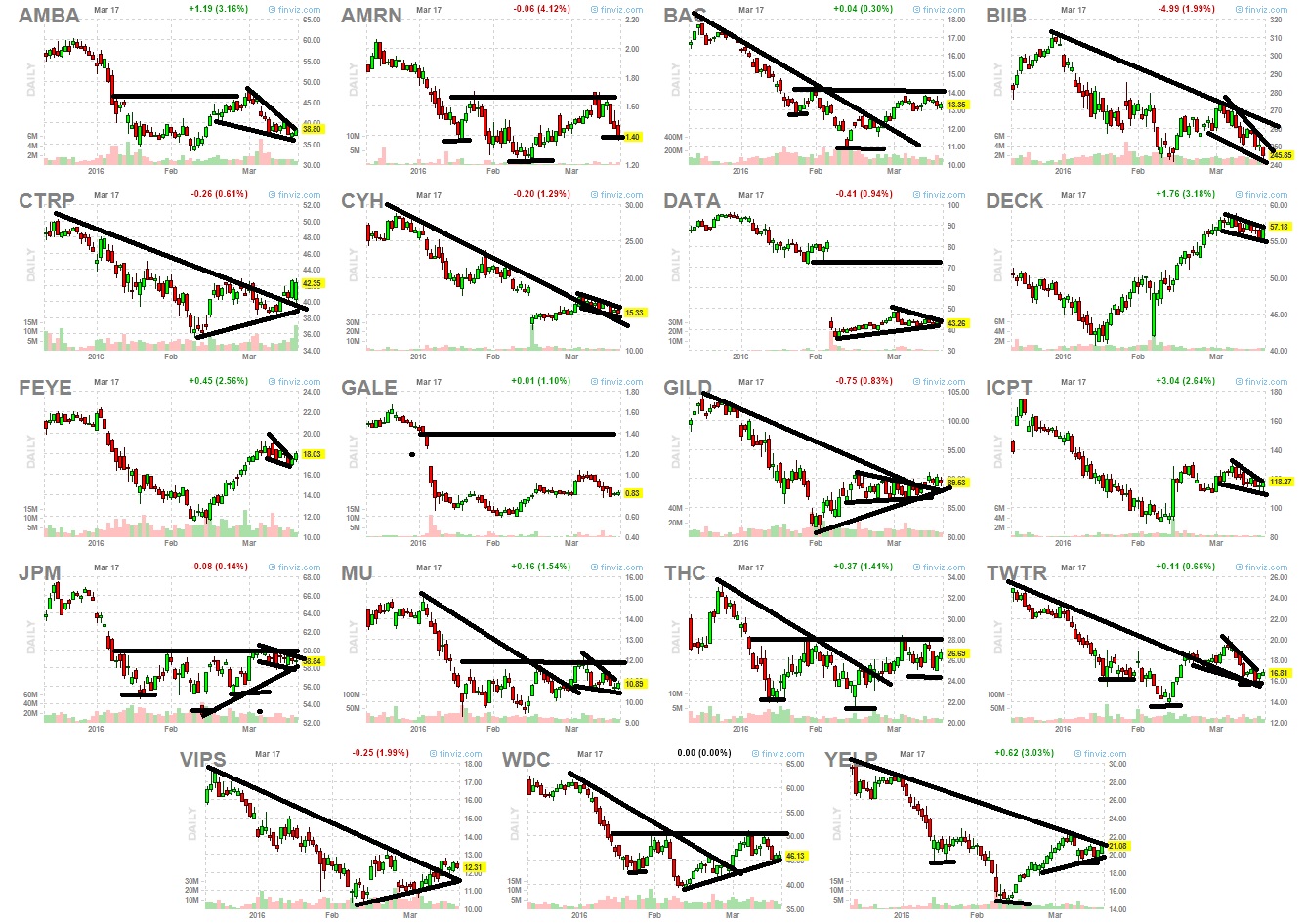

Bullish list.

Tickers:AMBA,AMRN,BAC,BIIB,CTRP,CYH,DATA,DECK,FEYE,GALE,GILD,ICPT,JPM,MU,THC,TWTR,VIPS,WDC,YELP,

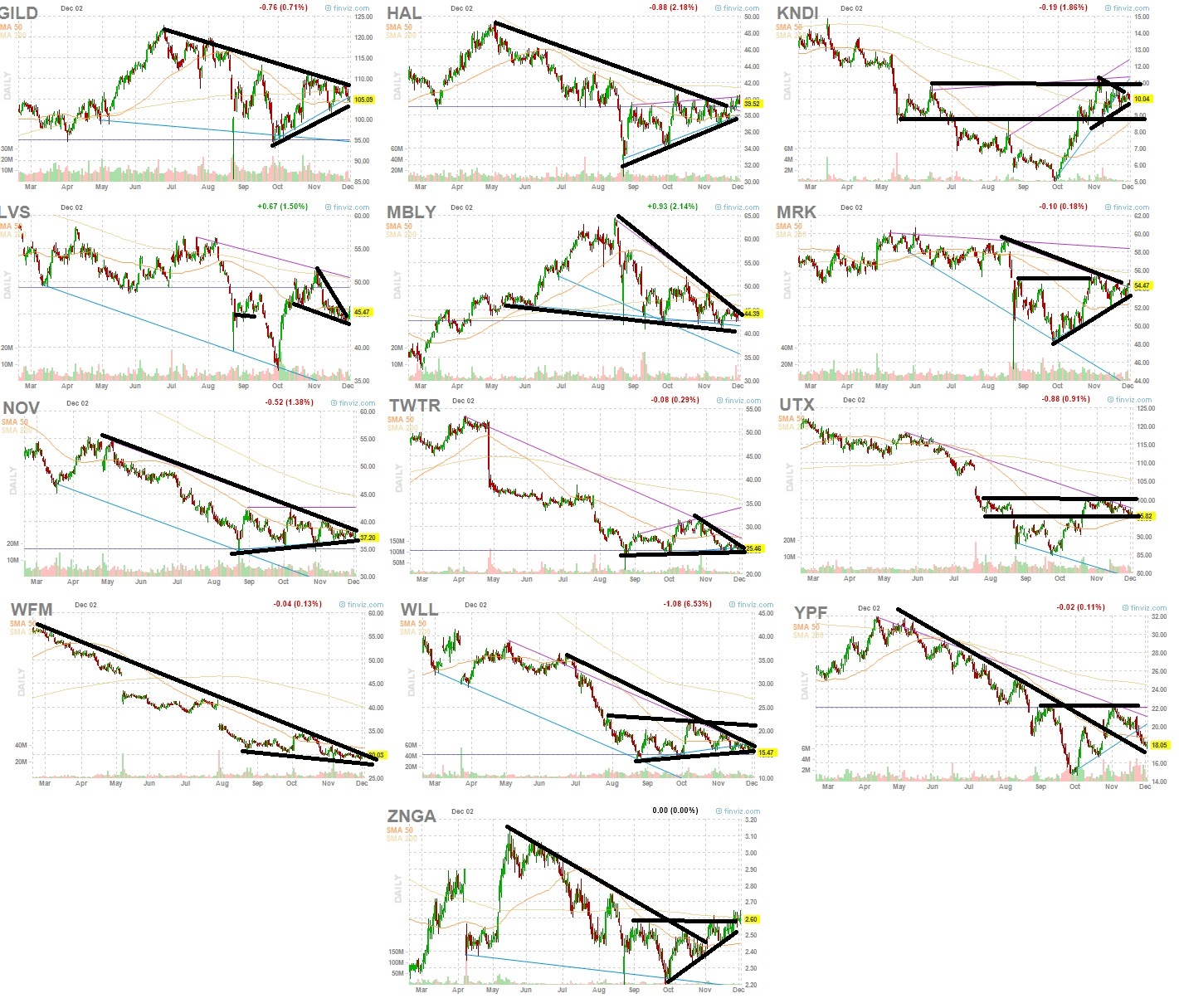

Bearish list.

Tickers:

COF,EA,INTC,NXPI,TRIP,WTW,

CREE,DD,DOW,UA,XLNX,

(not yet) ZTS,CYBR

Bullish (daily charts)

Bullish (weekly charts)

Bearish (daily charts)

Bearish (weekly charts)

Comments »