NOTE: The photos are too big. Click on them to expand if you want.

Just came back from NYC for a weekend vacation, but like any serious investor/trader, I had to do some walking around to see the extent of the damage in NYC. I saw firsthand the awfulness of retail and commercial RE and anyone that knows NYC can clearly tell the difference. In addition, a BAC trader friend of mine and I went to the new $1 billion BAC NYC headquarters in front of Bryant Park and also took a look at the excess and extravagance that you, the taxpayers, are now supporting (and not by choice). It’s sickening how there isn’t a limit to luxurious spending even after accepting a bailout.

BAC also just stopped issuing Styrofoam, plastic spoons, and other cheap cutlery to “help the environment by reducing non-biodegradeable waste”. Hold up. When I was up on the trading floor, there were 3-4 people up there (including my friend and I), and every single desk’s CNBC and every ceiling light was on. I even saw some traders stashing away plastic spoons in their bottom drawers. News is that 80-90% of BAC traders will get laid off, with decisions as early as this Friday. They will all be replaced by the Merrill traders (even though those guys took huge trading losses!).

Charts are perfect representations of the struggles of human emotion. However, if you get so immersed into charts and that’s all you use (like I do), then you slowly get disconnected from reality, disconnected from what’s truly happening beyond the chart. It is good to actually go out there and see what’s going on. What I found supports the case for massive upcoming retail and commerical RE liquidations. It is inevitable. No joke – there’s at least one vacancy on every block in Midtown. We’re talking about prime real estate and this is only the beginning.

As for retailers, I saw more employees than customers in at least 80% of the stores. I’m talking about 5th Ave, the “throw away your money” capital of the world. The employees were getting paid to talk to each, basically. Also, I told my friend to “Look at the Hands!”. That’s right. Are they holding anything…a shopping bag, perhaps? Nope. This was on a Sunday afternoon and people were not shopping. I could tell it was a disaster and yes, there were plenty of out-of-business signs. If Fifth Ave is the symbol of wealth in NYC, then the pictures below show not only the present, but the future as well.

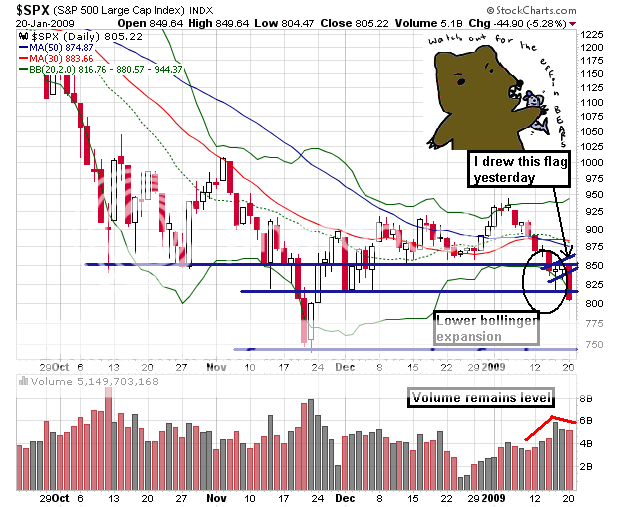

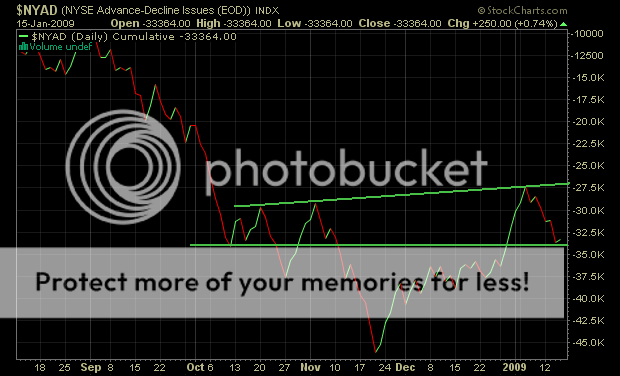

First, the usual charts. They will be important tomorrow as the financials get destroyed (thanks to RBS, and of course HBC, BCS, and LYG). Make note of the marked support levels. 834 (SPX) is the initial support level, followed by 830, and finally 820. There’s a good amount of support, but if the market undercuts 820, we could have some major problems. The financials are still in focus, don’t take your eyes off of them.

Next, BAC’s extravagant NYC HQ, now being partially funded by taxpayers (the extra $20 billion is going to the building either directly or indirectly…don’t think that it isn’t):

Lobby

Conference Lounge

These walls actually change color during the day (currently red). Ridiculous.

Do you need a jungle in your office? I didn’t think so.

They have the space age waterless urinals!

The trading floor that’s about to be slightly less occupied. Someone please turn off the TVs and the lights.

Finally, retailers and commercial real estate in NYC. I can’t fake these pictures. They are very real:

Even Elmo and the Cookie Monster are out of work.

Side-by-side vacant stores on Fifth Ave.

No, they’re NOT moving in.

This last one is right in the heart of Times Square!

*FYI – All of the above pics were taken in Midtown Manhattan, not South Bronx.

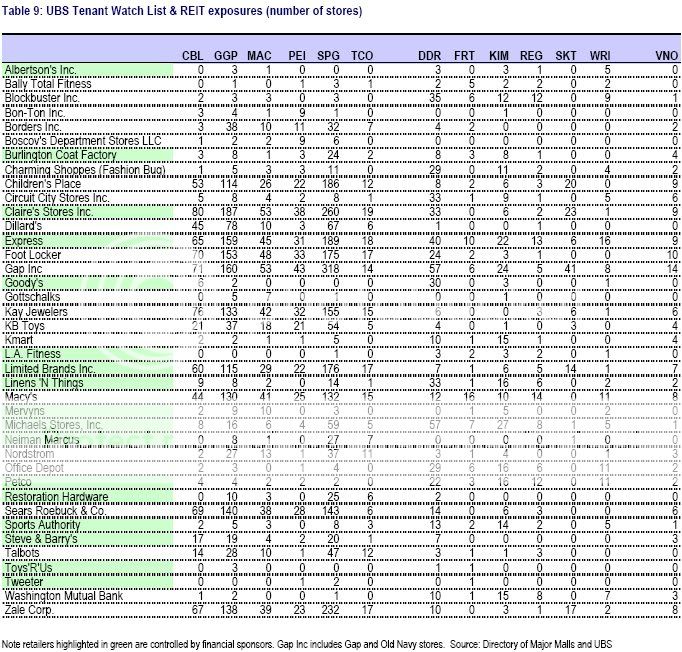

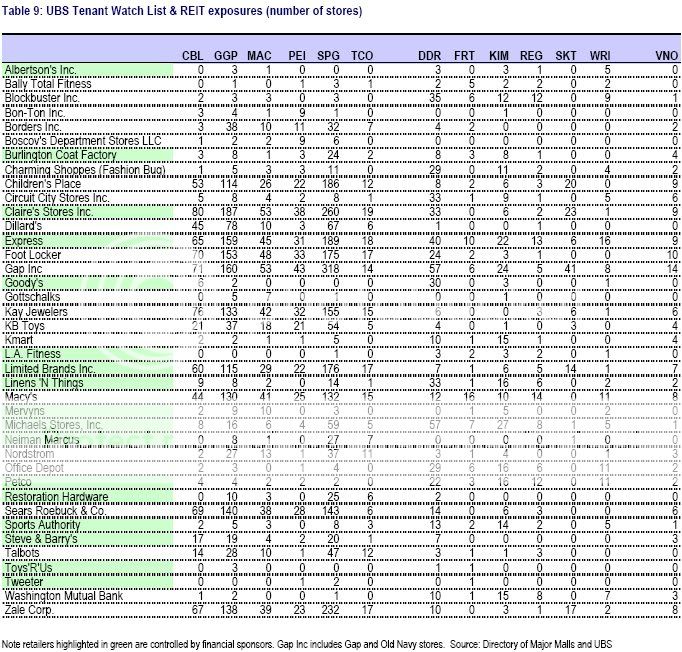

Here’s some useful data (courtesy of SB):

If you want to laugh after reading this depressing post, I recommend Dangerfield’s Comedy Club between 61st & 62nd Sts.

Comments »