We formed a force doji on a massive volume spike. I believe that we will see even greater spikes in volume. Typically, the doji is a 50/50 candle that basically shows the struggle between the bulls and bears. The volume was encouraging as it finally broke the tape’s trend of dullness. We’re no longer lolligag turtle fucking in this market. Excuse me, but I feel relieved of this.

Do I think the decline is over? No. I believe that this doji represents a pause in the decline. We’ll see a short-term rally, but I can’t imagine us shooting through the moon from this point on. That’s ridiculous. We hit the technical 820 support level today, and that was the reason for the rally. Anyone who thinks that the banking crisis is all over because BAC just received this absurd bailout is a fool. We’ve been throwing hundreds of billions at this problem, but to no avail.

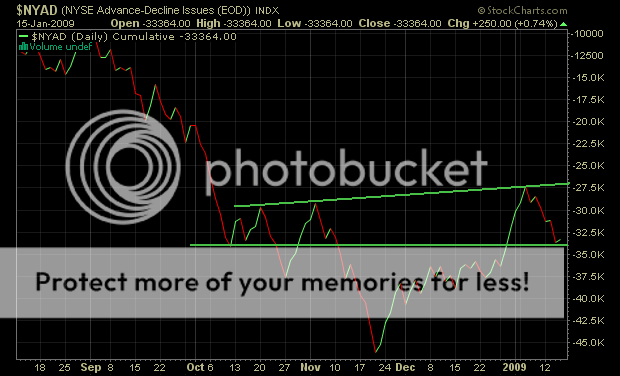

As for breadth, we made 173 new lows and 6 new highs. It is a deterioration of yesterday’s NH-NL index, but it’s acceptable given the bounce. We had a 2-to-1 advance-decline (A-D) line on the NYSE and a 1.5-to-1 A-D line on the NASDAQ. This is a typical reading for a doji suggesting that the bull/bear fight was a very close call.

If we gap up and stay up, we’ll form a morning star reversal, a highly reliable signal, even if it’s only for one more day. If we close lower, then it’ll just be a continuation of the downtrend. Treat the doji as a meeting point, a battleground with a lot of idiotic confusion and indecision on both sides. A winner will be picked at the close later today.

Personally, I’d like to see some capitulation. Yesterday was not a capitulation day. The bulls do not have full control, and I would advise both sides to remain cautious. I personally have financial shorts that are hedged with FAS, so I could care less what happens tomorrow. Looking at several charts in a non-biased way, many stocks do exhibit reversal signals for the short-term.

We have CPI@ 8:30AM, Industrial Production@ 9:15AM, and Consumer Sentiment@ 10:00AM. In addition, we have earnings from BAC, C, SCHW, JCI, PPG and FHN.

Important levels (SPX):

Support – 838 (Initial), 820 (Major)

Resistance – 850 (Initial), 855, 862, 874

Sorry for the delay. I was skiing in PA in 10 deg weather. Just a few hours ago, I was one of those idiots that dropped a glove halfway on the lift. Someone jacked it, which was infuriating.

If you enjoy the content at iBankCoin, please follow us on Twitter

Jeez where did you ski, dickington vermont? Cold hands bad! In december my bro dropped car keys on a powder day, got ski patrol to find them with a metal detector. I was cussing him out for going back lol.

Nice update. today had one of those rare trading actions. Volume on all three indexes high + reversal + re-reversal + bullish tail to close it out. It really is a major battle out there. lots of punches being thrown by bears and bulls, and its been a while since I seen it at this high relative volume.

Addict;

Nice posts. Are you a member of the MTA? Do you live in PA?

aumana – that must have SUCKED! Good thing you found them!

Gio – I could feel it yesterday.

El Fib – yes I am (MTA Baltimore and DC). No I don’t (PA). I went to Whitetail.

Quality update, thanks.

Now I know your a pure technical type…..but lets just say Obama did not announce a veto scenario (@816 S&P)and the gov waited till tuesday as it was reported the day or 2 prior about bailout plans….

Is it your contention that we would have bounced off the 820 level or would we have melted down ?

Addict;

I am a MTA member of Phila. Todays tape sucks. It is like WTF out there.

Thx, Stuart.

GW – I’ll answer that at the close.Today’s close marks either a reversal or continuation of the downtrend.

Fib – cool. Are you a CMT lvl 3 yet?

Thanks for the post. The early morning is great for checking the upcoming market action. Catch ya next week, looking for a good trading day.

Addict;

I should take the tests but I was a system engineer and everybody assumes you are a numbers geek. When John Bollinger talks about the end of the need for market tecs.

It was the same thing I heard about being a system tec. I don’t need another negative title. I like the people at MTA and enjoy the new ideas. Some are off the wall. My style is much like yours. Simple and to the point. I just bought a little DXO @ 2.84 best of luck.

Bob, thanks for stopping by.

Fib – There are many ideas from a lot of technicians. This one guy at my meeting on Tuesday said that we go to Dow 1,400 by 2027. Insane. Taking the tests reinforces your technical knowledge and gives you a nice, shiny CMT designation.

OK – I’m ignorant here.

What’s MTA?

Metropolitan Transportation Authority.

-Or- Market Technicians Association. They administer the Chartered Market Technician (CMT) designation which is also a NASD Series 86 exemption. They only grant around 1,200 designations per year.

Addict;

I agree about taking the test. I might take the tests this summer if the go away in May holds true. I don’t need an CMT job but like you say it would be a nice personal reward. Yes some of the stuff is fucking funny. During a bear market I like to use Linear Regression Channels and Ma’s with Stochastics for entry’s. Once I find a stock in my screens. I love to watch the FLY trade. He is like my alter ego. He is a good trader but I don’t have the balls for his style. He is fun to watch.