I must start this post with my sincere thanks for the comments you all left me on my semi-retirement post. I was treuly moved by your comments.

Because when one semi-retires from something, no one wants to hear that the semi-retiree has been doing nothing. That would represent pure laziness and sloth. Why would one semi-retire if he was going to do nothing? Indeud, I have been enjoying semi-retirement, having recently purchased a beautiful piece of property on the Cacapon River, West Virginia’s cleanest river.

I caught a nice smallmouth shortly after this picture was taken.

So life is good. Which is a nice segue to the reason I am posting this, which is that my Fidelity Sector Fund Rotational System killed it in July, and surged ahead of its $SPY benchmark.

The system rocketed up 7.5% in July, once again outperforming $SPY, which gained only 5.2%. The system is also outperforming $SPY in August, but the month is not even half-finished.

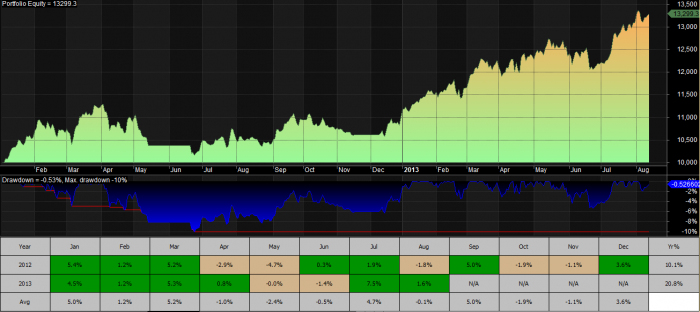

Year-to-date, the system has logged gains of 20.8%, and that is net of fees, commissions, etc. $SPY has gained 19.1% YTD.

The top five ranked Fidelity Sector Funds are as follows:

- FSAVX (Automotive)

- FSRPX (Retailing)

- FBSOX (IT Services)

- FSRBX (Banking)

- FSPHX (Healthcare)

The system rotated into some new funds last week. It is currently holding FSAVX, FSRBX, and FSRPX.

I’ll leave you with a little chart porn. Below is the equity curve and monthly performance for the system, starting in 2012. I use 2012 because that is when I started trading the system in real-time. Click on the graphic to make it larger.

Best to everyone!

Nice Pic Wood, I am sure there are many jealous readers here.

Like your update on the sector rotation my system identified QQQ, IJR VYM. PEY, KRE and KBE for 6.30% MTD. I started my sector model on Mar 1 with 10.3% since inception. So far Aug +2.41%.

Keep the updates coming and relish your slow down!

Congratulations, Wood. Good to hear from you again. Very nice, quiet, good looking area, if I didn’t know would have guessed Maine or Vermont. Fishing counts as “doing something”, right? The feeling of peace and quiet of getting away is incredible; we just closed on our vacation home in Myrtle Beach. I twisted my wife’s arm a lot to make it happen, especially since she was paying 🙂

I’m not surprised about the burst of performance from your system. I see the same sort of thing in some of the stuff I’m playing with. You could easily see a year or more of underperformance, than it suddenly catches up and leaps ahead all at once.

Thanks guys!

Bozo, as soon as we could drive, we would head up to Myrtle Beach and cruise the strip. Many fond memories there!

Have been considering Select Funds. Interested in your system.

Thx

marc russell

Is there any way I can follow your sector rotation system and trade myself ? Thanks Wood !

Marc and Tom, let me see what I can put together to make the signals accessible.

Thanks for your interest,

Wood

Appreciate. Looking forward to : )