Back in the halcyon days before the Armageddon trade of 2008, mean reversion was all the rage. Although mean reversion continued to work extremely well through the crash of 2008, most traders did not have the intestinal fortitude to buy the dips and sell the rips when it appeared that the financial world may collapse at any point.

It was during this period that I was working with another blogger/trader on several systems, one of which was a short-term mean reversion system. It is that system that is the subject of this blog post.

After the system was finished, we decided to register the trades officially at a tracking service and trade it live. It was our belief that the system was worth offering for subscription or had additional value beyond the money we could make trading it. Both of us had day jobs, and we fairly quickly realized that trading the close was difficult for both of us, for two reasons. The first reason is that for those of us who trade and work, Murphy’s Law ensures that whenever there is a big trade that needs to be made, work will interfere. The second reason is that systems that rely on binary buy or sell signals sometimes flip-flop or hover near the threshold. If it is 3:39 and the trade has to be entered by 3:40 for a market-on-close order and it is flip-flopping between buy, hold, and sell, making the correct trade can be a challenge. Couple this second reason with the first reason and we eventually decided to stop tracking the system and trading it live.

If I remember correctly (it has been a little over 4 years), we also weren’t sure if the system would continue working.

We can now look back and see that the system did indeed endure through a rough patch in 2009 and 2010. I believe the character of the market changed after the crash of 2008, and 2009 and 2010 saw a return to a market that wanted to trend. The S&P 500 returned better than 20% in 2009 and over 10% in 2010. The mean reversion system managed to squeeze out 10% in 2009 and was flat in 2010.

Based on this performance, and the flailing performance of other similar systems, it was easy to write mean reversion off as being dead.

My friend and partner went our separate ways, and have not worked together since.

I have not forgotten about this system, and continue to watch it. Consider that it now has better than 4 years of out-of-sample trades. So how has it been performing? I guess the title of this post gives it away…

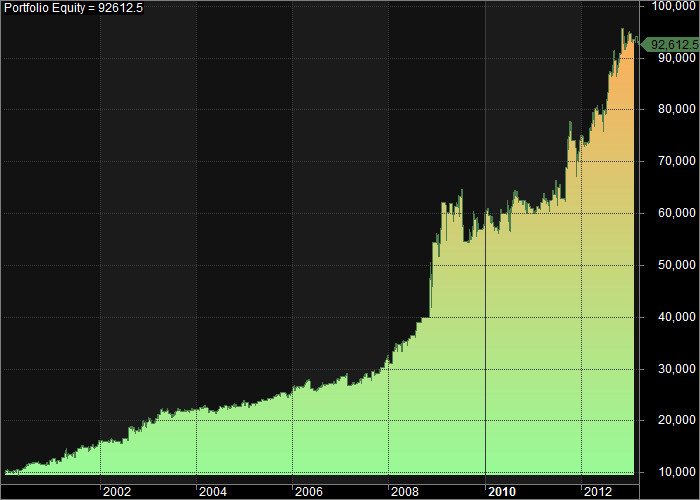

Let’s look at the equity curve for the long/short version. The system uses leverage for any trade that is with the trend. For example, if a dip is being bought and the trend is up, then 2x leverage is used.

That equity curve shows a system with an annualized return of 18.35%, including .005/share for commissions. In 2011 it returned 24.3%.

The equity curve clearly shows where mean reversion peaked in 2008 and where it took a 2 year cooling-off period in 2009 and 2010.

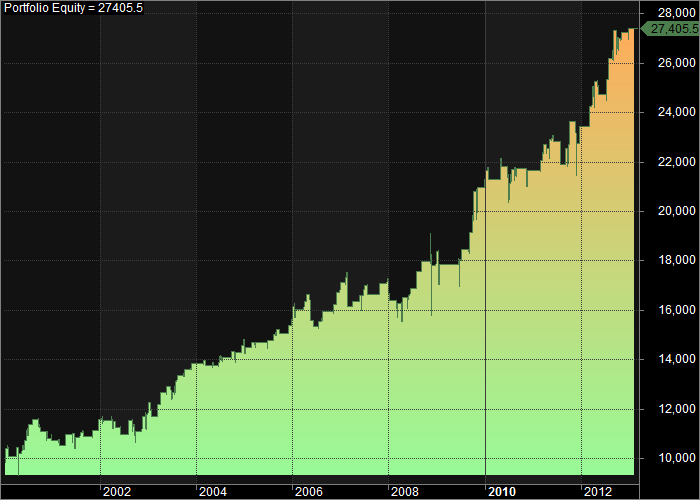

Now let’s look at the long-only version, still using leverage.

This equity curve shows a system with an annualized return of 7.93%, including .005/share for commissions. It has beat the S&P 500 in both 2011 and 2012 with about half the maximum drawdown of the S&P. Time in the market (exposure) is only 11%.

I will likely get deeper into the system stats in a later post.

For now, it seems ridiculous to me that I’m not trading a version of this system. This speaks to the difficulty in system trading as the rules must be adhered to even during long periods of under-performance. There are some important questions I intend to answer in the future. Once I have these answers, I may begin trading it again.

Here are some of the questions:

- Is there a way to accurately place orders for this system while at work?

- Can exposure be increased without significantly increasing drawdowns?

- Can tracking system health be used to in conjunction with the equity curve to improve results?

Do you plan on releasing the system details? Also, is the 11% represent time in the market, or does it represent exposure? Since you have 2x leverage, a 11% exposure would actually be apx 6.5% time in the market.

Addressing your questions:

1) There are a couple of ways that I’ve thought about with dealing with entering orders near the close.

You could just use the opening prices of the next day if that doesn’t deteriorate your performance too much. I’ve been playing around with using limit orders x% below the opening prices of the day after a buy-signal has been generated, which mitigates some of the performance deterioration, but my test results may have an optimistic bias since the Yahoo low data may not be stated as lower than it actually is.

Another approach is to decrease exposure on signals that may/may not trigger at EOD. For example if SPY prices are flip-flopping between signals, then enter in 50% of what you would risk in a situation it is a certain buy signal.

Oddmund Grotte from Quantified Strategies stated in one of his posts (can’t remember which one) that he just trades his system 15-30 minute from the close and he’s found it hasn’t significantly affected his performance. If you have a smart-phone you could implement this strategy and trade during a bathroom break?

Also, is the problem that you cannot enter the order exactly at the close? Or is the problem that you do not have the time due to work?

2) Have you thought of applying the system to a selected universe of stocks?

3) I haven’t done much research on equity curve feedback, but from what I’ve found is that it usually just reduces drawdown/risk, not increase returns. Since the risk already seems minimal, it may not help that much.

William, thanks for your comments.

I do not plan on releasing the system details. The exposure of 11% represents time in the market.

I need to run some tests with the opening prices. The problem with trading the open is that slippage is a real issue. And, you’ve got to deal with the listed open vs. the actual open. Most data is based on the listed open, which may be different than the price one actually gets.

Closing prices typically have much more liquidity and are much less prone to slippage.

What I need to look into is some of the mutual funds that price once a day. Some of them can be traded up to 4:00 I believe. If there are some that track $SPY well, that might be an option. The other option is instead to trade in AHs, and there might actually be enough liquidity to do that.

I do have a smart phone but the nature of my work may find me in a meeting between 3:30 and 4:00.

I have thought of applying the system to a selected universe of stocks, but then that makes things even more complicated 🙂

Interesting thoughts on equity curve feedback. Thanks!

Good Job Wood, Good Job.

Thanks!

Are you familiar with this system?

http://www.blueowlpress.com/WordPress/trading-systems/mean-reversion-based-on-rsi/

I tried it on the Australian $ and Cocoa over the last 5 years and it’s breakeven at best with some big drawdowns. Maybe it just works on S&P 500

donmat, I really like Bandy’s work. Big fan. I had not seen that system but it doesn’t surprise me that it doesn’t work on multiple markets. I have found that MR seems to work better on American markets. Why? I don’t know.

I have traded mean reversion systems using just LOC orders. Because you buy low closes and sell high closes, it works pretty well. I precomputed my indicators and determined what my trade size would be based on the close. Then I looked at the results and chose an order to submit. I would check in between 3 and 3:30 to see if prices were at a point where I wanted to change the order size, but mostly I just didn’t worry about being slightly off on how much leverage I used. This worked because I was just trading spy and sso (depending on the desired leverage). It would be harder if you are trading multiple stocks and want to buy the best ones.

I like it. That is pretty much how I operated except I used MOC.

How do you pre-compute the indicators? Do you use brute force, or do you reverse engineer it?

Not sure if you are asking me or jkw. If me, I’m still not sure what you are asking 😉

Regarding your questions….

1) Regarding price hovering, I’d suggest backtesting the system with a sub-optimal entry to see if that has a major effect on performance. I daresay that conventional wisdom would say your exits are more important than entries, at least in terms of risk.

2) If you think of time in the market as a risk factor, increasing time in the market for a system increases the risk (and probably the drawdowns). The increase in drawdowns might not be linear with the increase in exposure. If it were me, I’d try to develop a system that had similar exposure but that didn’t significantly overlap this system in terms of when it entered the market.

3) This one depends on how you implement system health. As William said, it will reduce risk but not increase returns (it may actually decrease returns).

KTB, agreed. I think it is always instructive to add a generous amount of slippage on the opening trade to see how that affects things.

Secondly, I agree that it would probably be time better spent to find/develop a system that doesn’t overlap this one. Thanks for that reminder. It is a good one.

It does take a lot of nerve to continue using a system when it is not performing for more than a few months; especially when you see the market getting away from you, either up or down. I’d be really interested in further postings about your system design.

I well remember 2008 and difficulties trading during the working day. I’m not sure there is a good solution. Our company started getting picky about non-work related computer use. My co-worker transferred his 401k to a brokerage account. He would enter limit buy orders on volatile stocks, two standard deviations below the closing price, at 8:00 AM before he left for work. When he got home he would check to see if he got filled. I just couldn’t do that, so I tried a different tack. I bought an adapter that plugged into the company’s digital phone system, and connected to my computer’s modem port. I did all my trading via dial-up internet access through our VoIP phone at a wonderful 19.2kB/sec. Incredibly slow and painful, but I did it for two years. And nobody ever figured it out.

Bozo, that is hardcore.

I don’t have any reason to suspect that anyone is watching my computer, but I don’t want to tempt fate. I like my job!

I get fast 3G phone coverage at work so my smartphone can really take care of most things as long as I don’t get in a hurry!

The other option is to install a VPN. I still haven’t figured out if I can do that without needing permission from the network administrator.

Do you have an iPad or other tablet at work? I keep all my trading stuff on a home computer that I remote into using either desktop or tablet software – thus, I’m able to run Amibroker without needing to be there. That being said, the whole flip-flopping of signals is frustrating – you just need to count on being wrong. I’m still using Profunds 2x which have a cutoff of 3:55pm.