TradingMarkets does a good job of providing technical setups, as well as trader education services, with most of it available free-of-charge. Some of the recent publications from TradingMarket’s Larry Connors and authors Cesar Alvarez and David Penn promise simple yet profitable strategies. Indeed, as I found, the Double 7s does make money, although the test did not account for commissions or slippage.

The problem with the Double 7s strategy, traded over the SPY, is that it does not trade often enough to generate a substantial annual return. However, TradingMarkets lists three other ETFs that work well with this strategy. In fact, they mention most of the equity ETFs work well with the Double 7s. The solution to the lack of opportunity may be to trade the 7s across a portfolio of ETFs.

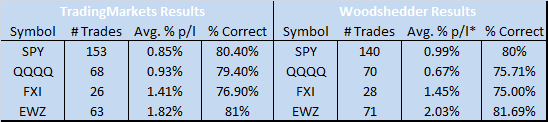

Here are the results as published in Connors’s book, vs. the results when I tested the strategy on the same ETFs.

*denotes data from AmiBroker platform. Tradestation results are used everywhere else.

Except for two places (SPY #Trades and QQQQ Avg. % p/l) the data derived from my testing is close to the results reported by TradingMarkets. I have a suspicion that TradingMarkets may have used the SPX 200 day average and applied it to the SPY, when the ETF was fewer than 200 days old. That may explain the 13 extra trades. The other difference in the #Trades seems to be due to subsequent strategy trading after publication of TradingMarkets results in 2008.

I did not determine why the AmiBroker Avg. % p/. results of 0.67% differs so greatly from TradingMarkets results of 0.93% for the Qs.

My main concern is that the system behaves as advertised, and it appears that it does.

The one detail not published about the Double 7s are equity curves. A strategy can be profitable and not be tradeable. The equity curve can help one determine if a profitable strategy is tradeable.

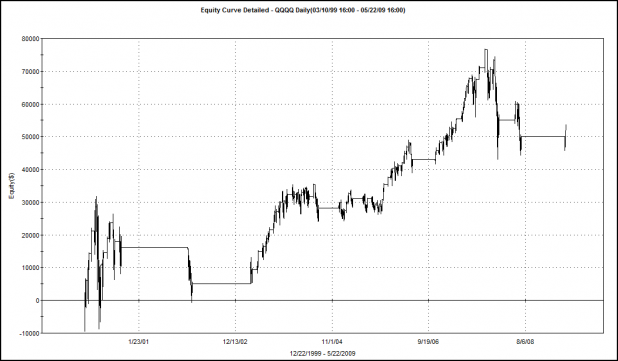

QQQQ Equity Curve

Not very pretty, or smooth… Notice the large drawdowns.

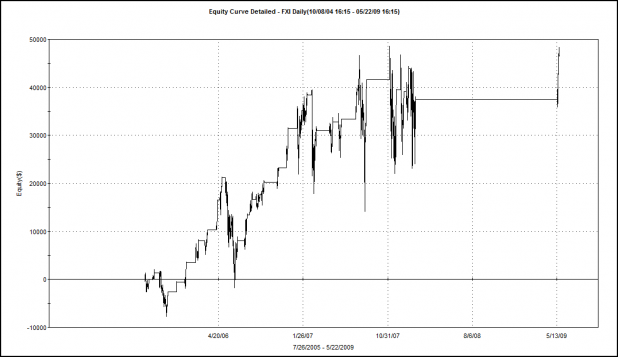

FXI Equity Curve

Note the huge drawdowns on FXI. One of the drawdowns was well over 50%. Again, not pretty, or smooth…

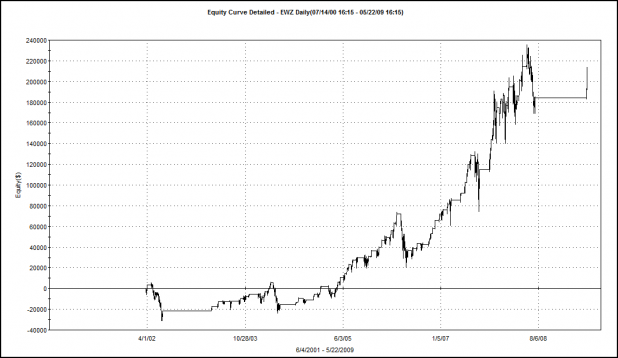

EWZ Equity Curve

The EWZ equity curve is a little better, there are several large drawdowns. One thing is for sure…this strategy likes to be traded over EWZ. The annual rate of return, when traded over EWZ is 14.10%, or almost double the return when the Double 7s is traded over the SPY.

What’s Next?

I have determined that results as reported by TradingMarkets can be replicated. However, the analysis has uncovered weaknesses in the strategy. These weaknesses have not been reported or discussed.

The first weakness is that the system does not trade often enough. By allowing the system to go short and trade a portfolio of ETFs, we can expect greater opportunity.

The second weakness is that the system, while profitable, may not be tradeable, due to the large drawdowns exposed within the equity curves.

Adding a short component to the system may smooth the equity curves. Also, allowing the system to trade a portfolio of ETFs may smooth the curve as well. We have to be careful though, assuming that the ETFs will trade independently of each other and smooth the curve, because as we saw in October and November 2008, all correlations became 1.

The next post will examine how adding short trades affects performance.

If I might be so bold as to put my $.02, I have a thought for you.

Split the SPX into two periods, above 200MA and below 200MA and backtest a portolio of ETFs that are long or ultra long on with the period that the SPX is above the 200MA.

Then, when SPX is beneath the 200MA, try using some short and ultrashort ETFs.

I suspect you might find more favourable results.

Wood,

I’ve been working this same problem, but scaling into and out of positions (confidence based system) based upon standard deviations from the 7 day high/low. However in Amibroker this has become a painful task, due to me wanting to make all different rules for entries and exits with different position sizes. Have you had any success pyramiding different entries with Amibroker?

Cuervo, that is basically what I’m going to do, except I’m probably not going to use the double ETFs at first.

Tyler, I have not used any code yet to pyramid. I just figured out how to perform percent-risk position sizing in a backtest. I’ve only had AB for a couple months, so I have a lot to learn.

I think your idea about using a confidence based system of STDs above / below the n-day high / low is really cool. I would like to try coding that.

good shit shed. I have the same problems re it is very difficult to code complex entries, double downs, etc.

I am really interested to see the results of cuervos’ idea, if you can crack the amibroker code.

For volatile etfs and stocks, if you don’t filter with MA, and optimize for the same (shorter) period length for long and short, this thing treads water when it isn’t banking. I’m starting to think it is better to keep swinging than to wait for setups in a MR approach. My brokerage agrees. Anyway, I dub this approach the ‘jumping monkey double Ls’ as it trades like it is on a coupla hits of acid.

OO-OO EE-EE AAA-AAA-AAA-AAA

Wood,

wrt to Connors’systems, I know that in his new book, he states that Stops hurt performance; would you ever recommend using a mechanical system without the use of stops.

Appreciate your work.

beano, true, stops hurt performance of systems, and I would guess that stops really hurt mean-reversion systems (the Double 7s is a MR system).

However, there are robust systems that use stops.

I’ve got really two more thoughts on stops, from the top of my head-

1. Stops are like car insurance. You hate paying those bastards, but when you need it, you’re glad you have it.

2. Using stops with systems can give one the peace-of-mind that is necessary to stick with the system through good times and bad.

Finally, I do trade one mechanical system that does not use stops. However, it does have an abnormal filter that will function as a stop during abnormal markets. However, the abnormal filter may go years without triggering.

Every other system I trade uses stops.

In my analysis of a variety of stops for this system (original, time based, % stop loss, mvg avgs, Williams %R, etc. etc), I found the original stop was the best, followed by the 8 day time stop (which curiously had the lowest drawdown of the bunch). I then asked several of my fellow traders “could you trade something without a stop.” The general concensus was “no.” Given that, and my personal unease with trading without stops, I considered using options to play the trade using the entire premium of the option as my stop and would size accordingly. But we haven’t had the targets over their 200 dma since I finished my testing so I haven’t been able to paper trade or actually trade that approach.

The other very interesting thing I discovered was that there were approximately 18 trades out of the 700 or so during my 10 year test period (I expanded the universe of stocks to 14 liquid ETFs – DIA EEM EFA EPP EWJ EWZ FXI IEV ILF IWM MDY QQQQ SMH AND SPY) that accounted for 32% of the total dollar loss. Each loss was greater than 10% and was held on average just over 28 days. But, no matter how I tried to account for those big losses with stops, I couldn’t better the original system or reduce the drawdown substantially. I will be very interested to see what you come up with.

I also tried the reverse trade (short when under 200 dma, sell the high, buy the low) but it had poor results. Again, something I will be interested to see what you come up with.

Great work Wood, thanks for sharing!

Mikey, thanks for your comments. Sounds like you’ve been down this road before. Part of the reason I’ve dragged this system out is because we are starting to get some ETFs above the 200 day.

Question- you reference an “original” stop. Could you explain it?

I’ve been messing around with the system more, getting another post together, and you’re right…I’m surprised that the short rule does not work very well at all. I’ll cover that in a day or so.

As for improving it beyond what you’ve been able to do, I don’t know. Did you try any percent risk position sizing?

I’m also kicking around the Standard Dev idea posted by Tyler.

No problem. The original stop I referenced is the exit at the Close when it closes above its 7 day high.

I tested 30+ different exits and exit combinations – time stops, % stops, time or 7DH stops, sell the next day after the signal (as opposed to the close), mvg avgs of the low or the close, W%R and ATR stop – before I ran out of time (this work was for a presentation to a small group of traders). The best stop was Sell the Close, the next best was an 8 day time stop, followed by Sell the Next day, 20 day time stop or 7DH, and then the 20 day time stop on its own.

Each of the five best exits had a normalized SQN (System Quality Number) above 2.0 that makes them tradeable according to Van Tharp to use position sizing to meet your objectives, but they are not ideal (for me anyway) as there is no downside stop with those time or 7DH stops.

Since I didn’t find any exits that I was comfortable with I didn’t move it into portfolio testing.

Hope this helps. Looking forward to your next post on the subject.