Sticking to the rules while trading a system can be difficult. The system stayed long [[QID]] and [[SDS]] despite getting very very close to meeting the exit criteria. Staying long has drawn-down the account 5% from the YTD high.

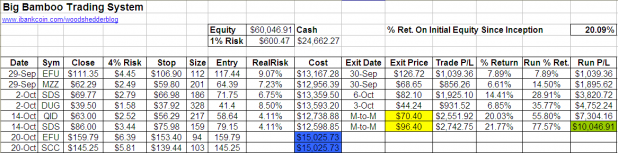

SDS and QID were marked-to-market (yellow highlighted cells) at Friday’s close. Stop losses have been updated to reflect a loss of 4% from the entry price. One might be tempted to move stops up to breakeven, but the system was not backtested with that variable.

New Entry Signals

On Monday’s open, the system will enter [[EFU]] and [[SCC]] . The spreadsheet has been updated to reflect Friday’s closing prices, for EFU and SCC, the estimated 4% stop on the new positions, and the estimated cost (in the blue cells).

This will be the first time the system as been all in, and it will be all on the short side.

Note that I’ve added a Cash calculation, and that the estimated costs of the new positions will be more than the cash the system has. This is due to using the percent-risk method for determining position-size and the marked-to-market open positions being used in the total equity calculation.

As this system will not use margin, on Monday it will only purchase the number of shares it can afford. Keep in mind that this is still not going to be perfect. It is entirely likely that the diETFs will open higher than Friday’s close, so margin may still be used, inadvertently. Having a marginable account becomes a necessity for real-world trading.

For more conservative risk managment, the best calculation to use when setting the final two positions is to figure the proceeds of both open positions QID and SDS, at a 4% loss. Doing so will ensure adherence to the 1% risk per trade. If one uses un-realized gains when calculating future position sizes, he should be aware his actual risk is increased to greater than 1%.

this thing is awesome.

all in, nice.

good luck on SCC!

4% on an inverse?

You will get stopped out withing 30 seconds of trading in this retarded tape.

Fly, obviously you have not been paying attention.

This system has a YTD ROI of 270%, with a 4% stop. With all due respect, it would have bested even your most healthy returns.

I will soon post an updated equity curve for 4%, 6%, and 8% stop levels, along with the CAGR and other stats for each stop.

You’re still keeping the 4% stop from the entry price, risking all the profits?

How about a trailing stop? Smaller guaranteed profit versus a potentially complete loss?

DPeezy, seems odd, no? Yet the way RSI2 seems to work, you have to risk profits in order to achieve the maximum potential from the move.

Initially, we were capturing smaller moves. Since 9/11/08, the average change of completed trades is up 30% over average change for the previous 11 months. As the trades have started having the potential for even larger profits, trailing stops make more sense. However, since the system started out capturing smaller moves ~7%, trailing stops I do not believe were given great consideration. At least not by me.

And actually, that YTD figure I listed for the Fly was since 11/09/07

Excuse my ignorance as I am rather new to this, but I thought the entry signal of the system was RSI(2) 80.

If I understand correctly the EFU and SCC closed over 80.

??

Thanks.

Sorry, something got garbled in my last.

I thought the entry signal was RSI(2) 80.

Wow..that’s not what I typed….again.

Weird.

eoR, No. The entry signal is not based on any sort of relative strength indicator.

RSI2 for SCC is 40.85. Hard to say what it will be Monday morning when it is purchased, but it really doesn’t matter. The first evening SCC closes with an RSI2>80, exit criteria will be met, and it will be sold the next open.

Perhaps the characters are causing a glitch. Let’s try this…

I thought the entry signal was RSI(2) less than 10 and the exit signal was RSI(2) greater than 80.

Wow… I completely misunderstood the system.

My apologies.

With all due respect, take your fucking robot and take a bubble bath together.

Robot trading is for fucking robots.

Let me know how it works, AFTER you put some skin in the game.

Why don’t you put some skin in the game? Commit 1% of your capital to it. Each trade you’d risk 1% of your 1%.

What do you have to lose? If it loses 20x in a row, you’ve lost 20K on a 10mil portfolio. Chump change.

I’m just saying cause it seems like your time masheene could really use a robot.

eoR- I have written a good bit about another system that uses RSI2 as an entry. The system underwent some tweaking and is now being traded. Due to the fact that I’m trading it, I’m not writing about it anymore.

Why would I use your advice, when my balls do just fine by me?

It’s sort of like going to the store for apples, when there is an apple tree in the backyard.

Who said I had a 10 mill portfolio?

Fly, who the fuck wants an apple tree, when you can have a money tree, in your backyard?

10million was a number I made up. If I would have said 1% of your 100K account, that would have been a ridiculous risk of 10 bucks per trade.

You’d have to be an idiot, or The Fly, to give me negative karma on that last comment.

Who wants apples when you can take a bath with a robot?

Wood, please post entry and exit data BEFORE end o’ biz Friday.

There is NO FUCKING WAY I get neg karma from this post.

None.

Retards.

Fuck all ya’all yuze all gettin nega karma biotches!

Anton, unfortunately for you, I cannot post from work. Thus no posts before the close of biz Friday. Also, all the testing on this has been with EOD data.

So, what’s the entry point for the Big Bamboo?

Monday’s open is the entry for the above diETFs.

Wood, you mentioned that you are trading another system that uses RS1(2) as an entry. I would also be interested in that system. Is it available as a service?

fly and woody in a blog war? i’m laying odds on woody here, sorry fly…., Armageddon is upon is and Robots will laser your skull into the ground, unless Sarah and Terminator can find you. Long live Bamboo

Susan, yes, we have 3 systems that use RSI2 for entries. 2 long/short, 1 short only. One of the systems was written about a lot on the blog, “RSI2 ETF System” in the categories should take you to most of the posts. The system was tweaked by me and my partner. Once we felt like it was robust, we began trading it, and I quit blogging about it. It is now the main system tracked by my Covestor account. You can see it has done well.

None are being offered as part of any service, although if there were to be a lot of interest expressed, then we would surely have to consider it.

Wall e, thanks for your support. Fly knows better. Like when much to his chagrin, I won numerous weekend blogging titles.

Nice, so you gear people up, but keep the secret. What happens if you get hit by a bus? All this hard work goes down the tubes. If you’re designing a proprietary system, then keep it to yourself. If you’re going to blog out all the details, make it open. Jerking people around is just childish.

Thanks for the continued updates and congratulations. I’ll keep checking in everyday.

Smithy, good day to you too, sir.

Since you are so concerned with my health, you’ll obviously feel much better to know that I have a partner, who knows all the secrets. Should I get hit by a bus, life will go on for the Big Bamboo.

I said from the beginning that this was an exercise designed to flesh out the psychology of system trading, more so than give people a system to actually trade. I did state that I did not recommend trading the system as it is still in its infancy.

I did not expect at the time that the system was going to hit a huge winning streak during one of the most volatile times in market history.

But to be clear, I post all the entries signals hours before they are to be acted on. This is no different than many of the Black Box systems being offered on the internets. Except with mine, you get everything, stats, exit rules, equity curves, etc, FOR FREE.

For 100K, I’ll gladly sell you the entry criteria.

If that is not your cup of tea, I hope that you’ll continue to enjoy my FREE blog.

Pinball, I’m seriously happy that this is helpful to you. That was the intent.

Wood, kidding about telling you when to post. Just enjoying your pie fight with Fly. Really appreciate the work that’s gone into the system.

Anton, you had me at “retard.”

Tell Anton I’m ready for bath time.

Oh, and I brought my friend Rosie for Fly and Wood.

http://mrl.nyu.edu/~perlin/experiments/rosie/rosie.jpg

She’ll let you go “Y2K” on her.

“Klaatu barada nikto.”

Translation: Leave our fucking fembots alone or we turn off the money-bot and burn your faces off.

Tell fly we’re here to repossess our time machine.

woody,

Too many ppl not expressing their gratitude and simply demanding shit from you. I appreciate all the information you have shared. I have followed you since your own blog through all the work drama and learning to build systems, etc. and have grown as a trader through your contributions and sharing.

Thanks.

B-rad, really, you’ve been around since TWW? Since me getting busted trading at work? lol…Man, thank you so much for reading through all that. You know then that I am just starting to see the rewards for all the effort I’ve been putting into all of this.

The Fly will go short on Monday after a quick morning bounce up, thanks to your Bambi system Woodrow! watch and see.

Sorry, Woodshedder, I wasn’t thinking so clearly before.

I discovered IBC from a forum where the market is discussed, strategies debated, and plays laid out for all to see, without any “secrets”. The other places I go online, are forums whose members are proud to share information freely. I guess I carried that mentality in here, expecting you to feel the same way. Clearly you don’t.

That said, I will adjust my expectations, and thank you for the service you do provide. You’re right, the blog is free and I was ungrateful. I apologize.

My one question then, is, if the Big Bamboo proves “viable”, will you continue to give buy-sign updates so people may choose to invest using the system, or will it become proprietary?

Smithy,

Instead of demanding all the answers from Shedder, why don’t you take the concepts he does share and then do the required tests to develop your own system?

There are enough posts on system trading here, at my blog, and at BHH’s, to construct dozens of systems to meet a variety of trading objectives and styles.

System development is not rocket science, it just requires a great deal of time and research to identify profitable systems that meet your financial goals while being compatible with your personality.

Because of the time required, it is unreasonable to expect people like Shedder to share all the details. Be thankful for what he does share, then take his ideas and roll own.

Oops, looks like Smithy posted again while I was typing the above comment.

Never mind.

No problem Smithy, I was probably a little harsh.

For the most part, I have always laid everything out for everyone to see. For goodness sakes I’m walking people step-by-step through trading a system. The only thing that is not disclosed is the entry. Maybe you look at the entry as everything, but that is incorrect. Exits and postion-sizing are easily 50-75% of what makes a system tick. I’m extremely hesitant to give out the entry because the more I look around, the more it appears to be somewhat novel.

Up until the market began going south pretty hard, I regularly blogged about other things besides this system. I anticipate that as the market firms up, I’ll rotate back into writing about other things, including standard technical analysis fare, psychology, risk, and philosophy, and probably some other systems, which I may or may not disclose.

Write now, the market is crap, and this system is gold, so it seems natural that I’ll continue to run with it on my blog.

I intend to keep giving the signals out until there is a really really good reason not to. It may be that someone “buys” the system. (Doubtful). I would obviously have to stop if that happened. As it stands, I see no reason not to keep giving out the signals.

Thanks Dog.

It is not rocket science. It requires work, both physically and mentally in terms of developing the system, and work on one’s psychology, so that the trader can actually maintain the discipline necessary to achieve the system’s potential.

woodrow, hows about a few words on how not to get caught at work – trading – (not for me but for those among us who have to go to the office)

Buylo, that is hard to say. Every situation will be different. I got busted in the most egregious way, which is to say I was at a conference, and logged in to my brokerage during lunch, at the hotel lobby. My colleague was there with me, and she noticed, and we had a short discussion on investing (not trading, mind you). I was in and out of my account in a couple of minutes. About 1 year later, I find out that she had been telling people, most importantly my boss, that I was “daytrading” at work.

The MOST IMPORTANT thing anyone can do is to be-friend the network admin. It was only because we were tight that he told me when they started watching my computer. It was also due to his help that he told me which company computers I could log in to during some time if I just HAD to make a trade.

At least where I work, they rely on the network admin. for all their info. They do not know how to monitor computers or the network. He can be your best friend or worst enemy.

I should add that ultimately, this was a good thing for me, as it kicked into high gear my desire to build systems that could be traded by working stiffs.

I have not made a trade at work in almost one year, and I am up this year after having a losing year (-3%) last year.

Everything happens for a reason. You just have to be open to what the reason might be.

Hey Wood: Just wondering, why is it so important to you to have a system that doesn’t require your input during the day? Since your systems are formula-based, couldn’t you use an automatic software solution to trade for you intraday? Or do you just like the idea that you’re there when the trades are happening just in case you want to change something?

Thanks for the new entry signal!

so if it opens below the stop do you still take the trade?

Michael, I do not do well when I have the ability to override a system. It is best when I just let things run as they should.

We have tested these systems to see how they would work intraday, and the results are not as good as just using market orders in the morning to open and close positions.

My suspicion is that when you are on the right side of these trades, the momentum carries through into the morning, to your benefit, usually.

I hope that answers your question.

I think that in the future we will work on some intraday systems, but for now, they are all end of day.

Perspective, hopefully it did not open past your hard stop. If so, you are stopped out, if your platform will allow such a thing.

If that did not happen, then it is even better, as now you are getting an even better price for the ETF. Offset the stop x% from your entry. The system recommends 4-6% stops.

Fair enough – thanks!

Woodshedder,

I was wondering about the specific rules on stops for the system. When you tested it, was the stop automatically set upon entry at 4% below the entry price or 4% below the close the day before? Thanks.

Stops were hit this morning before 10:30 AM PST.

Dan, stops should be automatically set upon entry at 4% below entry price.

I mentioned a couple of times that typical retail platforms like Scottrade do not offer this capability, and therefore a more professional order entry system is likely a must.

So yes, tested at 4% below the entry price.

Susan, sorry to hear that. I have SCC open at 138.88 and EFU open @ 151.09. They have not moved 4% beneath those entries, so I’m assuming your stops were set based on previous close?

Again, I’m trying hard to highlight all the difficulties of system trading, and being able to offset stops from the actual entry is one of them.

Thanks Woodshedder.

It all depends on what price you got in. My broker had huge spreads between bid and ask before 9:45AM EST. I could have sold SCC at 138.88 but could not have purchased for less than 145. Which means the stop was hit at around 10:00 AM EST.

what about a trailing stop, wouldn’t that solve the problem of having the stop adjusted for the entry?

Might require a large trailing stop like 15%, and a larger draw down in the system…

That way, people can set the trailing stop, and either leave it, or replace it with a 4-6% hard stop, once they get the chance.

Susan, do you mind telling me which broker? I’ve traded SCC before, and have never seen a spread like that before. In fact the worst slippage I ever had on SCC was .50cents above the open. Most times, I get the open. I did not trade it today, so unfortunately I can’t give a second look at the spread.

lol…I’m not trying to be harsh when I say that the system works the way it is, very well. That’s not to say it can’t use some tweaking. Trailing stops lower the performance. Yes, it could be set off the entry, but then one would have to log in right away and make it non-trailing, or it would get hit. And remember, the whole purpose of an end of day system is to not have to enter anything in during normal business hours.

Anybody else see the action in SCC this morning?

Interactive Brokers.

That’s crazy Susan. I’ll have to look deeper into this. It may mean that SCC gets excluded until it is more liquid. Thanks!

Woodman…Thanks for posting your system. We’ve all got our home brewed systems….Even I’ve got one. Currently mine has switched to a buy on the indecies. My system tracks trends of the advance/decline lines. It’s a pretty simple system that does not involve a lot of trading and catches the larger market moves quite well. So, it’s my sytem against yours..hehehehe. I’ve got a feeling your system will beat mine on a short term basis. Just wanted to thank you for publishing. Keep up the work.

fuck yall I’m pessamistic today… Let us all share in a bloodbath of Negative Karma, bitches

I was going to vote for myself, but I had to follow my campaign of change and do something different…

Then as I went to vote for McCain, I decided to change again, and voted for Ralph Nadar…

I hope you’re sad.

^that did say “I hope you’re happy” until I decided to change… i mean keep it the same. There I changed again.

DEE DEE DEE!!!

Stupid chinese GDP, was stopped out of EFU @145.04

Still in SCC, 4% stop sits @ 133.32

Just getting home…working on update to Big Bambi