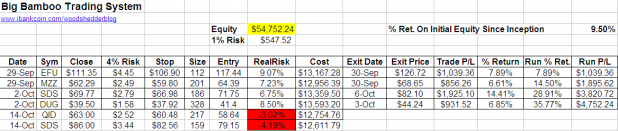

This morning, the Big Bamboo system purchased shares of [[QID]] and [[SDS]] at the open. The large gap-up on the indices was exactly what we wanted to see, as mentioned last night in the comments section. The setup was so sweet that I went ahead and bought some QID on the open, where I received a 5 penny price improvement from Scottrade versus the listed open. I note that as there has been some discussion about slippage and liquidity with these diETFs.

I want to continue with the theme of explaining this system (and system trading) from the inside out. Note the red squares on the spreadsheet. These squares show that had a 4% stop been set based on last night’s close, the diETF would have gapped down below the stop, and the trade would have either not triggered, or would have been instantly stopped out. While volatility is elevated, it will be very important to use a professional platform for order entries, to enable the stop to immediately be offset from the entry. The only other choice is to wait to receive the entry price, and then set the stop. As this system is designed to be traded by people who work, that is not always going to be a viable alternative.

While the diETF gapped down hard, that sort of action is ideal for this system. Even with a tight 4% stop, the price never was in any danger of stopping out the trade.

Also note that we are now risking $547.00 per trade. As the system makes more and more money, or loses more and more, we will be trading larger, or lesser size.

The stops are now offset 4% beneath the entries listed in the spreadsheet.

To Exit, or Not to Exit. That is the Question.

The exit for this trade is signaled when RSI2 closes above 80. While I will allow the paper-traded system to stay in the trade, I want to talk about why I may close out my QID tomorrow.

Pay careful attention to the RSI2 level, above. While SDS closed up ~8 points from the open, RSI2 barely budged. I’m not sure if this is because of the extreme volatility of late. It may be that today’s move, in comparison to the moves of the past 7 days, is small. Regardless, it makes me a tad worried about using RSI2 for an exit here, until we get a few more days of data to even things out.

Also note the huge ATR(10) of $11.96. Such huge daily swings make setting effective stops very difficult. One almost has to be on the right side of these trades, with well-timed entries, in order to be successful. In order to manage the volatility, one might choose to use stops based on a multiple of ATR(10). I hope to do a post on this topic in the future.

Again, the RSI2 on QID was more responsive than SDS, but not as much as I expected. I am going to have to look at the formula for RSI to determine the reason for this.

But back to the meat of the issue. Do you over-ride the system, and sell? Were I trading this system formally, I would not. However, while I am liking the Big Bamboo more and more, today’s trade was born more out of boredom, due to not having any trades over the past couple of weeks, than a desire to start trading the system. Therefore, I will likely wimp out, and sell the open. I hope that momentum carries through to the downside, and that I also get a price improvement upon closing out the position.

Not to muddy the water, but as BHH and I have been testing a variety of exits, we’ve found another one that is effective, but the jury is still out as to whether it is better than the RSI2 exit. This experimental/alternative indicator is signaling a exit for tomorrow. Maybe I’ll be better able to rationalize my early exit with this new information.

No New Entry Signals for Tomorrow

I like what you are doing, in part because on days like these I am too busy working to keep a close eye on the market. I have had to deal w/ far too many retards rushing into the market lately, which is in itself a signal that a bottom is not in.

The Big Bamboo is like the Malaysian regulators kane-ing the un-repentant.

Congrats.

Sort of, Pinball…if the un-repentant could suddenly get up off their knees and slam their fists into regulator’s solar plexus.

The system may have started out in a winning streak. That is both fun, and unfortunate. Unfortunate because I fear that people will put too much faith in it.

Good advice, and in this market we all have be ready to close a trade quickly either with stops or the execute button.

The more I read your posts, the more I realize how little I really know. With hard work and the information you are presenting here, I hope to someday develop my own trading system.

You have opened up a whole new world of trading for me to explore. Thank you and as always, your efforts here are greatly appreciated.

I awake to find myself longing to be short this market. Not egregiously so, but probably with some Nov – Jan puts and a smattering of ultrashort ETF’s.

Oh well.

wood, ridiculous gains on this system…thanks for sharing. Please keep posting the alerts, so that my kids can eat through this depression.

my only regret is that i sold near the close of the day… when it’s more than likely to gap up tomorrow.

that’s what i get for trading on emotion over RSI(2)!