Certainly was a great day for new breakouts. I may have to sell some of my laggard breakouts from a couple of weeks ago and add a few of these.

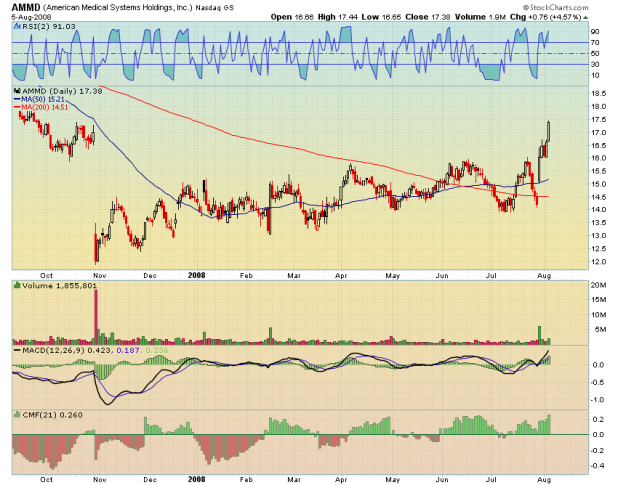

American Medical Systems Holdings, Inc. [[AMMD]] Unless you’ve been visiting Mars, you know this sector is HOT.

Advance Auto Parts, Inc. [[AAP]] Nice test of the May breakout level, and a recent test of the 50 day.

China Medical Technologies, Inc. (ADR) [[CMED]] I included this one as it did breakout today, although the chart ain’t so purty. Also, Cajun and Phil like it. As you know, hot sector.

[[IHI]] I wish I would have known 2 weeks ago about this ETF.

[[MASI]] reported tonight. Looks like the beat and raised. Definitely one to keep an eye on. Again, hot sector…Masimo Corporation engages in the development, licensing, and marketing of advanced signal processing technologies and products for the noninvasive monitoring of vital signs.

[[MCD]] All you skinny bitches out there need to go eat couple of fucking cheesburgers. Period. Nice looking chart.

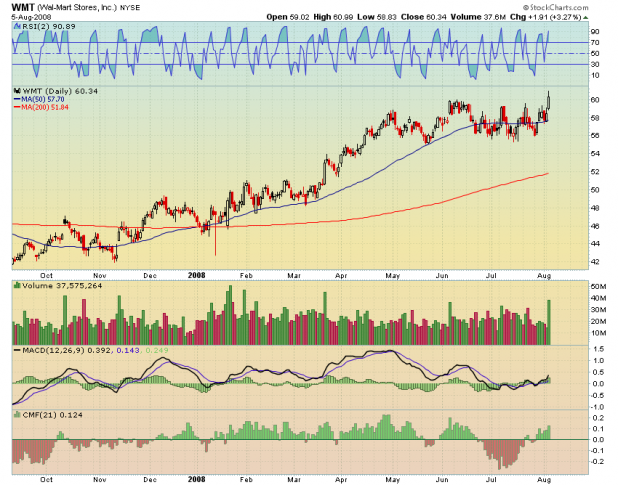

Wal-Mart Stores, Inc. [[WMT]] Gorgeous breakout. However, I’m not sure I can own WMT. I may give it some $$$ anyway.

Sigma-Aldrich Corporation [[SIAL]] Another fantastic looking breakout.

Good luck out there folks. Remember, use larger stops, and buy smaller positions.

Woodie,

I’m assuming the breakout you’re referring to in AMMD is from that short-ass rectangle? Here’s my fear. It just closed up that gay gap from back in October and it seems to be a little overextended. What do you think?

Junk

Do you really buy shit as thin as IHI? That bitch is skinnier than an Ethiopian marathoner. The volume on that one would need to be close to 150K before I would even make a purchase with Fly’s gay time masheen.

Junk, the nature of a breakout is that it will tend to be extended. If it has an RSI2 > 90ish, I probably will not buy it, and then wait for the pullback to evaluate. If I do buy it extended, I’ll take a partial position.

AMMD- look at the April-July pattern. It has most of the criteria of a William O’Neil base. Testing has shown that handles can be longer than WON uses, and still work well. That is what AMMD has…a c-w-h base, and a breakout.

I will hold them as thin as IHI, although I don’t like to. Keep in mind, these breakouts will get held until my profit target is hit, or my stop is hit. I don’t daytrade, so liquidity is not always a concern. Generally, if its thin, smaller position, larger stop.

AMMD- look at the April-July pattern. It has most of the criteria of a William O’Neil base. Testing has shown that handles can be longer than WON uses, and still work well. That is what AMMD has…a c-w-h base, and a breakout.

I assume that the left side of the cup starts at 4/7/08 and the right side ends at 6/17/08, making that the top of the handle. If that’s the case, the bottom of the handle would be around 7/14/08, which is at the low of the cup base. Looks more like a rectangle to me. WON claims that the low of the handle shouldn’t extend more than 50% into the depth of the cup. What are the dates of your landmarks (Right/Left side of cup, beginning and end of handle).

Hey

I’m ova here looking at SKF, while hanging upside down from my ceiling, and it looks like it’s breaking out.

AMMD, your landmarks are basically correct.

I have some results somewhere for breakouts from rectangles, and I recall them to be decent, so call it a rectangle if you want.

Testing of handles has shown that WON’s criteria is very much restrictive in terms of the amount of time he assigns and the distance of the pullback. These restrictions have caused me to miss good breakouts. Relaxing the handle criteria is a must.

Wood,

I agree. Rigid application of WON’s “rules” limits your ability to cash in significantly. However, the patterns are sound sources of information as they more often than not are accurate depictions of trader psychology.

I understand that this discussion of “investor psychology” and whatnot is over your head, Fly. Might I suggest that you go fuck yourself?

Love,

Junk

Wood likes to test handles.

lmao…you got me Fly. That is some gay sounding stuff.

Anyway, I knew you’d attempt revenge after my last post showed the defeat of the time masheen by the technical analysis machine.

I never read your posts. I just come here to throw shit around.

Hey

I gots anodder chart brakeout:

Take a looksy at SRS while hangin’ upside down from your ceiling, ova here.

“I never read your posts.”

That is classic.

Fly, another down day for SKF and SRS, and they’ll both likely trigger entry signals for the RSI2. Hang tight…

woodie,

which etf’s do you think are best suited for RSI(2) strategy. I read some where you said double etf’s are best. do you have a list of etf’d which work best

Viz.

Bill, that depends on what you want.

All the double etfs offer good opportunities, and there are more being made all the time…

My assumptions are that the etfs that cover a very very broad swath of the market environment are more likely to mean revert regularly than others. Honestly though, I’ve never really tested to see if that is true.

Wood;

Look at the OBV divergence on the MVIS daily chart. No one is buying smart or dumb money. Until I see smart money coming back in. I will stay away. OBV is great for ETF’s mostly and small cap. stocks.

BPOE…I’m going to start some testing with OBV. I’ll let you know what I can uncover.

I’m seeing some promise also with CMF.

Wood;

I have been trading in and out of FXP. I have been running some tests to get back in but they are telling me to stay away. I mean away by-by. I need to do more testing maybe it is a risk/reward profet thing. The thing that makes me cautious is this has become a well known trade and the market is acting bad to good news and good to bad news. The other thing is if the DOW breaks 11750 all hell might breakout to the upside.

I can’t believe you thought I was that fag junk spread in fly’s post. I hope you now know that he is NOT I, merely a sad imitator. Less verbose for sure. Ethiopian marathon runner? C’mon.

I only post under Danny.

woody, can I have your opinion on INP (etf) what with commodities going lower, India should perk up quite a bit. I’m in at 63.234 Aug. 6 – thanks

Danny, please don’t be offended…the guy was like a mad imitator. Plus, I knew it would stir up the cheese, if you found out I was questioning him….just a little good natured ribbing…

Buylo, I try and look at it tonight, or this afternoon if I get a second.

I’m not offended, I knew your detective work uncovered the truth.

hi woody,

i have a full time job like you. I started looking at RSI2, i had been reading it for last 1 month. looks promising. where can i find more about this strategy.I have been reading other sites too..like skill analytics and dogwood.

my question

1. looks like rsi2 going below 3 is ideal and nice entry. do you play with options

2. entering orders end of day around 3.55 is it better.

3. rsi2 is it on nasdaq 100 stocks or double etfs. what are your suggestion if i plan to take this trade starting next week. start with small like 1 contract.

4. which software/scanner can i use. I have IB , TOS.

thanks..keep up the good work.

Bill, send me an email…. woodshedder_blogspot at yahoo