In our latest post from the Hindsight Capital Division: trading the CMG dump that we saw on Friday. In no way is this an effort to play Monday morning Quarterback – this is solely for the purpose of maximizing profits during periods of high volatility, and understanding the environments during which these occur.

I was out on Friday and missed the trade, hence the write-up being posted in our Hindsight Capital section. However, it’s with great excitement that the move we saw on Friday was VERY tradeable and could have paid very huge.

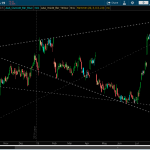

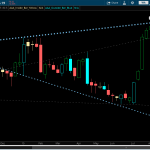

First, it’s important to know the long term details of where CMG was trading going into the news. Below we have the Daily, Weekly, and Monthly charts – which absolutely sparked the murderous annihilation. On the daily chart you’ll see that we are already at the bottom of our broadening formation series. On the weekly and monthly, however, you’ll see that we were ‘outside week’ and ‘outside month’ to the downside. As we know, the outside bars represent an expansion of volatility.

At this point, all we needed was the slightest punch to the downside to get the weak hands out. One of the most important facts to note is that the news came out on Friday of OPEX. An option writers absolute worst nightmare, behind possibly actually getting E. Coli. From a technical perspective, now, we have an absolute shit-storm brewing – as option writers are forced to short stock to hedge their option contacts.

That being said, here’s the one-minute chart off the news:

For the day traders, you have two beautiful entries off the inside 1-minute bars right off the news. As we know these bars represent a rest/equilibrium in the trend, and are imperative to your trading arsenal. These shorts entries would be below 595, then below 585. From there, it is up to the traders’ discretion on how to protect these positions. At the least, your stop is above the prior 1-minute bars highs.

Additionally, if you’re a trader and the 1-minute chart is too much for you, there’s a beautiful 5-minute setup late in the day that could have made you a killing. The last inside 5-minute bar at 552 was good for almost $20 in the last half-hour of the day.

If you would have looked at the longer term time-frames, you would see that we have a long way down to the bottom of the weekly broadening formation, and that a perfect “shit-storm” (if you will) could crush this stock very easily. Looking above at the weekly chart, we can see that our target would be close to 540 if said storm occurred. Interestingly enough, the timing couldn’t have been better.

Comments »