“I’m sitting on my hands here, not doing much”

How many times have you heard that? Every day? Every other day?

Well, if you have found that you yourself have said that, I’m here to lend a thoughtful hand and tell you that “Sitting on Your Hands” could equal cold, hard cash money – if you play your ‘options’ right. Get it?

Listen: If you are a trader, your JOB is to make money and constantly generate alpha day in and day out. If you manage a portfolio, it is a little different, but generating alpha (or atleasting collecting premium) is definitely under-utilized in this industry.

Listen, trading options is not easy. But here are the facts — about 70-80% of options expire worthless every single week. I feel like that’s a VERY high probability trade if you A) have an IQ higher than an ape and B) have the capability to do so, right? Rhetorical question – it’s a damn good strategy to generate alpha in a low VIX environment.

Case in point, today I really had no expectations for much movement. It has been a slow week, and I pondered taking the day off — but I said to myself, “Self, I can sell premium! Get off your ass!”

That being said, in order to conservative a little buying power and at the same time trade something with a little premium baked into the option, I love the UVXY.

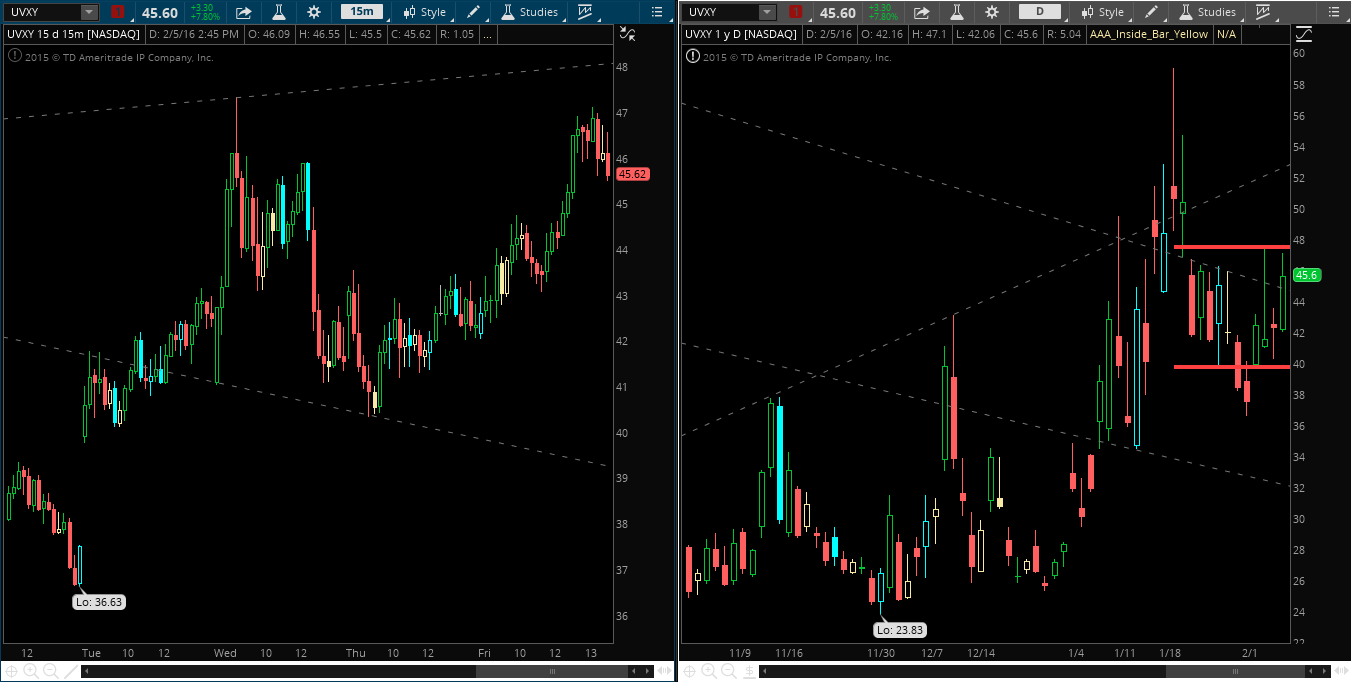

Below I have two side-by-side charts that we can use for this example – a 15-minute and daily chart:

Off the open the market decides to swan dive and UVXY calls get jumpy — love the premium spike.

Now if you look at the daily chart you can see a well defined range for UVXY: 40 on the low side and 48 on the high side. A perfect situation for an option strangle (stay with me, I know the jargon may scare some people, but bare with me).

That being said, let’s sell some low side puts and high side call options around this range. The 40.50 Puts were selling around .30 cents with the 47 calls bidding at .40 cents.

Now, let’s assume we have 10 contracts each: we have collected a total of .70 per contract, or $700. Now the easy part…we wait.

As the market swan dives our puts quickly deteriorate into the depths of hell, to nothing, and we can close them out mid-morning at .02 cents.

However, as the market continues to puke like a Freshman in college after bonging Jungle Juice all night, our 47 calls start spiking. Here we have two options:

- We can buy the stock (creating a covered call)

- Simply sell our call option for a net profit

Option 1 is IMMEASURABLY better because we can put ourselves in a “guaranteed” win position so long as we buy stock below our strike price of 47.

Here’s what I did:

I ended up purchasing the stock around 46.50 as it climbed to the highs of the day (as 1 contract represents 100 shares, we should buy 1000 shares of stock, hypothetically). As it UVXY hovered around 47, we have no fear because we are covered long with stock. At this point we have a .50 cent gain in our stock, but the options have gone from .40 cents to .70 cents – virtually a break even trade. (+$500 on the stock, -$300 on the option)

I put my stop at even on the stock and let her ride. We have a guaranteed winning position if we play our cards right.

As we get into the last hour of trade I am stopped out at 46.50 (even trade for the long stock) and we only remain short our 47 Call Option. UVXY begins trading around $46 to end the day — all the while our remaining call options decay into an oblivion.

Yes we had to “trade around” our short call, but it was no sweat.

To make a long story short, the options market is where you should be living on Friday’s. Between option decay and extreme premium explosion during expiration, you are doing yourself a huge disservice not trading these products.

Cheers and have a great weekend.

If you enjoy the content at iBankCoin, please follow us on Twitter

Simply sell our call option for a net profit

if you are shot call option, how can you sell it for a net profit, wouldn’t you have to buy it back for a loss?

I mis-wrote that Kevin, yes you are correct.

the problem with selling options is that it’s a strategy where 99 times out of 100 you’ll collect a few nickels…and then the 1 time you get fucking wiped out from a surprise move of some kind and completely erasing the progress of the previous 99 successful trades. Jeff/OA has get the options game covered here.

Matt, while I genuinely do appreciate your feedback,, your “99 times out of 100” comment is so insanely vague and lacking of substance that I have to respond to the entire post. For starters, my technical analysis and analysis of price action is top tier, and I’ll take it up against anyone. Combining that with my expertise in options trading, I am confident I can sit down at the table with the best of them. While I do have massive respect of Jeff/OA, you honestly have no clue my option background and skill set. The option trading market is massive, and to say I am going to “leave it” to other people is asinine. This is an educational platform and I’ll continue to provide my professional opinion, as will the other dozen-or-so bloggers here. Cheers.

@matt_bear – I’m pretty sure VarelResearch isn’t suggesting you use 100% of your portfolio on vol premium trades.

And no, I wouldn’t agree that the option game is covered at all ends by Jeff & OA (highest respect for both). There’s certainly room to discuss vol spread trades, calendar spread trades, premium collecting trades and many more here at IBC.

Pick up a book & don’t be scared to learn something new bro. As a trader it’s your responsibility to be informed and armed with as many weapons as possible. This is fucking war. Being specialized is great – but don’t turn down a lesson in sharp shooting.

Option Volatility & Pricing by Natenberg is a great into book into options btw.

selling premium works until you sell 40% OTM puts on LNKD and now your wife has to work on the corner

after actually reading the post its not as degenerate as I thought

I like the idea..

basically you close whichever option wins and whichever option is losing you buy stock to cover ?

This isn’t SeekingAlpha, Mr. Frog.

In the most basic sense, yes you are correct. Mind you, it was a Friday of OPEX with 2 hours remaining in the day.

Side note – if you’re selling premium on LNKD OTM puts it sounds like said wife would already have been working on the corner, because clearly the man of the house is a complete dip shit.