Well, here we are Monday night and the streets are apparently filled with dead bodies (per social media of course). Oil is just getting annihilated without any regard whatsoever (what’s new). The Small Caps are taking the brunt of this beating, down 17% from the December 1 highs.

I have only one real thing to say now:

Get the F$%K over it.

It’s time to move on and stop debating whether or not this is a recession.

If you weren’t short into the New Year then tough shit. If you were long, then you obviously should have gotten out of the way. Hindsight is 20/20, as they say. And if you blindly bought the dip and got killed, then you just shouldn’t be trading.

But here’s the deal, so many traders want to piss and moan about “wahhhh I didn’t get short” or “wwaaaahhh why aren’t we bouncing, we are oversold.” For the love of god grow a pair and quit your complaining. The market does not owe you anything. Your fundamentals and macro thesis’ are crap in periods of high volatility like we have had. Yes, the market will normalize and slowly we will resume some sort of trend – be it long or short. But in the meantime, leave the volatility to the traders. Accept that fact and move on.

SO….

What does all this mean going forward?

After this huge move and (seemingly) China settling down, it appears the relief rally is highly probable. At the least, pressing shorts is not worth the risk/reward. When will it happen and how long will it last? Who knows. But, there are a few things you MUST be watching in this upcoming period of lower volatility.

FIRST AND FOREMOST:

If you are a trader and you are not trading the VIX products (UVXY/VXX) then you need to consult your local Rabbi and possibly get your brain scanned. These products are DESIGNED TO DECAY AND GO TO ZERO OVER TIME. Yes, for all you quant majors I understand that there are periods in which this is not true (backwardation). However, these products are VERY tradeable and must be watched. If we have a relief rally, UVXY will get absolutely DESTROYED. Sell the calls, buy the puts, and short the stock – because this stands NO chance when we have the right circumstances at hand.

SECOND

All of the selling we have seen the last two weeks has been futures driven – and what that means for us technical traders is that almost all charts are going to look the same. SO, in the short term, stick to trading the index’s until we can identify natural buying (relative strength). Yes, FANG stocks have been the go to, but let’s wait and see if they continue to be that trend.

LASTLY

Earnings is upon us, each morning you should be identifying these news-related gaps and trading them accordingly. Oftentimes we see gap-and-go’s or gap-and-reverse’s, these are VERY tradeable as well.

All in all, keep risk off the table this week and be patient. There are NO indications either direction on where we are headed. Just relax.

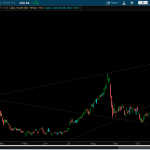

Overall, I will be watching the main indices (SPY, IWM, and DIA) to start off. Note (below) that IWM is daily hammer into support, our first hint that the relief rally is coming. ALSO, you MUST watch oil this week.

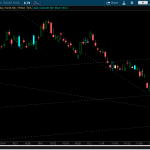

I am keeping a very close eye on SCO – the 2x leveraged inverse oil ETF. These options are juiced (indicating a 20pt move into February) and I will be looking to sell calls here. These ETFs get destroyed during re-balancing and can generate significant alpha.

If you enjoy the content at iBankCoin, please follow us on Twitter

“Futures driven”? As a futures trader, I think that completely erroneous. With the exception of a little exchange stop-popping (or order matching, if you prefer), it is the futures that are driven by the market, not the other way around.

pb – You’re and idiot. In equities, Futures lead Cash (spot price). That’s a quick way to get eliminated in a sell-side trading job interview.

VarelResearch – Hallelujah!!

About time someone recognize the decay present in those shitty Barclays & Credit Suisse money suckers. You 4got to mention “XIV” as part of that list. That’s another dead loser when the front end of the VIX curve steepends (especially b4 the roll date) – leaving investors who buy & hold this thing with crazy asymmetric risk.

Haha thanks probucks – beat me to the punch. I find it very interesting the things people decide to pick apart in these articles. Of all the opinions and data I posted, the “futures driven” line was picked apart (by an apparent ‘futures’ trader) lol. Too funny.

It is you who is the idiot. Futures are zero sum. In contrast, equity is created and destroyed on a regular basis. Via issuance or buybacks.

And let’s not forget “bankruptcy”. Clear example of equity destruction that has no parallel in the futures market. Dr. Fly, will you be worried about getting eliminated in a sell-side trading job interview? Neither will I. That Wall Street is full of shit when it come to such things, that is axiomatic. Time to prune the weeds from this peanut gallery concept.

Good post. I often wonder how long some of these inverse funds will last before they get delisted…. which will likely be once volatility fades on the products they track and they are no longer profitable…

May I ask how you get TOS to color the inside and outside bars differently? Thanks!

Thanks! Yeah agreed, basically until mainstreet sees the huge advantage we have I’d assume haha. The TOS codes are a proprietary study we developed through their ThinkScript editor.

Ah I see. As it’s a proprietary study, I’m assuming you don’t want to share the code, but would you be willing to point me to a resource that could help with writing something similar?

Thanks in advance

And finally, if futures “led” anything, that would create an exploitable arbitrage situation. Doesn’t exist. The only “leading” is done by the media, who continue to exploit a logical fallacy. Even Calculated Risk puts up an occasional “Sunday Night Futures” post. Ridiculous.

PB – let’s get this out in the open: I couldn’t care less about your thoughts and ridiculous use of the word ‘axiomatic.’ If you prefer to talk about the structure of the capital markets, find someone that doesn’t know how to trade. The Najarian’s might be a great start. Personally, I don’t give two shits about anything you commented. Now, if you would like to discuss trading, specifically the technical analysis that I am recently DESTROYING, we can chat. Until you can even remotely have a conversation with me on the mechanics of price action, you’re dog shit under an old tennis shoe.