Disclaimer: I couldn’t give two shits about Pandora. I think it’s a crap music service and their “wide selection” of music isn’t as varied as they claim it to be. I hear the same garbage no matter how many stations and filters I add to it. I am actually jamming out to Spotify while I type this out because I’m not a punk.

About 20 minutes ago Pandora announced that they were bringing back their lord and savior Tim Westergren as CEO. Tim was their founder and lead their “Music Genome Project”. To my knowledge it’s just an algorithm that tracks what you listen to and gives you other crap that you might want to listen to.

A lot of companies think the best play to bring a company back to prosperity is to bring the founder on board, cause they are a “visionary”. That idea is working very well over at Twitter as you can see…I

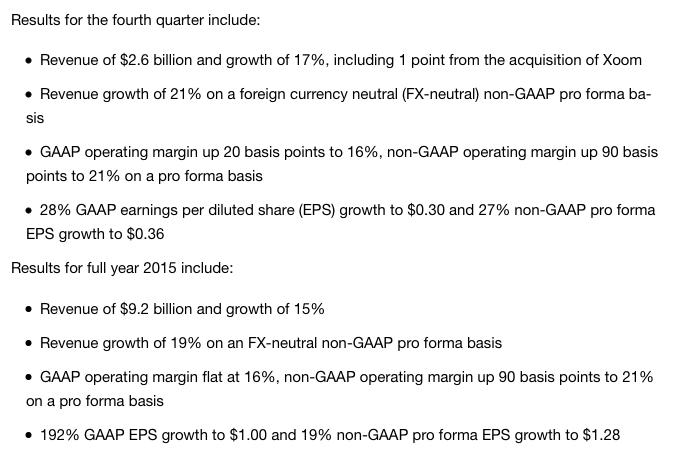

Pandora’s ditch of income has been growing YoY and is soon to unearth over in China if they keep digging.

Pandora Media Inc., $P is already down nearly 8% in the first 10 minutes of trading.

I don’t think this change will matter. What innovation is going on over at Pandora? None that I can see. If anything a larger tech giant will scoop them up sooner or later and gut them like fish.

Comments »