Starbucks Delivers On Earnings, But Spills $SBUX

Starbucks just reported their fiscal Q1..

Few highlights from their report…

- Global store sales increased 8% with store sales in America up 9% and China/Asia up 5%

- Opened 528 net new stores globally. This includes 281 stores in China/Asia Pacific.

- Company served over 23 million more customer occasions from its global comp store base – 18 million in the U.S in Q1 over the prior year.

- Company employees vowed to do a better job and spelling customer’s names correctly.

- Earnings of $0.46 vs $0.45 est.

Starbucks $SBUX was down as low as 5% after hours. Fun stuff.

For the full report click here.

Be sure to follow me on Twitter.

Comments »Shkreli Can’t Stop, Won’t Stop $VRX $KBIO

Bad boy Martin Shkreli. You know him, you love him, you hate him, a lot of you probably envy him a bit. Well as much as he claims to hate being in the news, he’s in it again!

Shkreli, the former CEO of both Turing Pharmaceuticals and KaloBios Pharmaceuticals was arrested for securities fraud back in December for using a public company’s assets to cover his personal debts. You know..ponzi scheme style stuff.

If you don’t remember..for some unknown reason..Martin first gained attention for raises the price of one of his drugs an astronomical amount in little time.

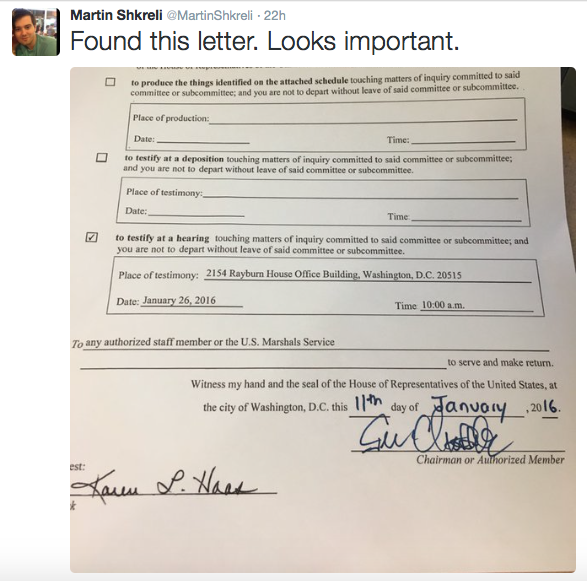

Martin was sent a subpoena to appear in front of a Senate panel to discuss drug prices..he himself posted about it on Twitter…

Shkreli is refusing to comply with the subpoena however and highly unlike that he will bother appearing whatsoever.

However, Valeant CEO Howard Schiller plans to appear before the committee. His company is under fire for buying competitors’ drugs and raising its prices.. cause capitalism.

Valeant was trading up 1.20% in todays trading session. $VRX

For shits and giggles here is $KBIOQ ….

Typical story of someone bragging about their fake KBIO profits here..

What will Martin do next..who the hell knows.

Follow me on Twitter!

Comments »ATTENTION: London Bridge Is Falling! $FTSE

The U.K’s FTSE 100 has officially entered into a bear market and is down 20% from it’s April record. European stocks are currently at a 13-month low.

Sprint Trips and Face Plants| $S $AAPL

According to StockTwits 69% of market participants are bearish on this company. This stock price has dropped up to 10.80% + today alone and 40% since it’s 52-week high of $5.45/share.

The company reported a loss last quarter which actually comes as a surprise to me. When the new iPhone was released Sprint came out with their “iPhone Forever” plan. Which to be honest was created for consumers that didn’t know how to do simple math. The entire idea is that you pay $15/month rather than pay for the 2-year contract..which depending on the GB size of the iPhone would be $99.99 at the cheapest. I know a lot of people that thought, “holy shit I can afford $15/mo easily!” yea well no shit you can but then you are paying $180 a year while I am paying $99.99 plus tax for a 2-year contract. Shit head.

Please learn to math, maybe chat with @RampCapitalLLC he’ll school you up a bit. — > check out his Do Math piece.

Analysts have been lowering expectations of this stock and doubting their plan to cut operating costs…something of which they desperately need to do. Maybe if they would hire some of the idiots that work at my local store they would save some money.

Last time I checked Sprint won’t be releasing their latest earnings until February 4th so for now…here is what I have..

This stock is bad and it should feel bad.

Follow the Twitter!

Comments »Apple Thrusts Itself Into India $AAPL

This news is off by a few hours, I AM SORRY. I was busy in class learning important shit to school you folks even further. Hate me for it. Anyway…

The Wall Street Journal reported that Apple is making a push to open its own simple and shiny Apple Stores in India. For years Apple has been selling its products through third-party firms but recently they have filed an application to the Trade Ministry using the name “Apple India Private Ltd” … very subtle.

India is an important market for Apple as their sales in the region have been on the rise, especially with the decline of iPhone sales overall for the company.

SIDE NOTE: Did you people expect the sales of iPhones to just exponentially increase within the same model phone over time? That makes no damn sense. Obviously the most sales will be when it is first released…I mean really…c’mon use your brains.

India, with a population of more than 1.2 billion people and an increasing market of smartphone users, this is a wise move by Apple to finally jump in instead of dipping a toe into the pool.

Apple $AAPL is currently down around 2.00% – 2.20% in today’s session as the entire market is shitting on itself.

Follow the Twitter!

Comments »

Facebook’s Adopted Services Are Growing Up $FB

Remember that messaging app that Facebook acquired for $19.2 BILLION back in 2014? I know I forgot about it for some time. Slack was occupying my time and you know…sending iMessages cause team iPhone..

WhatsApp is going to start testing out a different revenue stream by charging companies to send notifications to users. They are doing this while simultaneously dropping their WHOPPING $1 yearly subscription fee. I didn’t even know they HAD a subscription fee. Also it will not being using disgusting third-party advertising like a bunch of heathens! Good on them. With the $1 you are saving you could get a McChicken sandwich from McDonalds…pretty good trade off in my eyes.

On the other side of the Facebook camp lies Instagram. The awesome photo sharing service that allows you to show off your “fitness” interests why being half naked. Fun stuff.

Instagram, which was acquired for $1B in 2012, has announced that they will be expanding their expanding their advertising model and work more closely with small businesses and users in international markets. If you have an Instagram account you may have noticed sponsored photos hidden among your stream of selfies and photos of food. Only time will tell if this will make any bit of difference in Facebook’s stock price, but it is worth a look.

Facebook $FB closed Friday at 94.97 (-3.46%)

Comments »

Wal-Mart Rolling Back Number of Stores $WMT $TGT

Wal-Mart, the world’s largest retailer of rather cheap crap announced this morning that it will be kicking 16,000 employees in the ass in total with 10,000 of them being right here in the good ol’ U.S of A. Wal-Mart is said to be closing 102 Express Stores which are pretty small to start with and were just “pilot” stores. In total globally the retail mega giant will be closing 269 stores.

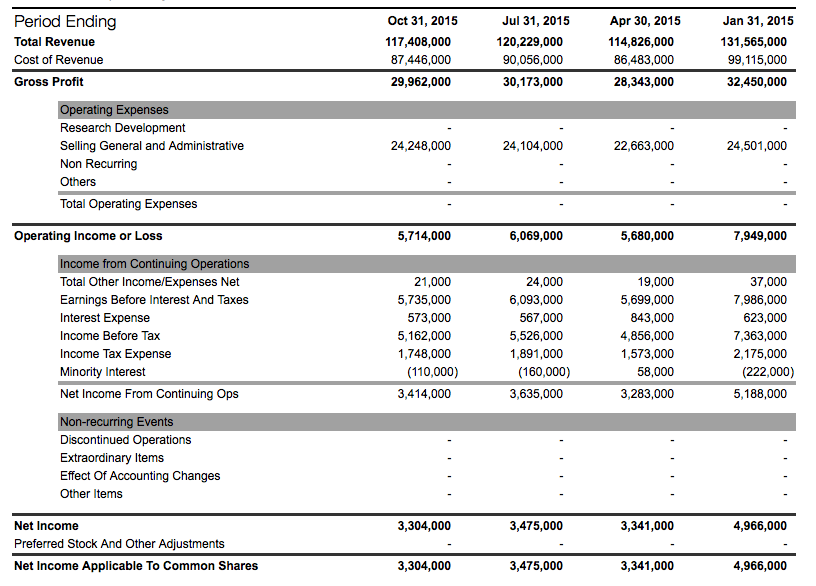

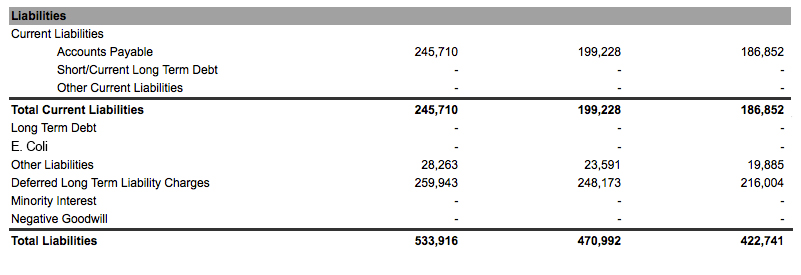

It’s going to be a bit before they release their year-end and Q4 earnings but here is a quick look at Q3 for those who care…

Personally I am hoping that the Wal-Mart in my area will not be effected by this news. We have enough assholes running around and Wal-Mart seems to do a pretty good job keeping them all in one place. It would be a shame if I had to see them at Target. Oh well.

Wal-Mart $WMT is currently down 1.68% in pre-market trading with just 15 minutes left on the clock. Target $TGT is also down 2%. ITS GOING TO BE A FUN FRIDAY EVERYONE!

Follow the Twitter!

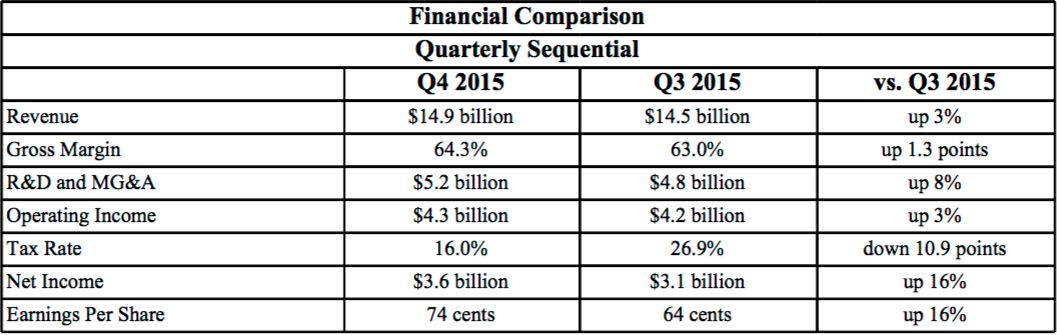

Comments »Intel Gets Taken Behind The Woodshed After Hours $INTC

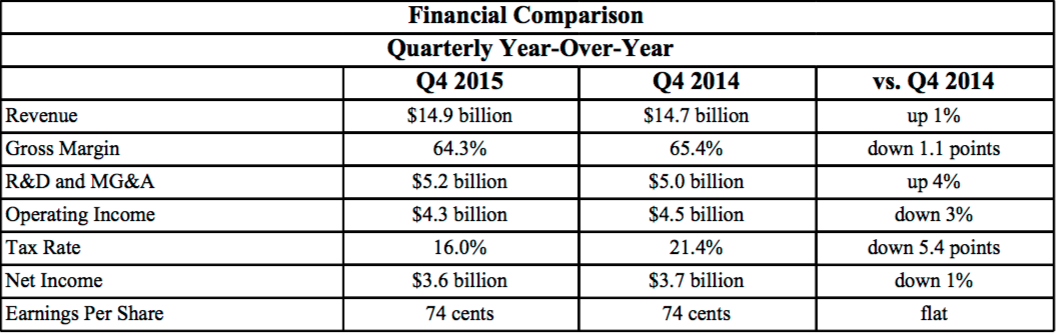

Intel reported solid earnings today with Q4 EPS beating estimates by $0.11 and revenue of $14.91B up 1.3% year-over-year.

“Our results for the fourth quarter marked a strong finish to the year and were consistent with expectations,” said Brian Krzanich, Intel CEO. “Our 2015 results demonstrate that Intel is evolving and our strategy is working. This year, we’ll continue to drive growth by powering the infrastructure for an increasingly smart and connected world.”

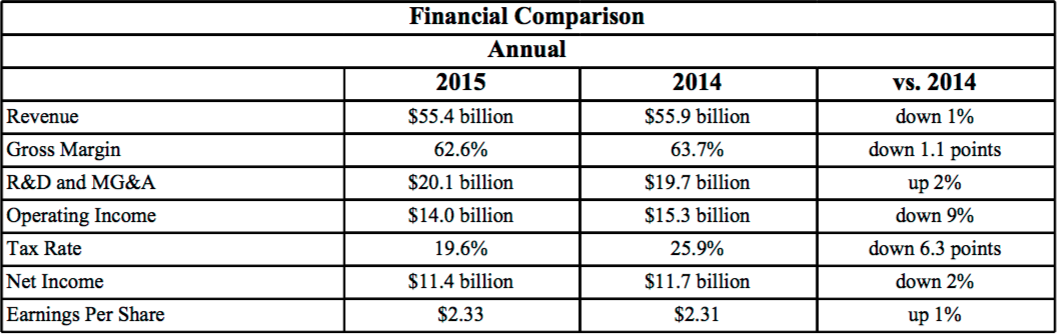

For those of you who don’t want to read the press release here are some numbers..

Client Computing Group revenue down 8 percent..Data Center Group revenue up 11 percent..Internet of Things Group revenue up 7 percent..Software and services operating segments revenue down 2 percent…and Non-Volatile Memory Solution Group revenue up 21 percent from 2014.

$INTC now down nearly 5.5% in after hours trading, completely erasing any gains made during today’s session.

Here is the full press release.

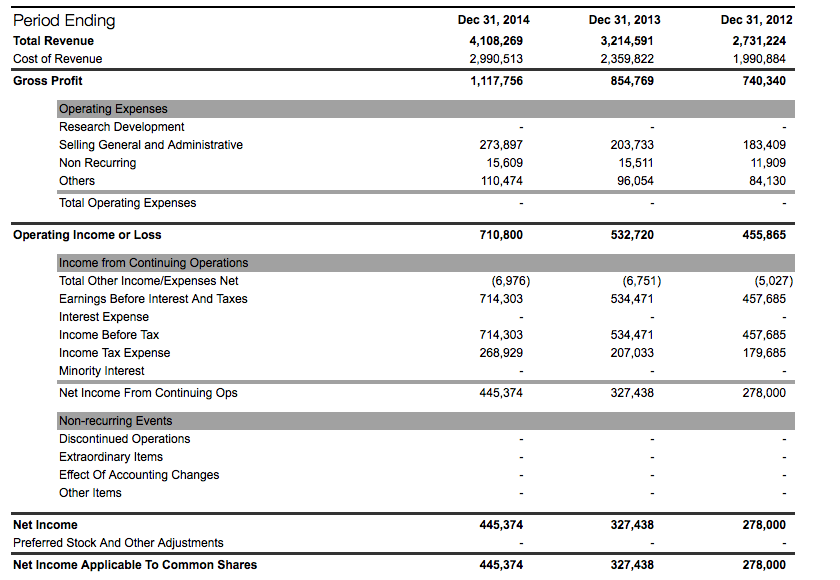

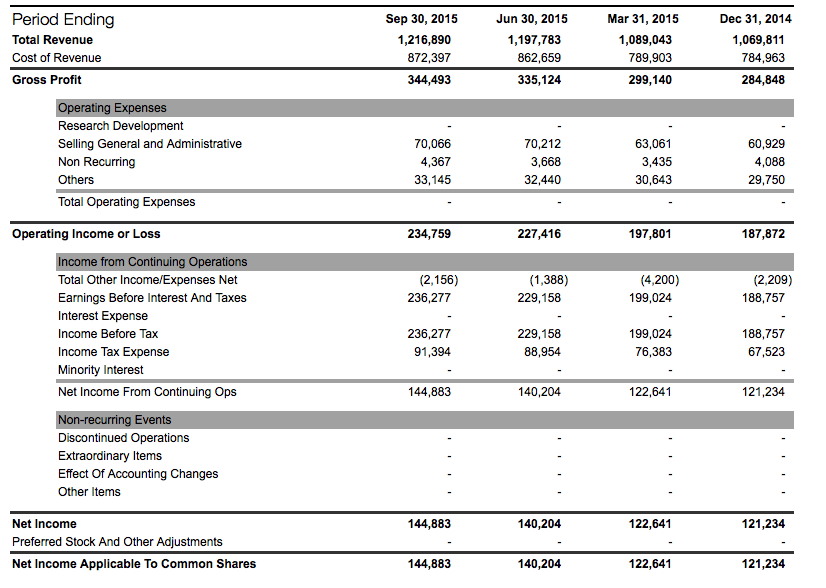

Comments »Chipotle is Far from Overcooked $CMG

We’ve all read the jokes on twitter about Chipotle’s E Coli problem. I know I have cracked a few bad ones, but none of you have a real sense of humor so I don’t give a shit.

I am here to say that regardless of what Chipotle’s earnings look like come December 31st, it will not matter in the long term. Millennials being obsessed with eating Chipotle is far from over. Every other day I have friends and family asking me whether or not it is safe to eat at the fast-casual restaurant again. As if I am some sort of FDA official. News flash, I am not. But I am a man living in suburban American surrounded by crazed people obsessed with their burritos who are indeed willing to pay extra for E Coli if that means they can get their burrito bowl fixins’.

This company has taken strides in the past to show its customers how much they care. Take for instance when they withheld the sale of carnitas because some farmers were caught banging the livestock or something. I think that’s what happened? Society as a whole moves on and forgets everything within two weeks anyhow. Our short attention spans keep us from holding any significant grudges against companies that fill our guts with edible pleasure. Remember when people had it out for Chick-fil-a? I bet you forgot about that one.

Chipotle has been taking out ads to reassure the public that they will do everything they can to improve on their practices and keep the food safe. Quite honestly, if they would just send a mass message out through their mobile app saying, “Hey, the E Coli is gone.” People would march by the thousands back to the burrito palace and buy up everything.

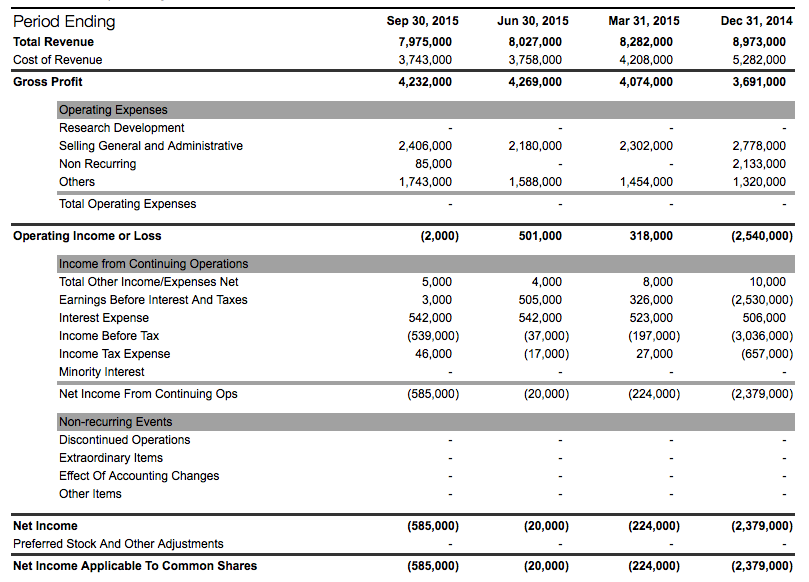

Here is the income statement for the last three years…

If this E Coli business DOES INDEED put a significant dent on Chipotle’s net income at this years end…so the hell what. Many investors/market speculators/general assholes don’t understand that the market, along with everything else in life cannot and will not go up exponentially at all times. There are highs and lows to everything. EVER. EEEE. THING! So get over it.

If the numbers are weak come December 31st, I see it as a buying opportunity, not the end of the burrito eating world. Unfortunately my words may not be graded until a few years from now but I don’t know much of anyone that bothers with REAL long-term investing anymore.

Anyway, lets look at the last three quarters..

The only numbers I care about is net income really. I mean, you go into business to make money. MONEY. If you are consistently making a profit then you’re a champ in my eyes. The largest increase was in the spring months. Weather got warmer and people were willing to venture outside again. It makes sense, does it not? The point I am trying to make is. If the numbers are weak come December 31st, it should not hinder your ability to reason with the writing on the wall. Chipotle is here to stay. I will probably be getting a burrito bowl later because I can. I’ll report on how fucking delicious it is.

Oh and it turns out Chipotle indeed does report E Coli on their balance sheet.. who knew.

Be sure to follow me on Twitter, say hi, maybe walk my dog for me.

Comments »