As mentioned in my introductory post, I’ve had a set of ‘trading rules’ that I’ve tried to follow to the best of my discipline. However, as they were my first attempt at creating such rules, I knew they were nowhere near perfect. They were thus expected to evolve through daily application, with the overall intention of arriving at a ‘consistently profitable‘ and ‘perfectly suited to my style’ set of rules.

So I spent some time tonight reviewing the old set of rules and adjusting them to fit the patterns of my latest successful trades. While a couple got thrown out, most were either reworded or made more specific. Here, then, are the results:

RISK

- Never more than 2%/trade, regardless of position size

- Standard: 2% = 30% loss in position

- “All-in”: 2% = 100% loss in position

- Enter trades at support/resistance/trendline

- Buy breakouts only after re-test/consolidation

- Never hold through earnings

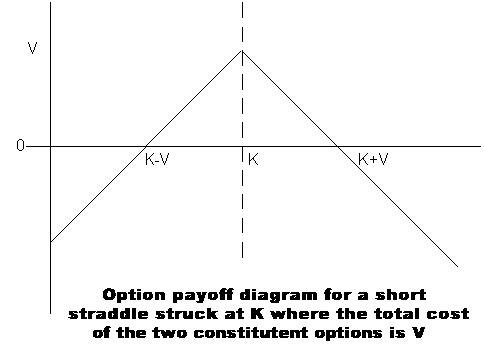

- Unless the trade is on volatility rather than the underlying stock

REWARD

- Hard Rule: Sell 1/2 of position at 100% gain.

- Always have a stop – trailing; line-in-the-sand; ‘written down’ – never just ‘mental’

- Set targets; if reached, sell to guarantee breakeven

- Sell on weakness in Stochastics/price action.

ROUTINE

- Enter new trades in the morning (before work)

- Use day limit orders for rest of the workday

- Work permitting, keep an eye on the market

- Examine all positions ~20-30min before close (lunchtime)

- Go through watchlist nightly; identify trades for next day

- Always look for ways to improve; learn from others’ mistakes

STICK TO THE PLAN!

Comments »