Tomorrow’s great idea is brought to you by the wonderful ‘fucktards’ at [[TMA]]. It sure takes special talent to lose over 85% of your stock’s value in a little over a week. And while I have no idea where the stock’s going next, I do know that implied volatility of 500%+ is egregiously high, especially when it used to average about 60%.

So how to profit from this? Short the volatility! (Thus assuming that 500%+ IV won’t last long.)

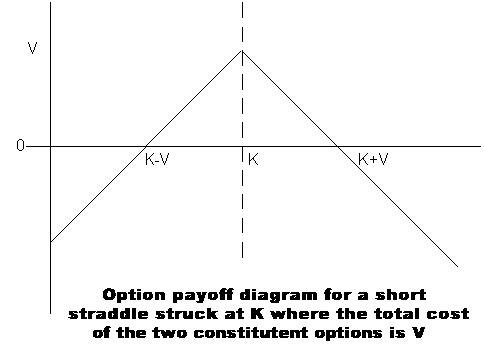

One way to accomplish that is to sell a straddle, that is sell both a call & a put of the same strike & expiration date. This creates a (close-to) delta-neutral position, which, as long as the stock’s price stays within a certain range, is profitable. Here’s a pretty picture to illustrate:

The high volatility helps out tremendously when entering this kind of trade, since the profitable range is determined by the premium paid for the options. High volatility creates expensive options, thus resulting in greater initial credit and a higher probability of reaping profits.

Back to [[TMA]] for a concrete example:

-

Mar 2008 2.50 options:

-

call (IV = 561%): $0.55 ask

-

put (IV = 475%): $1.30 ask

-

-

Selling both creates a credit of $1.85/option, $185/contract, with a slightly negative delta (-0.09).

-

These equal the greatest profits that can be gained from such a position.

-

-

As long as the stock’s price stays within $0.65 – $4.35, the position is profitable (either at expiration, or closing out ealier).

Just to compare, take a look at [[SANM]]:

-

Mar 2008 2.50 options:

-

call (IV = 74%): $0.25 ask

-

put (IV = 79%): $1.15 ask

-

-

Selling both creates a credit of $140/contract, with a higher negative delta (-0.17), in this case (we want to be as close to zero as possible).

-

Profitable range is reduced to $1.10 – $3.90.

So if TMA does nothing but sit right where it is now, assuming IV reduces and the premiums behave as for SANM, we should make ~$45/contract (30%). Those would be profits due to implied volatility only. Rest of the potential profits come from time decay, as the options move closer to expiration. Max. profit could be booked if the options expire worthless, although the chance of that happening is fairly small.

The downside risk of a short straddle is significant, if the stock falls or rises outside the range. In fact, much like short-selling stocks, the potential losses are unlimited. Stops are highly advisable.

What we’re betting on, however, is that the underlying stock stays within the profitable range, volatility falls, time-value decays (on near-term options), and profits are booked.

If you enjoy the content at iBankCoin, please follow us on Twitter

wow, this looks like smart stuff, because it went right over my head.

dig it, very very good explanation, very well written.

nice job dpeez. a truly educational article. tell me, did you put this trade on today?

I hate people like that! They are all crazy! They think they are the coolest and smartest ever. But really they are dumb