About damn time, too! I was getting real tired of all the media idiots calling it the ‘fear index’. So once again, with feeling this time, the VIX does not measure fear! Thank you.

Here’s the official word from the CBOE (emphasis mine):

VIX is commonly called the investor’s “fear gauge” because investors tend to be more fearful when market volatility is high and less so when volatility is low. While it may be a handy nickname, the “fear gauge” is really a bit of a misnomer and, when taken too literally, may lead to some confusion. It is important to remember what VIX truly measures: the market’s expectation of future volatility implied by S&P 500® stock index (SPX®) options prices. In other words, VIX uses options pricing as a way to measure perceived market risk and uncertainty.

This comes from the CBOE’s latest research note, released last Friday. It is highly recommended reading for anybody who uses or wants to use the VIX his trading, especially for those who are nowadays commenting that the VIX is “broken”.

Some other highlights from the reserach note:

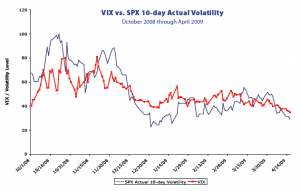

“As […] the economic tsunami continued, VIX – to the surprise of some – actually began to decline in early 2009 although there was still considerable “fear” in the marketplace, causing some observers to wonder if VIX was working properly. In fact, despite all of the bad news and continued fear, some of the market uncertainty had dissipated. […] Although the market continued to lose ground, it began to do so in a more regimented fashion.”

“As a measure of future volatility, VIX worked very well:”

“Given the general tendency for VIX to move inversely to the overall market, some observers have erroneously assumed VIX was created as an indicator of market direction rather than market volatility, a measure of stock prices rather than stock price changes.”

If you enjoy the content at iBankCoin, please follow us on Twitter“VIX levels reflect how options investors feel about the future, regardless of the current level of the S&P 500 Index. In other words, there is no fixed level for the VIX when the SPX is, for example, at 600, 700 or 1,000. […] There is no evidence to suggest that a particular level of VIX is tied to a particular SPX price at the bottom.”

where is download url, i cant locate..

For lots of old school photographs-there’s a awesome exclusive ibook that documents graffiti history.

I really feel other website enthusiasts would need to give consideration to this particular online site as an example. Remarkably clean and simple to use design and style, together with amazing subject matter! You are an expert in this type of area 🙂