An unfavorable jobless claims report would have normally been expected to sink the market today, effectively wiping out most of the gains from Tuesday. You will recall that during the past several weeks this was the case. Market up, market down. But something has changed. Call it fate, manipulation or asshattery. The fact of the matter is, you can’t make money if you’re not in the game. The position to be in now is LONG. The market should end the week positive. The bulls are back in control. I’m buying the major big cap indexes via DIA, SPY, and QQQQ. Also taking positions in EFA and some IWM tomorrow.

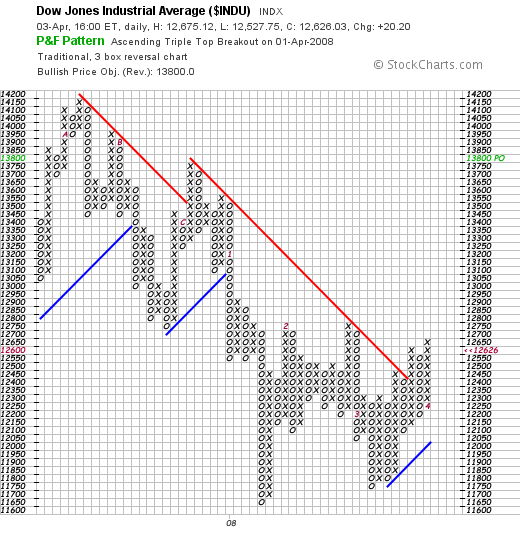

Take a look at the technical evidence:

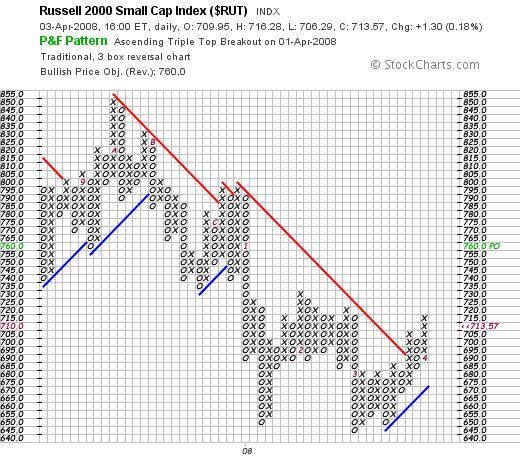

Look at the small caps:

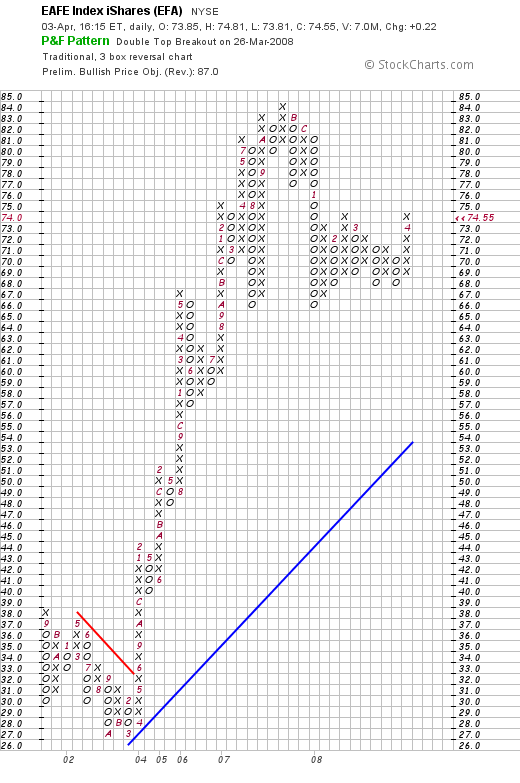

…and Large cap international…

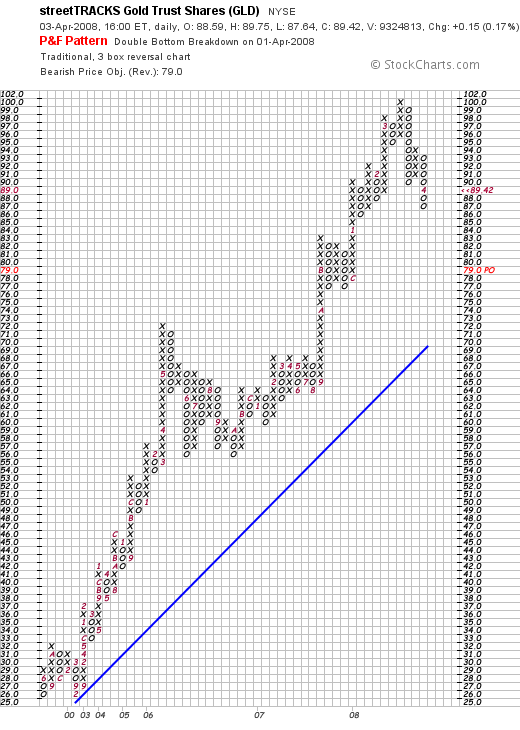

Finally, gold’s decline is helping to make the case…

Disclaimer: Technical analysis is a lazy man’s way to invest. You can lose money trading stocks on a technical basis. This information does not contain everything you need to know about the market or any particular stocks. In summary, conduct you own due diligence so you can take responsibility for you own results.

If you enjoy the content at iBankCoin, please follow us on Twitter

Technical Analysis aside, housing prices are still dropping, available credit is still drying up, delinquent credit accounts are rising, wages aren’t keeping up with inflation, and unemployment is on the rise.

Sounds like a great time to buy stocks? I hate being the last one on board for a bull run, but I think this is a suckers rally.

BTW, why did Fly move the King of the PG at the very fucking bottom of the page? I forget you’re down here half the time.

Anyway, congrats on the win and I look forward to reading more this month. I’m sure you will follow Dpeezy by setting the bar high for the rest of the PG.

YAY, I caught one!

Might rally for a couple of weeks…

The key for me will be to spot the sector that emerges as a leader. Solar and tech, maybe… Fly already showed transportation has the line of death. Unless we see some real market leaders and sectors that lead the pack, I think we’re very vulnerable to a pullback, just like last time we had our “tuesday 400 day”.

I still like some names, but no rush to get in here based on a little technical work. The tide HAS turned, but that was then… VIX is at support, and the tide goes out after coming in.

Visa and Master card could be good for the banks, stimulous check will be good at maybe JUNE, the Jan Rate cuts still need a couple months to take effect. I’ll be bullish in June if it proves to be good, or if a sector emerges… until then, you just a bull caught in my trap

My gut says we go higher. I know, it doesn’t make sense. This economy is already messed up. Why should a rally in the market make sense right now? Remember, we live in “The Matrix” with Ben and Hank.

I’m trusting what basic supply and demand for stocks are telling me. That’s what counts. Not what gets reported in the news. I’m not buying the economy or houses, I’m buying stocks and demand is definitely there right now.

Longs will have a good trade here.

VISA is going higher…much.