Buffalo Wild Wings shares are down 7% ahead of earnings. As seen below, the chart is forming a dreaded Hazmat Head and Shoulders.

The company is suspected of causing unbelievably nasty illnesses detailed here by Fly.

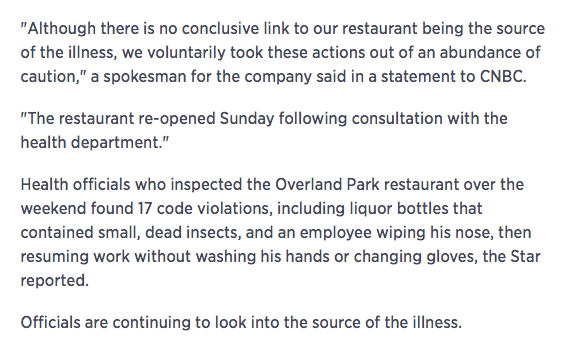

I don’t really know Buffalo management but so far their reaction isn’t encouraging (via CNBC.com):

I get that it’s one unit in a large chain. But read those code violations again. Now think about enjoying a nice Super Bowl afternoon dipping your wings in BWLD’s Sauce of Disgruntled Teen Worker. This is potentially a very serious problem for Buffalo Wild Wings. Customers get super freaked out about food making them violently ill. Take my word for it on this; I was a Psych Major.

Even if the illness is contained a Vomit / Diarrhea / Booger (VDB) troika of nasty is a big enough issue to change the entire risk/ reward ahead of earnings. Honestly, flat out poisoning people would be easier to forgive. They better be taking this more seriously by the conference call.

Nothing BWLD reports tonight in terms of financials matters anymore. Guidance is pointless. This is a binary outcome stock. If VDB is chain wide BWLD is going lower by 50%. Chipotle lost 60% of its best customers. Buffalo can’t afford that kind of hit. Super Sunday is already at risk. But an actual outbreak would kill business during the NCAA Tournament.

You might as well cancel a retailer’s Christmas. March Madness is everything to these guys.

Do what you want with the stock ahead of the bell. I wouldn’t touch it with a hazmat suit and salad tongs.

If you enjoy the content at iBankCoin, please follow us on Twitter

Nothing is more dangerous than potential GI issues after eating hot wings.

increase in VDB incidents at restaurants= bullish for grocery stores and home cooking?

Hi Jeff,

This was a comment from your last post on buybacks, but I was wondering if you could address it here.

I had a debate with someone on this topic the other day, and through your writings, I completely agree. However, if we were to look at the other side of the coin, market logic states that if a company issues more shares, then there is share dilution and the shareholder’s shares are no longer worth as much.

But if they do a buyback, then there are less shares in the market. This person’s contention was, because a shareholder’s ownership is now worth more (theoretically speaking to the inverse theory of share dilution), this is a way to return “value” to the shareholders. My retort was that it’s not actual cash, and now the dollars are gone forever.

Is that how you would respond, if not, how? Does this persons argument hold water? Thanks in advance for all the knowledge; truly starting to do much more individual thinking.

It demonstrably doesn’t work the way your friend says. Companies ride buybacks into the grave all the time.

The company is spending real money to create a theoretical gain for shareholders (and usually a tangible gain for executives).

The burden isn’t on you and I to prove there is a benefit to this form of giving cash back to shareholders. The burden is on your friend to prove a cause and effect.

Buybacks are the Dali Lama’s tip for Carl Spakler in Caddy Shack. It’s a hustle. Carl got stiffed.