[youtube: http://www.youtube.com/watch?v=rMjAf8Nwohs 450 300]

_____________________________

No, I’m not speaking of Mssr. Le Fly counting his Broken Robot Coin in his Counting House, whilst tossing flaming egg-nogs at his trader servant, Mssr. Le Cratchet.

I’m talking about the classic The Year Without A Santa Claus double production numbers from those brothers of Sun and Snow, the Heat and Cold Misers.

This piece is actually a cover by Big Bad Voodoo Daddy (an RC favourite, no doubt). While I prefer Dick Shawn’s Snow Miser in the original version, I have to give the overall production medal to BBVD, as they are large, bad, magical, and also your father. Besides, Heat Miser is a mite too drag queenish in the original…

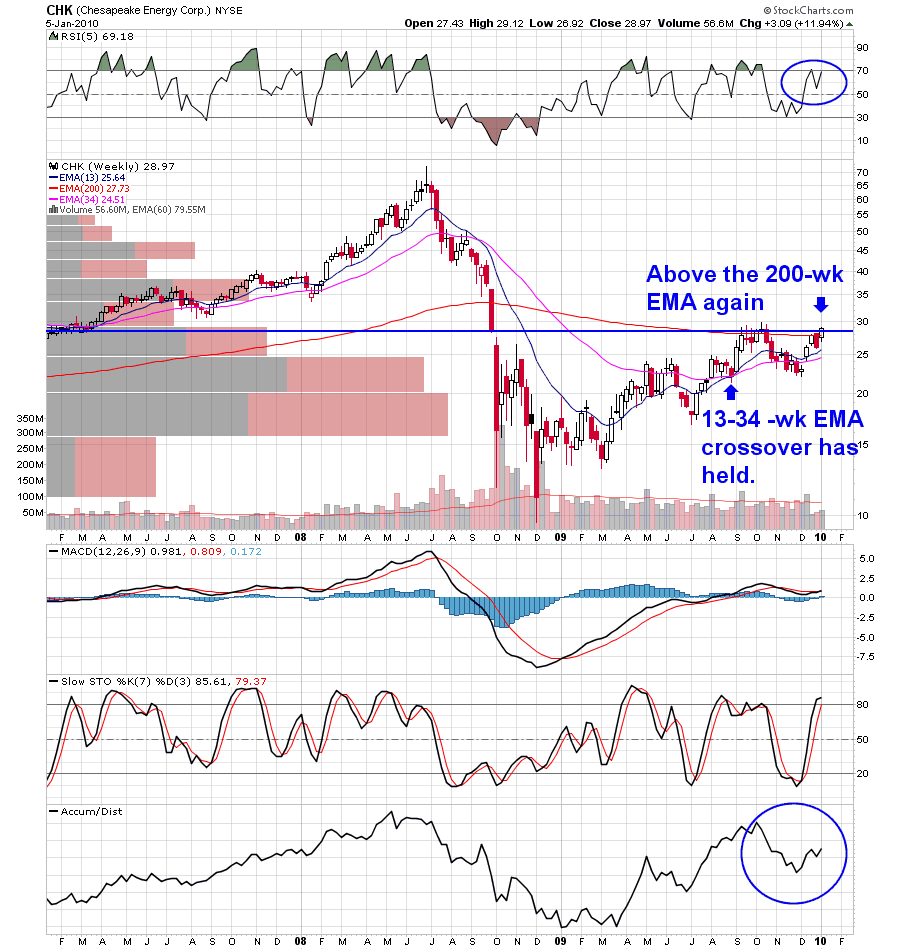

As I suspected, after a month’s worth of work, the market [[SPX]] tipped over the 50% fibonacci line today at $1121.50 or so, and is now seemingly out of the box like a busted robot and headed to $1227, where awaits our Golden Ratio of 61.8%. As I’ve mentioned, I think we will eventually get there, but not before a pullback, which could be quite gland-challenging.

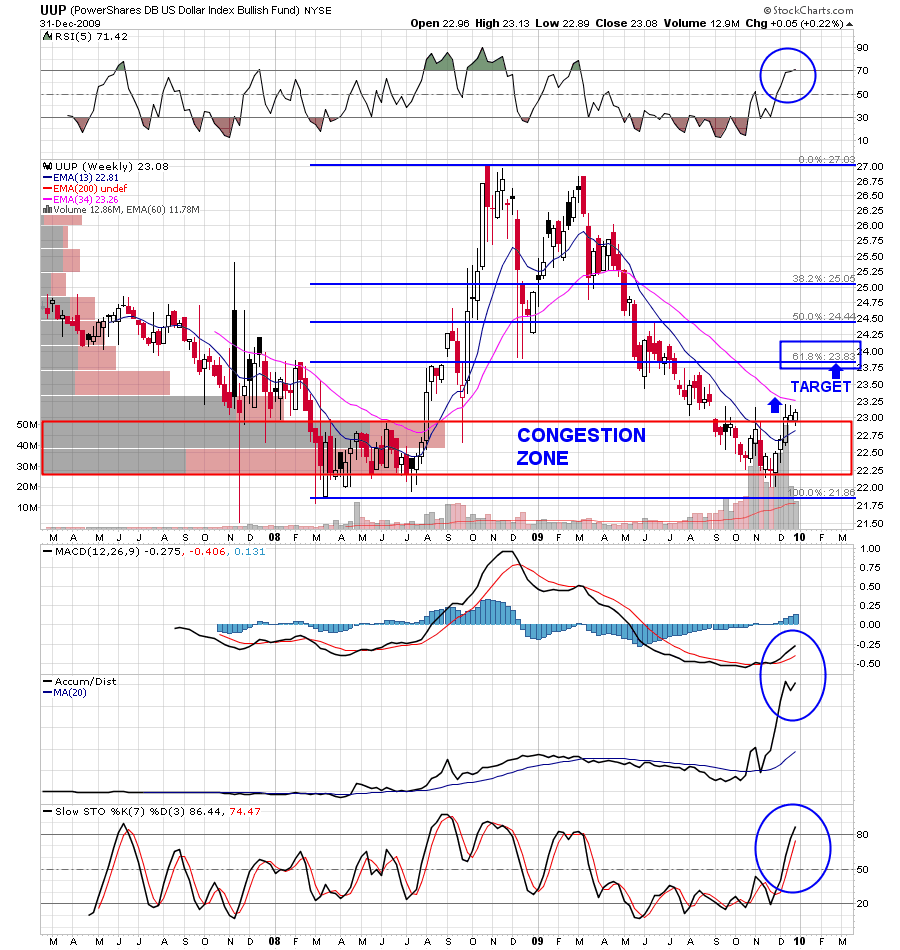

With [[TBT]] breaking out quite convincingly here, equities have been put on watch that their discount rates will continue to increase. As well, the dollar pullback, as shown by DXY and [[UUP]] today has also been de minimus. Maybe all the rules of finance will continue to be suspended in honor of Santa and Rudolph, but I wouldn’t bet my Christmas gelt on it.

That’s why I haven’t yet jumped in the molten gold pool yet, either, as appetizing as Royal Gold, Inc. [[RGLD]] and Silver Wheaton Corp. (USA) [[SLW]] are looking today. I could be wrong, but I don’t think the dollar is done shagging with us yet. No real worries, though, my Pagans. Santa Ben will soon take up his ink stamping device and all fans of the continued mass portraiture of the Inventor of Electricity will be appeased.

_____________________

May all your families have a Merry Christmas and Happy New Year, even if it may be Pagan, or whatever. It’s all about the kids, and what you make of them in the end, anyway.

Best to you all, and thanks for your well wishes and support in 2009.

__________________________

Bonus Clip, Humour Division:

[youtube: http://www.youtube.com/watch?v=X6yUCbqAGrg 450 300]

_________________________

Comments »