SUNE has plunged to new multi-year lows after announcing mixed earnings (met revenue expectations; created a loss per share of -91 cents vs -70 cents expected), cutting its full-year cash available for distribution guidance, and narrowing its full-year project delivery guidance from 4.5GW to 3.3GW-3.7GW.

The entire solar sector is selling off hard. At present, TAN SCTY SLTD SPWR ENPH FSLR TERP JASO TSL SEDF are down between -3 to -20%.

Here’s the full section on SUNE from Greenlight Capital’s 3Q shareholder letter:

For the first part of the year SUNE was by far the fund’s biggest winner. The shares rallied from $19.51 to a peak of $32.13 on June 23 before collapsing to $7.18 by September 30. SUNE’s business is to develop solar and wind projects for major utilities and commercial customers that agree to buy the power over a very long term, often 20 years. These projects have purchase contracts from highly creditworthy counterparties and produce an average unlevered return on capital of 10% and 13% in developed and emerging markets, respectively. SUNE makes money by selling the projects at a premium to investors seeking safe, long-term income.

Given the low-rate environment, SUNE thought it could make even more money if it created its own related yield vehicles to buy the projects and dividend the income to shareholders. It created TerraForm Power (TERP) for its developed markets projects and TerraForm Global (GLBL) for its emerging markets projects. Initially this worked very well, and in July 2014, SUNE successfully brought TERP public. This July it brought GLBL public with much less success.

In the weeks before the GLBL initial public offering, SUNE was at its highs and we contemplated trimming the position. Since we expected the IPO would trigger a further advance in the shares, we decided against it. Around this same time, oil and gas prices renewed their declines, causing the values of energy master limited partnerships to justifiably fall. We believed that TERP and GLBL would not be impacted, as neither is subject to commodity risk. We were wrong. Because the SUNE yield vehicles were relatively new to investors, the market did not distinguish them from other energy dividend flow-through structures. In mid-July, TERP began falling along with the rest of the sector, taking SUNE with it. GLBL IPO’d at a big discount a week later and traded poorly in the aftermarket.

SUNE investors should note the following:

As GLBL and TERP continued to fall they effectively lost access to the capital markets, and SUNE collapsed as the market became worried that SUNE would not be able to sell its projects and could even run out of money. Ironically, the market judged SUNE’s rapidly growing and massive backlog of attractive projects to be a liability.

SUNE’s hard-to-decipher financial statements fed the stock collapse. SUNE consolidates both TERP and GLBL on its GAAP statements. The complicating result is two-fold: First, when SUNE sells a project to TERP or GLBL it bears the operating costs but doesn’t get to book the revenue from the sale. The result is the appearance of an operating loss. Second, TERP and GLBL use non-recourse project finance debt to fund the purchases and the debt appears on SUNE’s balance sheet. The result is that SUNE appears to be heavily levered and losing money. From a GAAP perspective that’s true, but from an economic perspective it is not. Nonetheless, this hasn’t stopped some wise guys from dubbing it “SunEnron”.

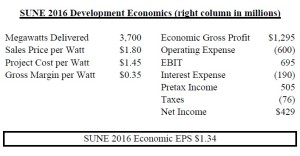

SUNE responded to the deteriorating environment by raising additional equity, finding third parties to buy its projects, and slowing its development pipeline. All of these actions have marginally lowered the company’s value, but have stabilized the situation. Taking into account the more conservative business plan, when we look through the complicated financials we believe that SUNE’s development business is poised to have economic earnings in 2016 of about $1.34 per share, assuming that TERP and GLBL ***do not regain access*** to the capital markets.

At 315M shares and a $1.8B market cap, SUNE is trading at about 4.3x $1.34 of “economic earnings” in the worst case where yield co’s don’t regain access to capital markets. Look, SUNE can always get cheaper, but that’s not a bad place to start buying given what we know is on the immediate horizon as it relates to the future of energy.

SUNE has additional value from its ownership of TERP and GLBL shares. During the panic, the market has fixated on the question of whether TERP and GLBL can access money cheaply enough to buy projects and grow their dividends. This is relevant insofar as it will determine whether they can be long-term buyers of SUNE’s projects, but we believe the market’s focus is too narrow.

The better question is: Do TERP and GLBL have the opportunity to buy projects at returns that exceed the risk? If they do, the capital markets would be wise to fund them. We believe the answer is a resounding “Yes.” A power plant with a long-term power purchase agreement is roughly equivalent to a secured lender. As the customers are strong credits, the ability to buy a portfolio of these projects at a 7% unlevered yield in developed markets and a 10% yield in emerging markets should be very attractive in the current income-starved environment, where 7-year A-rated corporate bonds yield less than 3.5%. We believe that once the market sorts through the mess, TERP and GLBL should recover and regain access to the capital markets. This would allow SUNE to realize substantial additional value.

The most important thing for SUNE bulls is whether SUNE and its yield vehicles TERP and GLBL can get access to funding, or whether there’s going to be a leverage-induced collapse. From Bronte Capital’s John Hempton, when he announced on October 2 they’d taken a position in SUNE:

Non-bank financials “blow up” for one of three reasons, (i) credit risk, (ii) duration mismatches and (iii) and unstable funding. If you want to assess TerraForm Power (Sun Edison’s yield co) you need to assess whether the credit risk on the projects (the counter-party) is okay, how the contract and funding is (eg floating/fixed etc) and all the ways in which project development funding is able to roll into long-dated funding.

A friend put this to a yieldco and the management balked at providing that level of project detail. My friend’s response: “well, are you Northern Rock?”

And that is the guts of the issue and the market fear. We have gone to considerable effort to convince ourselves Sun Edison is not Northern Rock with solar panels. We have talked to several people who have organised funding for these things and it seems okay to us. Specifically all construction finance automatically can be termed out as project finance (over the life of the project and linked to the project) when the construction is done.

If this is true the market fear for this company cannot cause insolvency. Given that the company is priced as if insolvency is likely this stock should produce a good return from here.

Alas we could be wrong here. We can’t see all the funding (the disclosure is complex) but the bits we have seen have this character. We checked through several sources and we don’t think the company can have a “run on the bank”. The Northern Rock outcome is unlikely.

Now of course we have not seen and understood all of the finance deals. Only the ones we can find. But that is sufficient to know we are probably right. And that is the case for buying. The old projects are good and they should run off at an attractive clip.

You should read the whole post. Hempton goes on to call for the head of SunEdison CEO Ahmad Chatila to roll.

He has not done very much that is wrong except create a business which he personally is a woefully inadequate CEO for. For this he should be rewarded: as recognition of (a) what he has truly created and (b) for going quietly and constructively.

Calculate his payout, add thirty percent and fire him.

There is a core criteria on picking the new CEO.

They need to be boring and from a control culture. The idea CEO would be someone from (say) the risk management department of Goldman Sachs. What you want is a dull suit occupied by someone whose job it is to pull wings off butterflies. Someone whose job it is to ensure – and be seen to ensure – that bad projects are not funded.

The market wants someone who will get on an earnings call and talk about asset liability matching, FX risk mitigation and basically sounds like the CEO of a mortgage REIT, not a semiconductor visionary.

You want risk aversion above all other things.

This company has got to become dull and predictable and it has to get there fast. Anything short of dull and predictable will end badly.

Here’s what SUNE’s CEO said on the call:

Right now I want the company to become more boring, Boring, and cash-flow generating.

Someone appears to be listening.

In a yield starved world, where the climate cops are pushing to zero carbon emissions in the next few decades, I see things much like Einhorn and Hempton. However –and pay attention to this– there still remains a possibility there could be a run on SUNE, and today we’re seeing investors panic because the company soothed no one when they said that “there are no assurances that we will be able to raise the $6.5 billion-$8.8 billion needed to fund the construction of renewable energy assets through 2016.”

So don’t mortgage the house and back up the truck, even here, and for the love of mike, pick up a long dated hedge.

But understand, this sort of panic is required for the much ballyhooed “blood on the street” conditions you’re looking to buy. Just don’t blow up buying it.

And as I said yesterday, nearly all of this is a self-inflicted gunshot wound. They can fix a lot of this.

I’ve only had a few orders hit thus far. I’m still very small and my average cost is $6.12. I would imagine, however, that the margin clerks are just about ready to start their work. Look for signs of capitulation starting around 2pm EST into the close.

If you enjoy the content at iBankCoin, please follow us on Twitter

good work

I agree with Sir Fly–this is a detailed analysis–and as a suffering SUNE shareholder sitting on a 40% loss, it is good to read balanced and direct

I should probably buy some as a hedge against my oil short unless the correlation between oil and solar breaks down. Thoughts greystoke? TY.

I don’t know that anyone really knows of a great way to hedge oil, long or short. That’s a long post unto itself.

Given SUNE’s specific situation, I would not suggest using it as a hedge on oil.

I would suggest buying SUNE as a play on probability. In other words, it’s a speculative opportunity to take advantage of:

1/changing energy policy trends 2/forced margin selling by crowded hedge funds 3/fear & misunderstanding of what SUNE and its yieldco’s are 4/realization that the patient will live if the patient would only stop shooting itself in the head

Thanks graystoke

And.. the price can’t go below 0