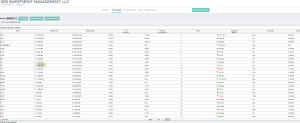

Based on 13F filings, a dated (6/15) view on the top holders of SUNE:

When we click on the holdings of top-15 holder SRS holdings, we see the following:

SUNE isn’t their only major holding that’s recently experienced a serious decline, for example, FEYE, SCTY & QCOM.

Even their winners, like DATA and PANW, have been weak recently. DATA just killed it on ER & PANW is destroying all comers in cyber security sales. I wonder how much of their recent weakness is due to the decline of say a SUNE or VRX? Hard to tell for sure. Both have high p/s ratios, AWS launched its QuickSight data analytics service, and I hear China is getting out of the corporate hacking game.

Hah-hah. That was fun. China, right. Ok, while there is a possibility these are the reasons, it doesn’t take very long to shoot them down. (I mean, have you seen QuickSight?) IMHO, there is a far greater probability that this weakness has more to do with weak hands. I’ll explain.

Although we don’t know how SRS is hedged or what kind of leverage they utilize, we do know, however, that many hedge funds stopped hedging as much as they once did. Hedging is expensive and hard to do effectively.

We also know that a hedge fund that’s scared of leverage is about as common as a dentist who’s scared of teeth.

And we know hedge funds have a tendency to cluster. Research is hard to do well and it’s also quite expensive. It’s attractive to “buy the mind” of someone who has a history of doing good research, like an Einhorn, Loeb or Ackman, and follow them into a trade. It can be a pretty smart strategy, but there are times when doing so is going to bring with it high volatility (shallow risk) and in some cases, deep risk. (Permanent loss of capital.)

Finally, we know that loss aversion tells us that humans hate losses nearly twice as much as they enjoy gains.

The net result is when unhedged funds –with low conviction– follow others into leveraged trades, it’s a recipe for tears volatility.

When we see a drawdown in a common hedge fund favorite, much like we’ve seen in SUNE, VRX, SCTY, etc…the probability is high they’re going to be forced to sell something, and most often their low-conviction buys & recent winners are the first to go.

Here’s the most important thing, volatility can be a two-edged sword. Handled improperly, it can destroy you. Handled correctly, it can be your best friend.

Unless it’s say, a horribly overpriced growth stock that is no longer growing, or a stock that’s going to zero due to things like fraud or insolvency, then forced selling is an opportunity for unforced buyers. “Buy when the cannons are firing, and sell when the trumpets are blowing” as Nathan Rothschild is rumored to have said.

I’ve made more scaled purchases of SUNE today. Still small, average price of $5.50. Started picking up TERP as well. Both continued to be pummeled over the Vivint Solar acquisition and more specifically, concerns over SUNE’s debt. ($11.7b sounds like a big number, but this figure is the consolidated total of SUNE’s DevCo, along with SUNE’s retained projects, and both TERP and GLBL debt. Most importantly, counter party risk is low, suggesting it’s most likely a great deal of this selling has been due to a combination of leverage, margin-induced forced selling and a lack of conviction.)

I’ll build this up to 2% position. But if I’m wrong, and it goes to zero, position size will serve as primary risk management.

Cheap can always get cheaper.* Here’s to hoping it does.

*It’s the reason why most people are better off not trying to catch a falling knife.

If you enjoy the content at iBankCoin, please follow us on Twitter

I was looking at $4.50 as a target to start building a position, I guess today is the day to start nibbling.