Comments »By Joe Brock

LONDON (Reuters) – Oil rose above $67 a barrel on Thursday after a 3.5 percent decline the previous day, boosted by forecasts of higher oil prices from U.S. investment bank Goldman Sachs (GS.N).

U.S. crude for July delivery rose $1.10 to $67.22 a barrel by 1135 GMT. London Brent crude gained $1.43 to $67.31.

Further support for oil prices came from a weaker U.S. dollar, which can boost the appeal of oil and other commodities as a hedge against inflation.

“For the better or for the worse, a switch in the Goldman price forecast rarely does not have a price influence and we will need to take it as a market input for the next few days,” said Petromatrix analyst Olivier Jakob.

Goldman Sachs raised its end of 2009 oil price forecast to $85 a barrel from $65 and introduced a new end of 2010 forecast of $95.

“The recent rally in WTI (U.S. crude) prices is likely to be but the first stage in the oil price rally that we expect will accompany a recovery in economic activity,” Goldman said in a research note.

Oil closed down more than $2 on Wednesday following a report by the U.S. Energy Information Administration that U.S. crude inventories rose 2.9 million barrels, against expectations for a decline of 1.4 million barrels in a Reuters poll.

Saudi Oil Minister Ali al-Naimi has said the producer group OPEC would wait until crude inventories fall to around 53 days of forward cover before considering raising output, nearly 10 days below current levels.

London’s FTSE 100 share index .FTSE turned lower on Thursday after the Bank of England kept interest rates unchanged at a record low of 0.5 percent. European shares were higher ahead of the European Central Bank’s own rate decision.

The latest signal on the state of the U.S. economy will come from employment data due on Friday.

U.S. non-farm payroll jobs likely fell by 520,000 jobs last month, the smallest number in seven months, a Reuters poll showed, but economists expect the U.S. unemployment rate to rise to 9.2 percent in May, the highest since September 1983.

INTC Buys WIND For $11.50 a Share

Comments »By David B. Wilkerson

INTC WINDCHICAGO (MarketWatch) — Chipmaking giant Intel Corp. /quotes/comstock/15*!intc/quotes/nls/intc (INTC 15.84, -0.10, -0.63%) said Thursday it would acquire Wind River Systems Inc. /quotes/comstock/15*!wind/quotes/nls/wind (WIND 8.00, -0.01, -0.12%) for $11.50 a share in cash, or about $884 million. Intel said the software vendor will be part of its strategy to “grow its processor and software presence outside the traditional PC and server market segments into embedded systems and mobile handheld devices.” The transaction is expected to close this summer.

Europe Is Reluctant to Play Ball

Green shoots prevents the EU from lower rates…they stay unchanged @ 1%

Comments »By Christian Vits

June 4 (Bloomberg) — The European Central Bank kept its benchmark interest rate at a record low of 1 percent today after first signs of an economic recovery emerged.

The Frankfurt-based ECB will also reveal details of its asset-purchase plan, and economists say it is unlikely to signal it will buy more than the 60 billion euros ($85 billion) of covered bonds already announced. President Jean-Claude Trichet, who is trying to heal a rift among policy makers, holds a press conference at 2:30 p.m.

“The reality is that the ECB are done cutting rates and will not be announcing any further policy initiatives,” said James Nixon, an economist at Societe Generale SA in London. Still, “I’m very concerned that much more has to be done to stimulate the economy from here.”

The 22-member Governing Council has been split over whether to follow the Federal Reserve and Bank of England, which have cut their key rates close to zero and are buying government and corporate bonds to tackle the worst recession in six decades. The debate over how far the ECB should go reached the highest level of European government this week, with German Chancellor Angela Merkel backing the Bundesbank’s view that asset purchases are a step too far.

Clash of Views

Bundesbank President Axel Weber argues there is no real risk of deflation and buying assets to flood the economy with money is an unnecessary risk that could sow the seeds of future crises. Officials from smaller nations such as Slovenia’s Marko Kranjec and Cyprus’s Athanasios Orphanides are less certain and have indicated the ECB could buy a broader range of assets to fight the recession.

The Bank of England today kept its key rate at 0.5 percent and reiterated its plan to buy 125 billion pounds ($206 billion) of government and corporate bonds.

Investors will be looking for information from Trichet on the types of covered bonds the ECB will purchase, whether they will be bought on the primary or secondary markets, and whether national central banks will conduct the operations.

The ECB’s plan is worth 0.6 percent of euro-region gross domestic product. By contrast, the asset-purchase programs of the Fed and Bank of England amount to about 12 percent and 10 percent of their respective economies.

Green Shoots

ECB purchases are “no more than a gesture,” said Thomas Mayer, chief European economist at Deutsche Bank AG in London. “The economy is on its way to stabilizing and I would expect growth to turn positive later this year.”

Evidence is mounting that the worst of the financial crisis may have passed. The contraction in Europe’s manufacturing and service industries is easing and European confidence in the economic outlook rose to a six-month high in April. In Germany, Europe’s largest economy, business sentiment increased for a second month in May.

Praktiker AG, Germany’s second-biggest home-improvement retailer, said on May 27 that revenue has rebounded in its domestic market since the end of March.

Merkel on June 2 scolded the Fed and Bank of England for pumping too much money into their economies and said that by deciding to buy covered bonds, the ECB had “bowed somewhat to international pressure.” She urged a return to a “policy of reason.”

Original Package

At its May 7 meeting, the ECB debated a package of asset purchases worth about 125 billion euros that included commercial paper and corporate bonds, before agreeing to buy only covered bonds, people briefed on the talks have said. Covered bonds are low-risk securities backed by mortgages or public-sector loans.

Weber may have been instrumental in having the package reduced. He said on May 12: “Note well: It’s not our goal simply to print money. I currently don’t see the need for outright purchases of further private debt obligations.”

Others want to keep that option open. Kranjec said in a May 13 interview that the ECB hadn’t ruled out purchasing a wider range of assets and was “very likely” to spend more than 60 billion euros.

Austria’s Ewald Nowotny, in a May 29 letter to hoteliers obtained by Bloomberg, said the ECB can buy commercial paper and bonds to help lower long-term interest rates.

The euro-region economy will shrink 4.2 percent this year, according to the International Monetary Fund. That’s more than the projected 2.8 percent contraction in the U.S. and 4.1 percent slump in the U.K. Trichet said last month that the ECB’s latest staff projections, due today, are likely to be in line with those of the IMF.

The ECB will keep the door “wide open” for additional policy action, said Holger Schmieding, chief European economist at Bank of America-Merrill Lynch in London. “Apparently there’s no consensus in the Governing Council, so there’s a chance the ECB will come up with a surprise.”

It Might Be A Sizzling Summer

Rates are making governments sweat

Multi Media Link

Comments »By NELSON D. SCHWARTZ

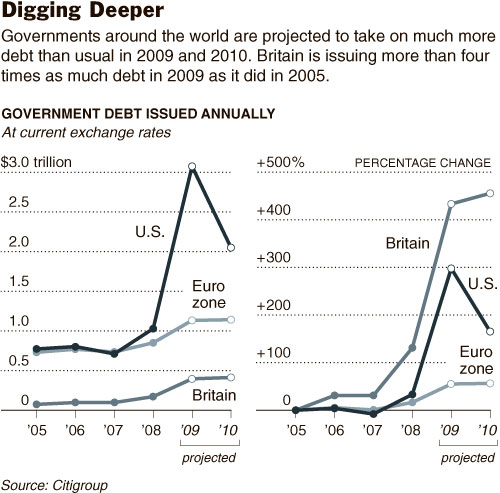

Published: June 3, 2009As governments worldwide try to spend their way out of recession, many countries are finding themselves in the same situation as embattled consumers: paying higher interest rates on their rapidly expanding debt.

Increased rates could translate into hundreds of billions of dollars more in government spending for countries like the United States, Britain and Germany.

Even a single percentage point increase could cost the Treasury an additional $50 billion annually over a few years — and, eventually, an additional $170 billion annually.

This could put unprecedented pressure on other government spending, including social programs and military spending, while also sapping economic growth by forcing up rates on debt held by companies, homeowners and consumers.

“It will be more expensive for everybody,” said Olivier J. Blanchard, chief economist of the International Monetary Fund in Washington. “As government borrowing in the world increases, interest rates will go up. We’re already starting to see it.”

Since the end of 2008, the yield on the benchmark 10-year Treasury note has increased by one and a half percentage points, rising to 3.54 percent from 2 percent, the sharpest upward move in 15 years. Over the same period, the yield on German 10-year bonds has risen to 3.57 percent, from 2.93 percent. And British bond yields have increased to 3.78 percent, from 3.41 percent.

Concern over the long-term effect of greater debt prompted Ben S. Bernanke, the Federal Reserve chairman, to say in testimony before Congress on Wednesday, “Even as we take steps to address the recession and threats to financial stability, maintaining the confidence of the financial markets requires that we, as a nation, begin planning now for the restoration of fiscal balance.”

For now, the cost of more debt is the price government is willing to pay to spend its way out of recession, hoping that a return to fiscal health will increase tax revenue and repay the debt.

But in the last three weeks, the pace of the increase in the 10-year Treasury note’s yield has quickened, spurred by a Congressional Budget Office estimate that net government debt will rise to 65 percent of the gross domestic product at the end of fiscal 2010, from 41 percent at the end of fiscal 2008.

In 2009 and 2010, Washington will sell more than $5 trillion in new debt, according to Citigroup. A decade from now, according to the Congressional Budget office, Washington’s outstanding debt could equal 82 percent of G.D.P., or just over $17 trillion.

Governments borrow money in part by getting investors to buy their bonds, which are essentially i.o.u.’s. To attract investors for all the new debt, governments will have to compete with stock and corporate bond markets for investors’ money, hence the rising yields.

Although interest rates remain low by historical standards, the recent spike in rates comes at a critical juncture, threatening to damp the positive effects of new stimulus spending by governments around the world.

Under President Obama’s 2010 budget, total interest payments by the federal government could rise to $806 billion in 2019, from $170 billion this year, according to the Congressional Budget Office. Much of that projected increase is a result of higher government borrowing, but the forecast also assumes that the average 10-year note yield will increase to 4.7 percent.

Some of the increase in rates earlier this year actually stems from rising confidence in an economic recovery and growing tolerance for risk, as investors abandon government bonds for higher-yielding but riskier corporate bonds and stocks.

Now the threat posed by the rise in government debt is getting increasing attention from investors and traders.

“It’s a gigantic issue,” said Kenneth Rogoff, a Harvard professor and the co-author of a forthcoming book, “This Time is Different: Eight Centuries of Financial Folly.” “It leaves us very vulnerable to a global rise in interest rates that might be substantially beyond our control.”

Mr. Rogoff estimates that if the budget office’s debt estimate proves correct, every one percentage point increase in rates could eventually cost Washington an added $170 billion a year.

The long-term situation is particularly perilous, because the added interest costs will worsen what have become record deficits as Washington has rushed to bail out industries and stimulate the economy.

A year ago, under old budget and policy assumptions and before the financial crisis escalated, the Congressional Budget Office projected that outstanding federal debt would hit $5.3 trillion in 10 years.

“It’s an exaggeration of course, but it’s a little like what happened to the subprime borrowers,” Mr. Rogoff said. “People are just assuming the funding will always be there.”

These assumptions may not hold over time. Spending could be reduced, economic growth could be greater than predicted or interest rates could be affected by other factors.

In the meantime, Europe is also turning to the markets to replenish overstretched coffers. In 2009 and 2010, according to Citigroup, the 16-nation euro zone will sell nearly 1.6 trillion euros ($2.6 trillion) in new debt, while Britain plans to offer £490 billion ($799 billion) in new debt.

Britain’s debt sales might seem less alarming than the multitrillion-dollar offerings from the euro zone and the United States. But Mark D. Schofield, global head of interest rate strategy at Citigroup in London, said, “It’s a huge increase in percentage terms, and it dwarfs anything else.”

Standard & Poor’s caught some traders and investors off-guard last month when it warned that Britain’s sovereign debt was in danger of losing its AAA rating, lowering the outlook to negative from stable. It was the first time since Standard & Poor’s initiated coverage of British debt in 1978 that the country received a negative outlook.

Britain’s government debt now equals 55 percent of G.D.P., but Standard and Poor’s estimates it could approach 100 percent by 2013.

“It wasn’t just a message for the U.K., but they were the easiest of the G-7 to target,” said Mark Wall, chief euro-area economist at Deutsche Bank in London, referring to the seven largest industrial nations. “The global financial markets took this as a message as much for the U.S. as the U.K.”

While still worrisome, the short-term debt picture within the euro zone is better than that in either Britain or the United States, Mr. Schofield said.

Over the long term, however, he said that higher rates could compound Europe’s larger problem of prolonged economic weakness and slow its recovery from the current recession.

Even regions that are unlikely to issue substantial amounts of new debt — like South America and Eastern Europe — will be affected by rising rates as they refinance their existing debt.

Asian economies have the least to fear from the prospect of increased rates. “Asia is in much better shape with lower levels of debt and they can afford larger deficits without the market penalizing them,” Mr. Blanchard of the I.M.F. said. “China, for example, is in a very strong position to pay for its stimulus.”

What Could Knock H Out of The Box ?

Comments »For years many companies, governments and researchers have predicted that our energy future must lie with the universe’s simplest element. The mooted hydrogen economy would use the gas to store and transport renewable or low-carbon energy, and power fuel cells in the transport sector or in portable electronics.

But creating the necessary society-wide infrastructure has proved difficult and expensive to get off the ground. And now a rival idea, first suggested in 2006 by Nobel chemistry laureate George Olah at the University of Southern California, has received a boost.

The methanol economy, say its supporters, could be with us much sooner than the hydrogen one.

Hydrogen dangersOlah’s rationale is that modifying our existing oil and petrol-focused infrastructure to run on methanol will be much easier than refitting the world’s liquid-fuel-based economy to deal with an explosive gas.

Methanol has already been used to power portable gadgets and could potentially power vehicles and other devices. Now US chemists have worked out the conditions needed to make the feedstock for methanol production using renewable energy.

The research is significant because just as the lack of an efficient way to generate and store hydrogen is a major barrier to the idea of running civilisation on it, sourcing methanol on a vast scale is a similarly major hurdle.

Clean solutionThe best way to make methanol is by steam reforming methane, produced when syngas – a mixture of hydrogen and carbon monoxide – is turned into liquid hydrocarbons via reactions such as the Fischer-Tropsch process.

The process is used today to make diesel and other liquid fuels from coal, and kept South African cars going during the country’s international isolation in the 1980s and 90s.

However, the whole point of the methanol economy would be to create a greener society, so any syngas must come from an environmentally friendly source, not fossil fuels.

Now chemist Scott Barnett at Northwestern University in Evanston, Illinois, and colleagues have shown that a solid oxide electrolysis cell, more normally used to split water into hydrogen and oxygen, could be that source.

Viable brewUsing a mix of one part CO2, one part hydrogen and two parts water in the device generates syngas at a rate which compares favourably with the processes used to make it from natural gas, says Barnett. At peak conditions of 800 °C and 1.3 volts, the system can produce 7 standard cubic centimetres of syngas per minute for every square centimetre of the electrolysis cell’s surface.

The next stage, turning the syngas into methanol, is a standard industrial reaction that is well understood.

Barnett’s method requires a steady stream of water vapour and CO2, but both gases are released when the methanol is used in fuel cells, and could be captured and re-used, he says.

That would add to the costs involved, but a hydrogen economy would require similar gas-capture technology, says Barnett, because hydrogen production requires a plentiful source of fresh water, which is heavy to cart about.

Olah thinks Barnett’s study is a useful one. “This [methanol economy] approach is now starting to be implemented around the world,” he says. “New methanol plants are being built in China, South Korea, Japan and Iceland.”

Limited scopeBut others remain sceptical that methanol will ever occupy more than a small niche. There are several well-known problems with the use of methanol. Like hydrogen, and unlike petrol, methanol is not a source of energy, but simply an energy store, points out Ulf Bossel at the European Fuel Cell Forum in Oberrohrdorf, Switzerland. “The energy carried by methanol is less than was needed to make it,” he adds.

Barnett agrees that methanol is a poor substitute for using the power from a renewable generator like a wind turbine directly. But he says that in cases where direct use is not possible, liquid methanol beats the efficiency of hydrogen for storage and transportation.

Methanol could be used to store energy from renewable sources that often produce more electricity than is needed at a particular time, he says, and could also be useful at off-grid sites.

In these situations, Bossel agrees a modest methanol economy makes sense. “The hydrogen idea is gradually fading,” he says. “Methanol could be a better solution because it is easier to handle.”

Australia Serves Up A Disappointing Trade Balance Report

This does not bode well for green shoots theorists

Comments »By Victoria Batchelor

June 4 (Bloomberg) — Australia’s trade balance unexpectedly fell into deficit in April as exports of coal, iron ore and wheat declined.

The nation posted a A$91 million ($73 million) shortfall compared with a revised A$2.3 billion surplus in March, the Australian Bureau of Statistics said in Sydney today. The median estimate in a Bloomberg News survey of 17 economists was for A$1.7 billion surplus.

The economy expanded last quarter as rising consumer spending helped the nation defy a worldwide slump that sent Japan, Europe and the U.S. into recession. A report yesterday also showed businesses cut spending on machinery and equipment by the most since 1991 as mining companies including BHP Billiton Ltd. and Rio Tinto Group pared investment amid weak global demand.

“Australia has weathered the global financial storm much better than other advanced economies,” Riki Polygenis, an economist at Australia & New Zealand Banking Group Ltd. in Melbourne, said before today’s report was released. Still, “the economy may falter later in the year. It is yet to experience the full impact on incomes from lower export prices, particularly for bulk commodities.”

Gross domestic product expanded 0.4 percent in the first quarter from the previous three months, the statistics bureau said yesterday. Economists estimated a 0.2 percent contraction.

Cash Handouts

More than A$12 billion in government cash handouts to lower-income earners, combined with record interest-rate reductions since September, helped bolster the economy.

Imports fell 2 percent to A$21.77 billion in April, today’s report showed. Imports of capital goods, such as trucks and machinery, dropped 1 percent and imports of consumer goods decreased 1 percent.

Exports declined 11 percent from March to A$21.68 billion. Shipments of non-rural goods, which include metals and minerals, slumped 12 percent.

Rio Tinto, the world’s second-largest iron ore exporter, committed last month to a 33 percent reduction in contract prices with Japanese steelmakers, the first drop in seven years.

Rio Tinto slashed its global spending by $5 billion to $4 billion this year and BHP shut its $2.2 billion Ravensthorpe nickel mine.

Profit Slumps

Profit at BHP Billiton, the world’s largest mining company, slumped 57 percent in the six months ended Dec. 31 on costs to close mines and plants after metal prices slumped.

While emerging economies, including China, are turning around “recovery in the major countries is likely to take longer to begin and be slower when it does occur,” Australia’s central bank Governor Glenn Stevens said this week.

Stevens and his board left the benchmark interest rate unchanged at a 49-year low of 3 percent on June 2. The governor said the bank has scope to cut interest rates further if needed.

Agricultural shipments fell 11 percent in April, the trade report showed. Exports of grains tumbled 27 percent.