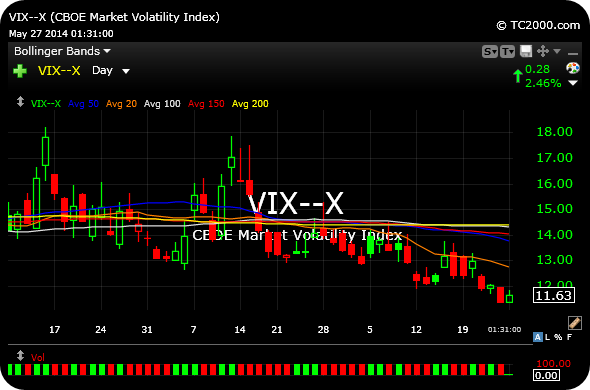

In the event we see a further rally the rest of this week, here are some actionable long ideas which are heavily-shorted.

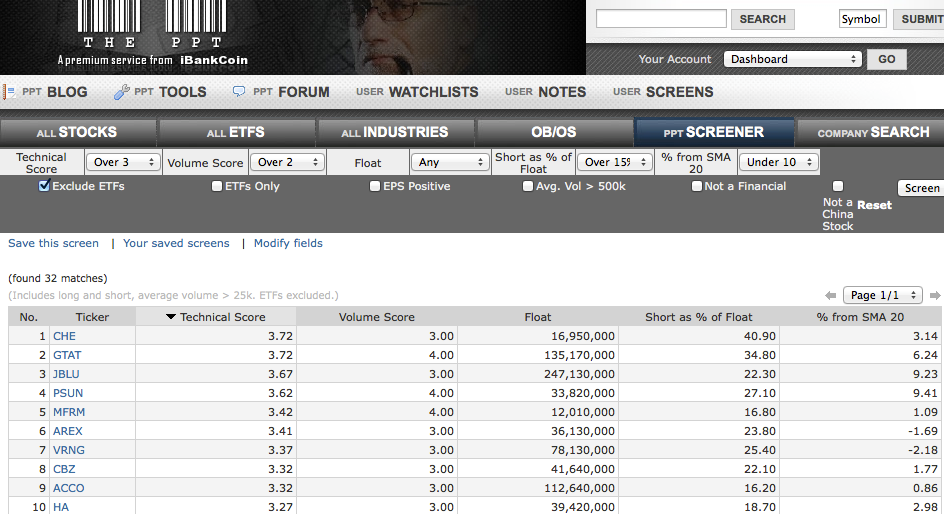

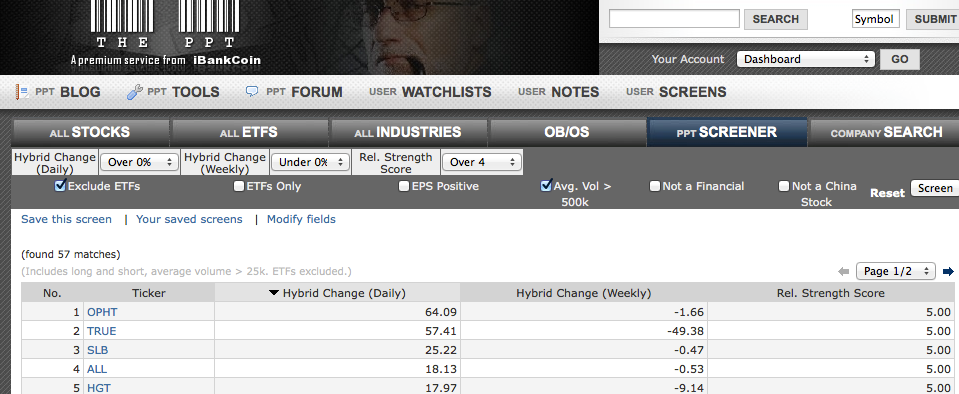

Please click the screen shot below for a larger view of my “12631 FINISH HIM! SHORT KILLER SCREEN” inside The PPT. Obviously these stocks are going to have the highest percentage of shorts and, according to the algorithm, are set up well to squeeze further.

If this bull goes buck wild, this is a great idea screen.

Members can click here to view and save it.

_____________________________________________

Comments »