https://www.youtube.com/watch?v=7KBw1Fto0pM

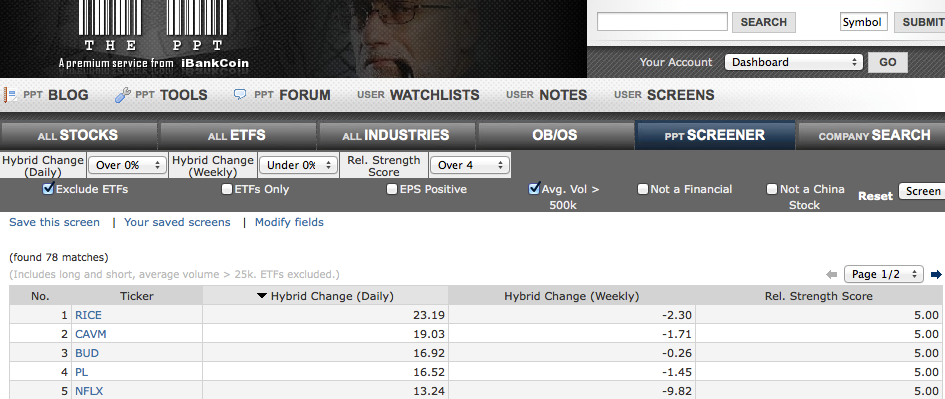

I am back to being short bonds [via long TBT], for the first time in several months.

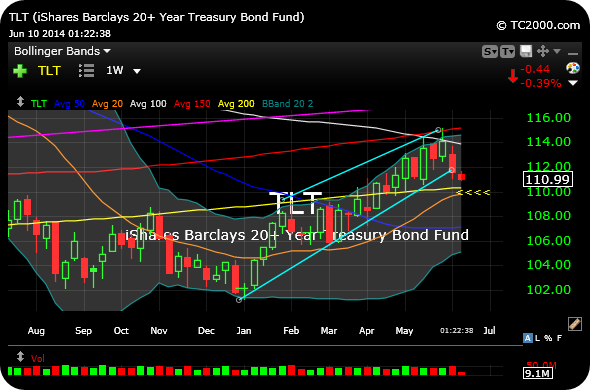

The straight-up ETF for bond prices, below, shows the 2014 rally is in danger of cracking after the crack of the rising channel (light blue lines).

An initial target is the middle weekly Bollinger Band, which is the orange line (20-period weekly moving average).

If TLT closes back over $113 the thesis becomes essentially void.

_______________________________________________

Comments »