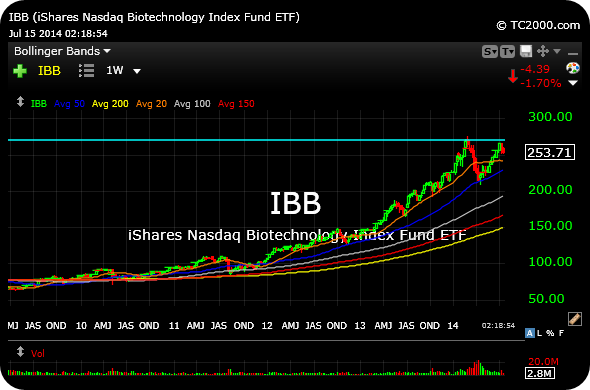

The BIS trade (ultra-short biotechnology sector ETF), with which we had success inside the 12631 Trading Service earlier this year, is appealing once again.

The IBB, sector ETF for biotechs, is flashing a double peak pattern on the weekly chart after a steep multi-year bull run. I do not see too many traders eager to call for a double-top here, and understandably so given how many bear traps we have seen in recent years.

Still, this most recent peak has a clear negative divergence versus the prior one, in terms of the RSI weekly.

A break below $250 here likely seems me testing out the short side again.

_________________________________________________________________________

Comments »