We should have two terrific, if not classic, NFL games today, with Tom Brady versus Peyton Manning and the heated rivalry between the 49ers and Seahawks.

Buffalo Wild Wings is, of course, the quintessential NFL-related stock, serving wings, burgers, and beers amid a bevy of flatscreen TV’s.

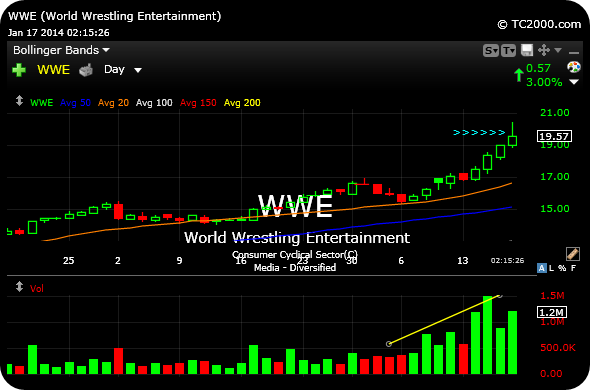

The stock has seen a tremendous run in recent years, going much higher than I expected. I have not shorted it yet, even though I previously charted it as a potential short setup (which obviously never triggered).

Currently, though, with the weakness in consumer stocks, an aggressive trader might consider playing BWLD for a quick gap-fill lower next week, seen on the daily chart below.

Earnings are scheduled for February 4th.

______________________________________________________________

Comments »